Will Tata Motors and Fiat Ride Out the Jinx?

The joint venture between Fiat Automobiles and Tata Motors has all the trappings of a troubled marriage; but there is enough reason for the partners to give it another shot

In the car business, automobile dealers form an important part of the business and are considered family by companies. So, a few months ago, when Pune-based B.U. Bhandari, one of the oldest and most networked car dealers in Maharashtra, quit from Tata Motors, there were clear signals that all was not well with the car company’s business. Bhandari’s showroom sold Tata and Fiat cars but had of late stopped making money.

For the year 2009-2010, the Tata Motors-Fiat joint venture’s losses have increased 39 percent to Rs. 920 crore from Rs. 698 crore in the previous year. For Fiat, the year so far has been disastrous. Sales of Fiat cars have plummeted from over 2,100 cars in March 2010 to less than 1,700 in September. Market share has declined from 1.17 percent to 0.83 percent for the same period and its Ranjangaon plant now lies largely under-utilised. For Tata Motors, which put about Rs. 550 crore as equity in the JV, it seems like an increasingly loss-making proposition.

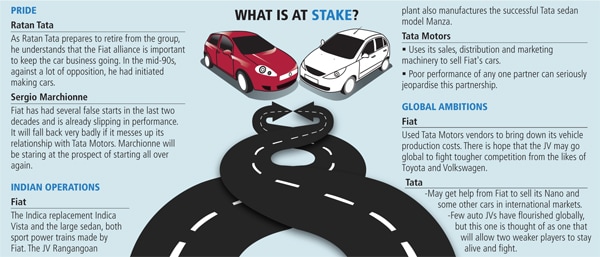

The 50:50 JV between Tata Motors and Fiat Automobiles was formed in 2006 by the flamboyant Sergio Marchionne and the reticent Ratan Tata. It now has its back to the wall. The project had been formed to specifically sort out the problems of the car business of the two companies.

Prakash Telang, managing director, Tata Motors, says, “There are some issues with the JV that need to be sorted out.” His counterpart in Fiat, Rajeev Kapoor, who heads the JV, puts up a brave face: “It [the JV] has a bright future despite niggling problems.”

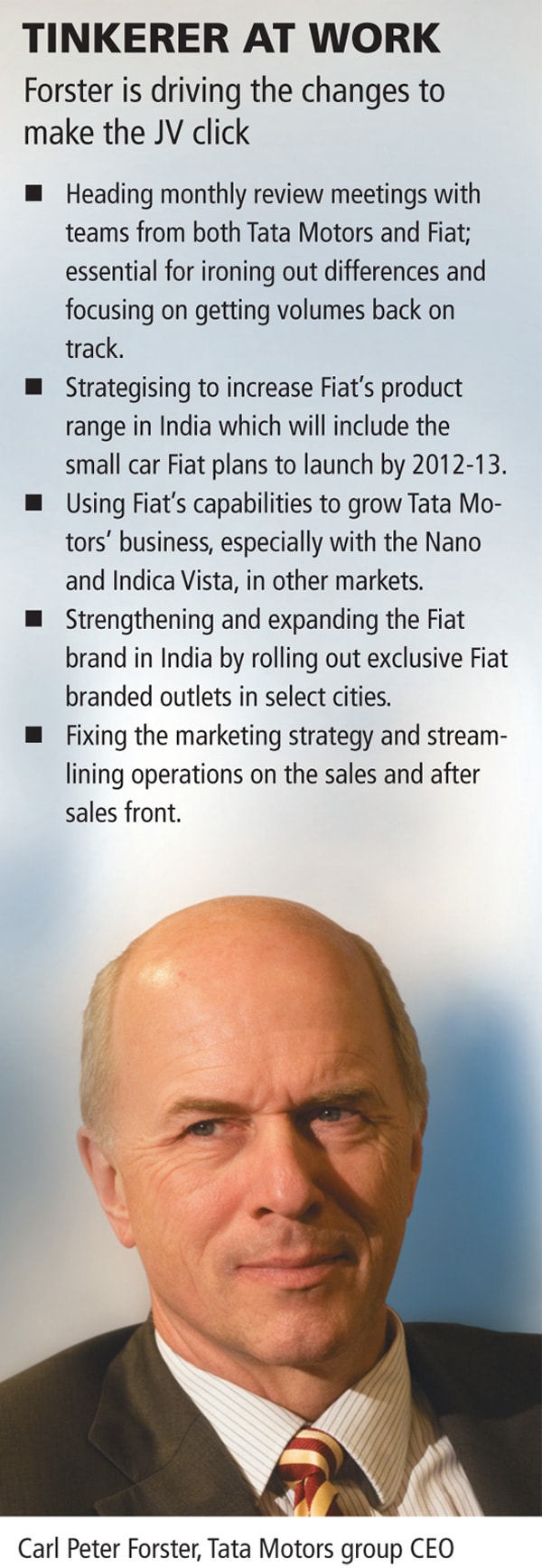

But moves within the two companies indicate that the problems of the car businesses and hence the JV, run deeper. In Tata Motors, the new CEO Carl Peter Foster chairs a more rigorous review meeting on the JV every month. Two months after Foster took over, Rajiv Dube, who built Tata Motors’ car business quit the firm. A Tata Motors exec, who did not wish to be named, says that Foster expressed displeasure about the car business right from his first visit to the Pune factory. He is said to have asked Dube why Tata Motors was relying on outsiders for engines and lamented on the lack of an engine development programme within the company.

