Niyo Launches NiyoX in partnership with Equitas Small Finance Bank

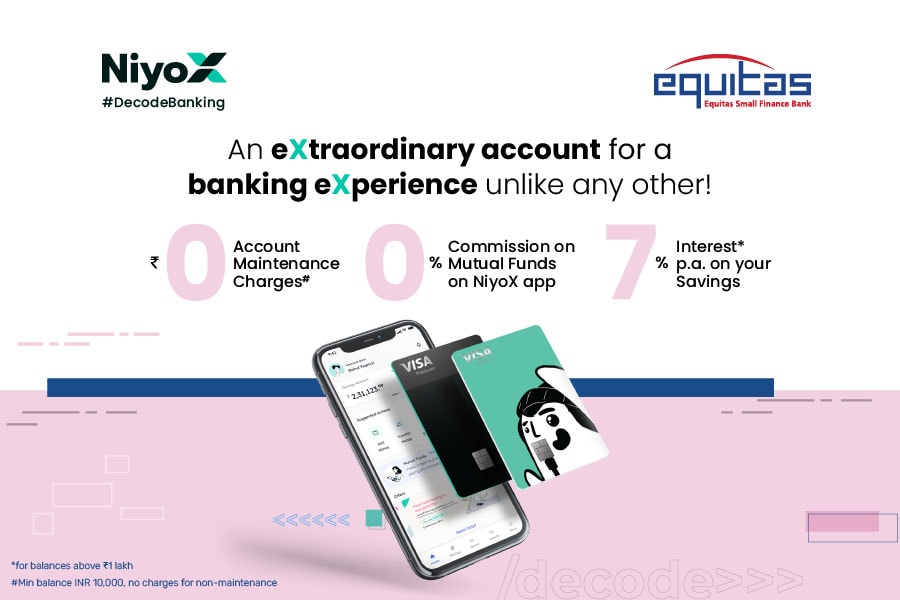

Introduces '007 Banking' - 0 maintenance charges, 0% commission mutual funds and 7%* interest on account balance

Mumbai, March 25, 2021: India’s leading fintech company, Niyo, today launched yet another pioneering mobile-first digital banking solution NiyoX in partnership with Equitas Small Finance Bank and VISA. Their newest product brings in a 2-in-1 proposition of a digital savings account and a wealth management platform to help you grow your money along with you.

Ahead of the launch, Niyo conducted a nationwide survey among 8000 millennials living in metro and non-metro cities to understand their banking needs post COVID-19. Remarkably, 55% respondents said they’d switch banks for rewards & offers and the rest 45% for better interest rates. NiyoX aspires to address this with its compelling features: a digital savings account with a VISA Platinum Debit Card, an industry-high 7%* p.a. interest rate on account balance, instant account opening through a seamless digital onboarding process, and a promise of “zero non-maintenance fee”. It’s a perfect solution for the fast-paced lifestyle of today’s millennial Indian.

Niyo’s Co-founder and CEO Vinay Bagri said, “As India's leading digital banking fintech startup, our primary focus is on easing and enhancing customer experience, and the launch of NiyoX is a testament to our commitment to the digital transformation of the banking space. We are delighted to launch our most ambitious product through our strategic partnership with Equitas SFB where we will provide the best possible savings account combined with a best-in-class investment account, all tied together with Niyo’s usual thought-through and delightful user interface. We are confident that this will become the most sought-after banking product very soon."

NiyoX is a 2-in-1 account that provides its users access to a full wealth management suite in addition to the savings account. The comprehensive wealth management suite powered by Niyo Money provides 0 commission mutual funds, a facility to track all your investments at one place, robo advisory and a feature that rounds up your expenses and invests the change. Domestic and international stocks will soon be launched on this platform.

NiyoX will also bring in a multilayer reward system comprising referral incentives, rewards points and scratch card-based cashback topped up with more exclusive offers for the users. With this launch, Niyo aims to on-board 2M customers by calendar year end 2021.

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.