Casino Royale: The Story Of Qualcomm

How Qualcomm learnt to love the Chinese, parked its tank in Intel’s backyard and its tollbooth at the centre of India’s telecom highway

There is something about technology companies that makes them want to dominate the world. Oracle, SAP, Microsoft, IBM, Google and even Apple all want the world to veer around to their point of view and therefore their products. Maybe it is something to with the transient nature of technology advantage. Those who manage to be dominant, even for a short-while, are seen as visionaries. And then there are those who are almost in that camp but not quite. For much of its life Qualcomm has been in the latter camp — the almost-Microsoft.

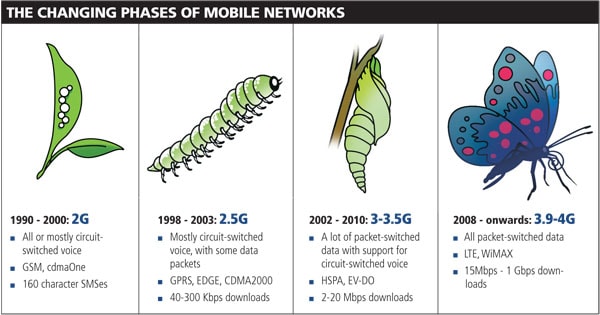

It was founded in 1985 by MIT professor-turned-entrepreneur, Irwin Jacobs, together with six of his friends. They had invented a proprietary technology that became the seed for the wireless standard CDMA, a technique that allows large amounts of information to be transmitted over limited wireless spectrum by using complex matching algorithms.

CDMA began to be adopted by the world’s mobile operators from the mid-90s after years of relentless hard-selling by Jacobs, backed up by equally relentless patenting by his engineers in the

R&D department.

Globally, this strategy has been very successful. Today, the company founded by Jacobs is led by his son Paul, and sits on a pile of over $18 billion in cash while generating another $2-3 billion in free cash flows every year!

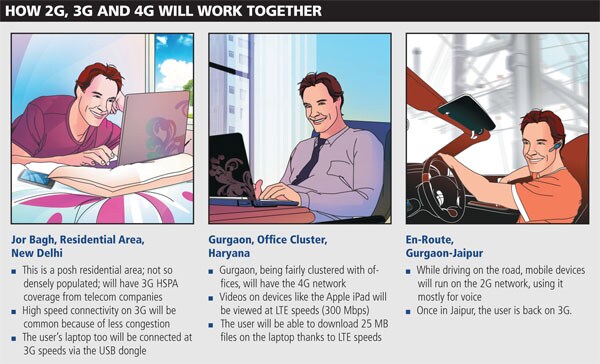

While this is brilliant in itself, India had eluded Qualcomm’s grasp. It has not made too much money here because its business model has just not worked here. However, things might be on the cusp of a change for Qualcomm because of a change in market dynamics and some canny risk-taking by the company to adapt its business model to fit this changed scenario. A win here will not only get it success in India, but also sink the ambition armada of its longtime foe, Intel, and with it, spell the endgame for the rival wireless standard backed by it — WiMAX.

Qualcomm’s model as it exists is simple. Be inventive, file as many patents as possible in wireless communication, and then build products around those or wait for people to queue up to use those patents and pay a nice royalty to the company.