Two expatriates, Peter Mertns and Timothy Leverton have been brought in to head crucial functions — quality and research, respectively — to bring the standards up to speed. Recently, Foster moved R. Ramakrishnan, a highly rated executive who was responsible in developing a brand new line of commercial vehicles, to the passenger car business.

Fiat on the other hand has hastened the launch of a newer version of the Linea, the T-Jet, a more powerful car, which sports an imported engine. Fiat is also planning to set up its own branded, exclusive showroom, a departure from the original idea of selling cars exclusively from Tata Motors’ dealers.

To understand the flurry of activity around the car businesses, a little background on the Fiat-Tata JV should help. In late 2005, as Ratan Tata was looking at the next phase of growth for his car venture, he found that it would take the company an investment upwards of Rs. 1,500 crore and three to four years to put a new engine development programme on track. Indica needed a new power train to compete with the newer models of cars being introduced in the market and also to comply with newer environmental rules.

Around the same time, Marchionne was looking for a new lease of life for Fiat in India. Having lost all its dealerships, Marchionne desperately wanted sales and service presence across the country. Fortunately for the Tatas, Fiat has the best engines for small cars, both petrol and diesel.

In what seemed a perfect fit, each wanted what the other had and the deal was talked of as a win-win for both the companies. As per the agreement, the JV would make Fiat cars and engines at the Ranjangaon plant near Pune. It would also manufacture one of Tata Motors’ models, Manza, a sedan. The JV would then sell its production to Tata Motors, which in turn would sell the cars through its dealership. Tata Motors had, as part of their agreement, also committed to take a stipulated number of power trains to keep the business of the JV going.

On the face of it, the JV seemed loaded in favour of Fiat. Its capital for the venture, which came in the form of its Ranjangaon manufacturing plant, would be used better. It got to sell its engines to a customer who guaranteed offtake. It sold Fiat cars to Tata Motors, at a small margin. Tata on the other hand, had to pay the JV for the Manzas made in the plant, in addition to a royalty for the Fiat engines it sourced.

Fiat seemed to be winning it all till its sales plunged this year. Customers found that Fiat’s small premium hatchback Punto was under-powered for its premium price, while the sedan Linea had air conditioning problems. The two models, which sold good numbers in the first few months after the launch, saw the sales numbers dwindle soon afterwards. Kapoor, in an interview a year ago, had estimated sales of 6,000 cars per month for the Punto, saying it was in the big volume segment. The car sells less than 1,500 units today.

For the Tatas, the Indica Vista, a completely overhauled model complete with the latest engine, was expected to draw more individual customers, as opposed to taxi operators who bought its diesel vehicles. The Vista sells about 5,500 a month, again half of its estimated numbers. Initially, because the company had branded the new generation cars Indica Vista, research showed consumers thought it was just another variant. More importantly, Tata Motors still has to depend heavily on Fiat if it wants variations of the power train. This put it in an awkward position, much like Mahindra and Mahindra which has to depend on Renault for even minor modifications of the engines it uses in its sedan, Logan.

Similarly, the Manza was priced below other cars in its segment. This led customers to believe that it was an extended Indigo. These positioning missteps caused the company dear in enhancing the sales of its new models.

Even as Telang and Kapoor downplay the extent of the problems facing the JV, company insiders say that the two companies have been trading charges at each other for the debacle.

Fiat executives blame Tata sales personnel for not pushing hard enough to sell their cars. On the other hand, Tata executives blame Fiat for the poor quality of its cars and the subsequent service problems it causes at dealerships.

Should the two companies be worried yet? Last year, the joint venture sold merchandise — finished cars and engines worth a little over Rs. 3,000 crore to the JV. For both companies, this is a fraction of their overall sales. But there are some positives that can’t be ignored. Fiat has in a short time got access to 150 dealers and services stations, while Tata has a good product in Vista with which it has managed to retain the No. 3 position in the passenger car market in India.

The JV is important for the two companies much beyond the sales numbers. For Ratan Tata, the car project is a matter of a personal conviction, which he executed despite strong opposition from inside the group. At a time when he was focussed on building the Nano, his personal friendship with Marchionne has given a new lease of life to Tata’s car business in one stroke.

