New Roadmap for PE Fund-raising

There is a preference for deal-by-deal engagement, allowing investors to decide on a case-to-case basis

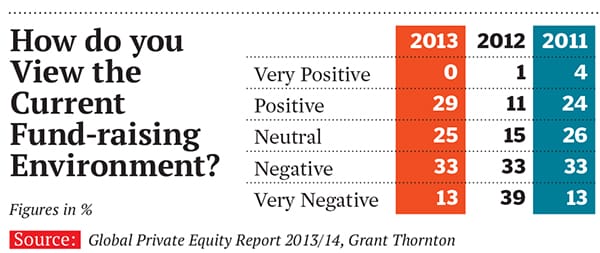

The fund-raising sentiment for PE firms globally seems to be improving. This is borne out by the fact that a majority of the world’s top PE executives are either positive or neutral about the fund-raising environment this year, a marked improvement from last year. This is one of the key findings of a global survey conducted by Grant Thornton. As many as 54 percent of those surveyed said they were either positive or neutral about this year’s environment, compared to just 27 percent a year ago. The Global Private Equity Report 2013-14 is the result of in-depth interviews conducted with 156 senior PE practitioners worldwide.

The survey also shows the lines between fund-raising and investor relations are blurring. Fund-raising is now being seen by PEs as a constant process of engagement. With the power clearly shifting in favour of LPs, they are being wooed by concessions, co-investment rights, advisory board seats and fee discounts.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)