Lenovo's India connect

India has come as a timely growth opportunity for the Chinese giant which is facing headwinds at home

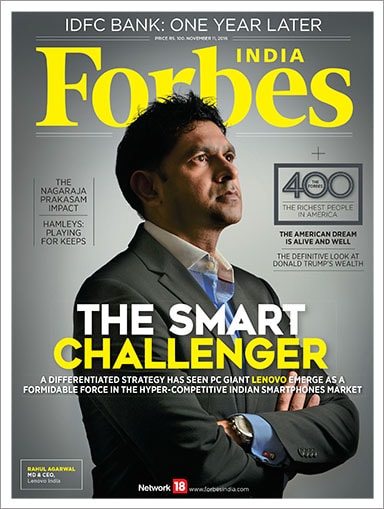

For Chinese consumer technology major Lenovo, the last fiscal didn’t bring in great news. The personal computers and smartphones giant faced challenges from multiple fronts, leading to a net loss for the year. Worse, in its home market, China, rival smartphone makers had eaten into its market share. It is in this context that Lenovo’s India operations gain greater significance. At a time when its home market was getting tougher, the company’s India story began to gain momentum. Today, market intelligence firm IDC’s figures show that in the April-June 2016 quarter, Lenovo (together with brand Motorola, which it owns) has emerged as the third-largest smartphone vendor in India, with a 7.7 percent share by volume. In value terms, Lenovo stood second in market share. Clearly, India is proving to be a blessing at a tough time.

The Lenovo India strategy, as Associate Editor Aveek Datta writes, is driven by a few key elements. India is a rare example where the Chinese giant has put equal emphasis on pushing both its brands—Lenovo and Motorola—given the size and dynamics of the Indian market, which is expected to become the second largest smartphone market in the world by 2017. The other aspect of the India game plan is Lenovo’s heavy accent on online sales channels to give it that initial impetus and save on time and costs. The early adoption of 4G devices is the third important pillar of the company’s growth strategy. The results have already started showing. Lenovo India’s FY16 turnover was nearly double that of FY15. Not surprisingly, the Lenovo global management is now keen to see Indian turnover triple to $6 billion by FY19.

The Lenovo India strategy, as Associate Editor Aveek Datta writes, is driven by a few key elements. India is a rare example where the Chinese giant has put equal emphasis on pushing both its brands—Lenovo and Motorola—given the size and dynamics of the Indian market, which is expected to become the second largest smartphone market in the world by 2017. The other aspect of the India game plan is Lenovo’s heavy accent on online sales channels to give it that initial impetus and save on time and costs. The early adoption of 4G devices is the third important pillar of the company’s growth strategy. The results have already started showing. Lenovo India’s FY16 turnover was nearly double that of FY15. Not surprisingly, the Lenovo global management is now keen to see Indian turnover triple to $6 billion by FY19.Lenovo’s India play aside, this issue also brings you the Forbes 400 listing of the wealthiest people in America. This year, the role of immigrants in the Forbes 400 gets special focus even as the issue is the subject of intense debate in the US in the countdown to the presidential elections in that country. While immigrants are getting knocked around in election debates, over 10 percent of the Forbes 400 this year comprise those born outside the US. That can only be a good sign for the American entrepreneurship story. As Monte Burke of Forbes writes, “The very act of immigrating is entrepreneurial, a self-selected risk taken to better one’s circumstances.” The number of immigrants contributing to the entrepreneurship ecosystem in the US has only been rising. This year, 42 of the Forbes 400 are those who immigrated to America. Ten years ago, that number stood at 35, twenty years back it was 26 and thirty years earlier, it was 20. Some names: Google founder Sergey Brin, eBay founder Pierre Omidyar, Tesla founder Elon Musk. Need anyone say more?

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)