Bootstrapped and free from the shackles of external funding

Building businesses without relying on external investors is often attractive for entrepreneurs

While entrepreneurs often need to engage with venture capitalists and private equity firms to take their businesses to the next level, many will secretly tell you how they would have loved to have been free of the shackles of external funding. Several promoters I have met say the idea of bootstrapping—building businesses with their own money—is extremely appealing to them. But for various reasons, they need to seek funds from VCs and PEs and thus begins a never-ending tug-of-war between the two sides. Not all VC/PE-entrepreneur equations are tension-ridden though, and there are several instances where they have worked together cohesively and built very successful businesses. However, the freedom that bootstrapping accords makes it very attractive, at least in the initial stages when a venture is being built from ground up.

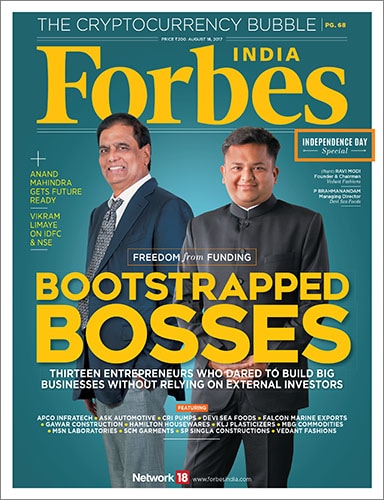

We thought it would be appropriate that this year’s Independence Day special issue of Forbes India should dwell deeper on the aspect of bootstrapping, and celebrate entrepreneurs who have dared to build large, successful businesses despite having stayed away from the lure of external equity. Celebrating such achievements is even more important at a time when raising funds from the outside seems to be cause enough for entrepreneurs to uncork the champagne. Significantly, PEs and VCs have now begun to tighten the screws on several such ventures as it becomes clear that cash burn must give way to some visibility on profits. For bootstrapped companies, the freedom which they have to build businesses their own way often leads to triumphs which many externally funded entities may find hard to achieve.

For this special issue, we joined hands with analytics and ratings major Crisil, our Knowledge Partner for this package, and picked out 13 exciting undertakings—from sectors as varied as marine products to apparel to bridge-building. You will find that bootstrapped ventures typically avoid unrelated diversifications, generally prefer organic growth, manage debt better and are adept at handling business cycles.

This is not to say that bootstrapped companies will forever shy away from external funds. Once a business reaches a certain scale and eyes bigger peaks, it may become necessary to look outside by way of private equity or venture capital. This is more so when acquisitions may be targeted or large projects planned. But till then, bootstrapping serves such ventures well. As Sridhar Vembu, the founder of software products company Zoho and an ardent supporter of bootstrapping, says in a most engaging interview on page 64, bootstrapped companies can find smaller niches that venture-backed firms may not be interested in. Speaking candidly on why he chose to strictly avoid external equity, Vembu says: “For a VC, a company is necessarily a disposable commodity, no matter how much undying love it professes.”

Whether you agree with Vembu or not, the success stories of Zoho and other bootstrapped ventures do strike a chord with many entrepreneurs.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@nw18.com

Twitter id:@TheSouravM

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)