Holding the Foreign Hand - FIIs in Mutual Funds

Indian mutual funds can now raise money from foreign retail investors. It is just the boost that the troubled sector needed

The floodgates might just have opened for the Indian mutual fund industry. Indian markets have always been considered to be very attractive for investors in developed markets, but mutual funds in India were never allowed to tap retail investors from abroad. Hence, mutual funds used the Mauritius route to attract international investors into their portfolio management schemes (PMS) or offshore funds. This has often been considered cumbersome and the target customer has always been institutional investors. The latest Budget proposal, however, might just change all this.

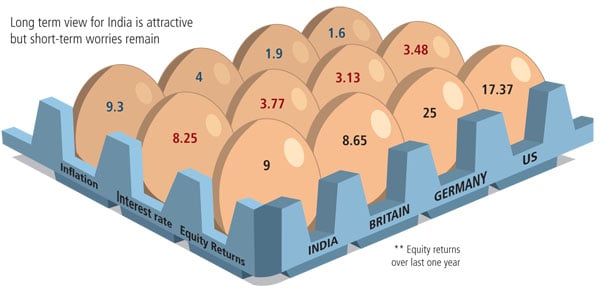

Infographic: Hemal Sheth

The global mutual fund market is around $20 trillion, with emerging markets claiming an increasing share of the pie. The Indian mutual fund accounts for only $150 billion, but if the economy grows at even around 8 percent and mutual funds are allowed to sell their products directly to foreign retail investors, the size of the market can double in a few years.

There already exists a large market for offshore India-focussed funds with more than 150 such schemes in operation. This means foreign nationals want ways to punt on Indian equities. Given that the global wealth management market is growing at a rate of around 10 percent and the Indian market is expected to grow at twice the rate, the Indian market should easily touch $400 billion in the next five years. If Indian mutual funds find a market internationally, then this figure can go up further.

However, without clarity on issues such as taxation and ‘Know Your Customer’ norms, investors may not flock to Indian mutual funds. “With ‘Know Your Customer’ norms becoming compulsory, nobody is clear about how to clear a foreign retail investor. We need to wait for more details before we become euphoric about this proposal,” says the CEO of a mid-sized mutual fund. Most foreign institutional investors come through the Mauritius route or countries with who India has signed a double taxation treaty. This helps the countries withhold tax. Mutual funds want to know how these issues will be addressed in countries where such treaties are not signed.

But overall, the industry is optimistic. There is a general feeling that bigger mutual funds will benefit more because they have the size and the money to expand into global markets. Also, mutual funds that sell exchange-traded funds (ETFs) will have an advantage over others as international investors will prefer mutual funds that sell index funds and ETFs. These funds are better known to foreign investors and bypass the fund manager risk.

But the key area is distribution. Most of the top funds in India are homegrown and do not have a foreign partner and will have to use the same distributor as mid-size and smaller funds. “All Indian mutual funds will be on equal footing when it comes to operating in the international markets, especially when it comes to distribution,” says Sanjiv Shah, executive director, Benchmark Mutual Fund.

But the biggest beneficiaries will be foreign mutual funds that operate in the Indian market because they already have an established distribution model in many countries and will find it easier to sell their Indian funds.

After the ban of entry loads, the Indian mutual fund industry went through a phase of low confidence with industry players thinking that selling mutual funds in India has been made a difficult proposition. The latest proposal comes as a very pleasant surprise.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)