Protect your assets with comprehensive general insurance solutions

Often, people underestimate the value of a suitable insurance cover until it is too late

Life is full of surprises; some pleasant, some otherwise. Unforeseen events such as theft, accident or natural disasters like fire, earthquake, flood and storm, etc. can cause serious loss and/or damage. Health could be another cause of concern – sudden illness and medical exigencies can not only be traumatic but also make a huge dent in your savings.

Even while travelling, you are exposed to various hazards including health issues, mishaps, baggage/documents loss and other financial problems. While these risks cannot be completely eliminated, it makes sense to safeguard yourself and all that you value against life’s uncertainties to ensure peace of mind.

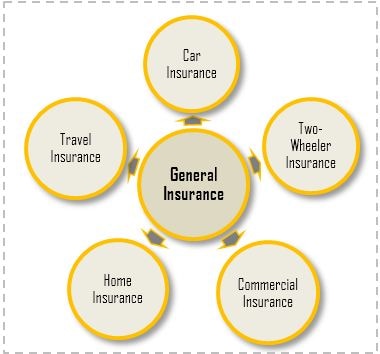

Cover your bases with General Insurance

Risk management is key to financial success. Often, people overlook the importance of having a suitable insurance cover only to realize it at a time when it’s too late. Imagine yourself being caught up in an adverse situation or losing your home or car, or being injured in an accident at home or abroad! How would you deal with the situation? Would you be able to recover financially in the absence of insurance?

It may seem quite unlikely but any such event can impede your financial wellbeing and have devastating effect on your finances, lifestyle and future. Your financial soundness, therefore, hinges on the security and safety of your assets. With proper planning, you can provide protection to yourself, your loved ones as well as the things you cherish. Whether it is your business, your house, car, jewellery and other valuables, general insurance products can help you mitigate risks and safeguard your assets. For medical exigencies, you can opt for health insurance, which offers protection for emergency expenses in case of sudden illness or injury.

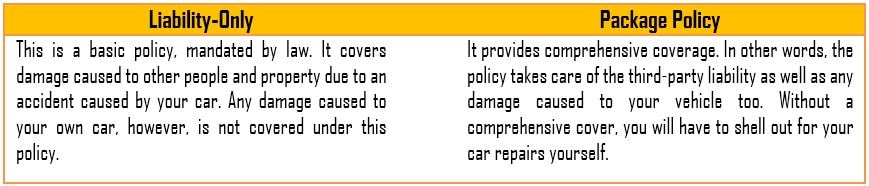

It is, however, important to note that merely having insurance is not enough. Your insurance cover should be comprehensive and also accessible whenever required. A comprehensive cover provides extensive coverage. For instance, a comprehensive car insurance policy provides complete coverage from loss or damage caused to you as well as to others due to theft or accident.

At Liberty General Insurance

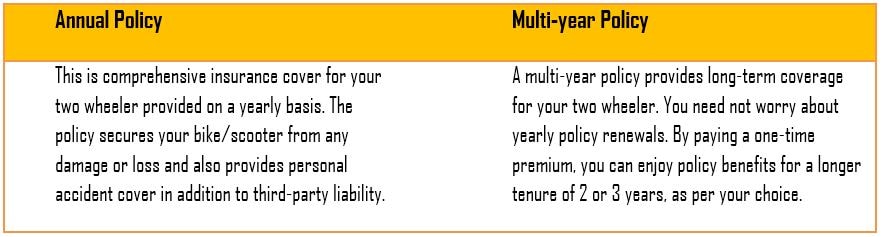

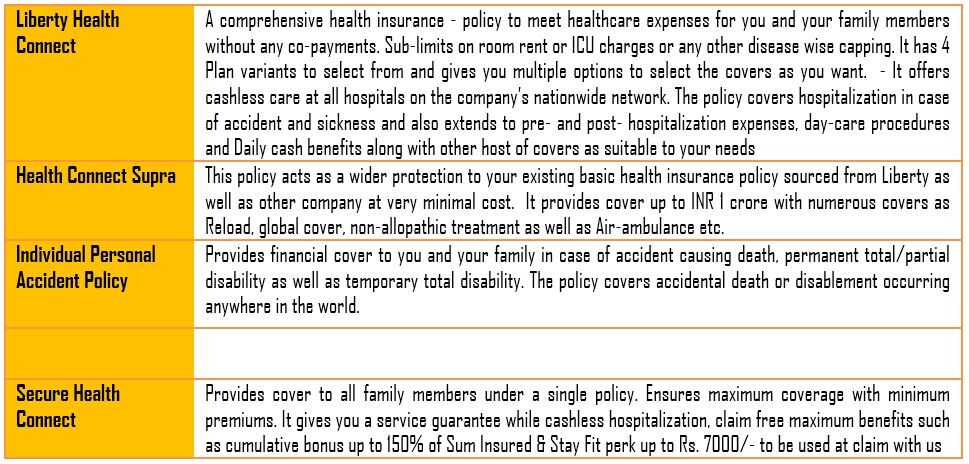

Liberty General Insurance’s (LGI) health, car and two-wheeler insurance products come with a variety of features and options.