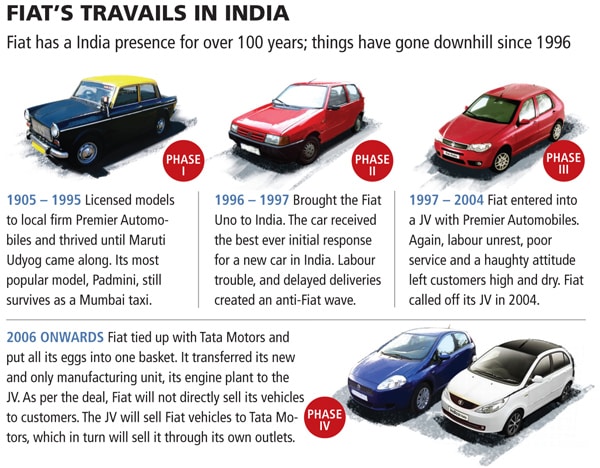

Fiat, on the other hand, has a history of failure in its car business in India. It has made three attempts, and at the end of each of those, it has only ended up with higher losses. In its last joint venture with Premier Automobiles, Fiat made losses of over Rs. 2,000 crore and ended up losing all its dealers due to a host of problems that included its main plant in Kurla getting flooded in the Mumbai rains. As European competitors like Volkswagen and Renault were committing big investments into the country, Fiat wanted a quick fix too and a tie-up with Tata Motors seemed just right.

But neither Marchionne nor Tata meant for the tie-up to solve merely the obvious problems. It was envisioned that Tata Motors would eventually help Fiat in sourcing cheaper components from India, and Fiat could help Tata sell its car in select overseas markets. Though Tata Motors has said that there is no plan yet to sell the Nano through Fiat outlets globally, Tata officials say that the option could be considered in the future.

Seen in the global light, the tie-up between a weak European player and a strong emerging market player takes a more strategic meaning. That makes it all the more necessary for the two companies to make it work. But right now, there is an urgent need for the companies to iron out the problems.

For one, competition in the small car business is increasing rapidly. German car marker Volkswagen, in three years, has garnered a market share which is three times that of Fiat. Next month, Toyota will launch its small car Etios, which is specifically designed for the Indian market. Auto industry analysts say that the Etios, with its Toyota pedigree, may well make deep inroads into Tata and Fiat territory too.

Telang says a lot of corrective measures are already underway. In the early days, as the JV was suddenly thrust upon the executives of both the companies, issues were thrashed out at the senior managerial level. The JV was represented equally by the two companies, with three members each on the board. Today, Tata Motors’ new CEO Carl Peter Forster has taken the onus on himself to set things right.

The upshot of this effort is trickling down to the 150 dealers that sell Fiat and Tata cars in the country. Around the time of the launch of the Linea Turbo Jet, Fiat realised that it needed a more focussed sales approach. So Fiat sales representatives now have a new uniform so that they can be identified easily. The initiative is in its early days and for now, primarily in outlets selling the Linea T-Jet. “If two brands are sold under one roof, then cross selling happens. And this is despite the fact that Fiat offers one of the highest commission rates to its dealer staff in the industry,” says a former Tata Motors employee who didn’t want to be named.

Kapoor though, believes that brand cannibalisation is not a chronic problem ailing the JV. “The customer base is entirely different. There will always be people who will say that I was there to see both and I have chosen this brand. But then there are people who are very clear about what they want,” he says. But then, do these brand conscious customers who want to buy a Fiat want to be seen in a Tata dealership? “Tata Motor dealerships have a very middle class touch and feel. Their cars don’t cater to the premium segment. So a Linea and a Punto selling in the same dealership is a problem,” adds the ex-Tata Motors employee. But analysts believe that Fiat’s problems lie elsewhere. “Both Fiat and Tata are ranked quite poorly in terms of their after-sales service and brand image, and these are the two main reasons why Fiat is struggling to make its mark in India,” says Darius Lam, senior market analyst at J.D. Power, a global market research firm.

Fiat’s close scrutiny of its operations and inputs via global consultancy firm Accenture, has brought about one good change: More number of test drives. The company realised that it was not doing enough on the test drive front, so customers weren’t getting the required opportunity to experience the car.

“There is effort required. In terms of the brand experience at the dealership levels: Providing sufficient number of test drives, following up on the sales and service. So these are the activities that are being done jointly by the working teams, and I have no hesitation to say that probably it is working in the right direction,” says Telang.

Fiat is also reworking its advertising strategy, which smacked of confusion earlier. The popular Indian cricketer Yuvraj Singh was used for just one ad campaign as the car’s brand ambassador. It didn’t work so another ad followed, projecting the Punto’s performance capability. That too was replaced with an ad where a thief tries to steal a Punto in a parking lot. “There has been no consistency in the advertising strategy. It seemed like Fiat really didn’t have any strategy and it simply plonked its products here,” says another Tata Motors official who didn’t want to be named.

Even as the immediate problems of the joint venture are being attended to quickly, at the Tata Motors headquarters, Foster is said to drawing up a long-term strategy for his car business. Earlier, in his first briefing, he had said that there could be a partnership with Fiat for an engine development programme.

Says a senior Tata Motors executive: “We need to iron out our own internal problems before we can expect the JV to deliver results.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)