Anil Rai Gupta: Staying in the game to build an institution at Havells

Anil Rai Gupta concedes he has big shoes to fill at Havells. After a series of setbacks, the manufacturer of fast-moving electrical goods is now reaping the benefits of its diversified focus on exports and ramping up its in-house production capacity along with investing in R&D

Anil Rai Gupta, Chairman and Managing director of Havells India. Image: Madhu Kapparath

Anil Rai Gupta, Chairman and Managing director of Havells India. Image: Madhu Kapparath

A small-town youngster from Punjab’s Gobindgarh decided to change his debt-ridden family’s fortune and moved to the capital city of India to set up a business. In 1958, first-generation entrepreneur Qimat Rai Gupta commenced his journey with savings of ₹10,000 from what is today well-known as Asia’s biggest wholesale market for electrical products—Bhagirath Palace. After working as a trader over the years, in 1971, he got an opportunity to become the owner of a supplier company that was on the brink of bankruptcy. Life was about to change for the unconventional founder, who acquired the blacklisted company Havells from Haveli Ram Gandhi.

There was no turning back since then. He took the small trading enterprise and turned it into a household brand that it is today with a series of acquisitions, joint ventures, and entering new product categories. Popularly known as QRG and a pioneer of fast-moving electrical goods (FMEG) in the country, he steered the brand from a few lakhs to ₹16,500 crore in revenue over four decades. In November 2014, at the time of his demise, the market cap of Havells was ₹18,000 crore. A couple of months prior to that, the 77-year-old had joined the billionaires club and made his debut on the Forbes India Rich List at Rank 48 with a net worth of $1.95 billion.

The veteran encountered many setbacks along the way, but remained headstrong during the crisis. “One thing that I learnt from my father and continue to believe in is that during times of crisis, leaders have to come out in front because people look at the leader’s mindset. If it’s positive, the organisation and all the stakeholders related to it become more confident,” Anil Rai Gupta tells Forbes India, sitting in his father’s cabin at QRG Towers in Noida. The toughest time for the company was undeniably the 2007 acquisition of German lighting and fixtures maker SLI Lighting, owner of the Sylvania brand. The European market was hit by the financial crisis soon after the acquisition, and Sylvania felt the blow. Havells pulled all the strings to make the deal work—and even briefly managed to do so—but eventually sold it off completely by 2017.

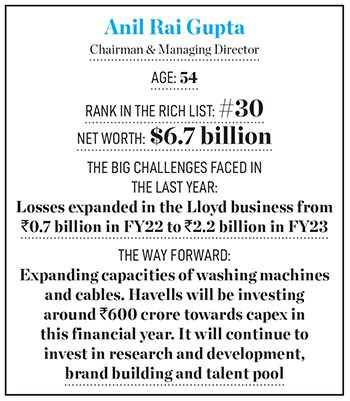

The second-generation entrepreneur admits that he had big shoes to fill after the passing of QRG, but he gained a lot from the experience of working under him for 20 years. Today, the company manufactures everything from switchgears, cables, and electrical consumer durables to air conditioners and refrigerators in its 15 facilities across the country. The 52-year-old company, which got listed on the bourses in 1993, has a market cap of ₹77,767 crore and six brands under its umbrella, from mass to mass-premium category.

The second-generation entrepreneur admits that he had big shoes to fill after the passing of QRG, but he gained a lot from the experience of working under him for 20 years. Today, the company manufactures everything from switchgears, cables, and electrical consumer durables to air conditioners and refrigerators in its 15 facilities across the country. The 52-year-old company, which got listed on the bourses in 1993, has a market cap of ₹77,767 crore and six brands under its umbrella, from mass to mass-premium category.

Anil Rai Gupta and his mother Vinod are ranked 30th on the 2023 Forbes India Rich List with a net worth of $6.7 billion. Their rival, Inder Jaisinghani of Polycab, rose 28 spots to Rank 32 with a net worth of $6.4 billion. The chairman and managing director of India’s largest wire and cable maker is one of the biggest gainers on the list—his wealth is up the most in percentage terms, as the company benefited from increasing electrification. No, it’s not a Coke versus Pepsi kind of situation yet because Havells is more focussed on business-to-consumer (B2C) whereas Polycab generates a major chunk of its revenue from business-to-business (B2B) operations. But it has now gradually started expanding its FMEG portfolio.

Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Polycab is one of the largest exporters of power cables. It saw an 88 percent growth in exports, with the US and Australia making up a majority of its overseas sales. Looking at the current tailwind in the cable sector, especially on the back of the renewables push, Polycab stands out in terms of a better cable portfolio. This has spurred the growth of the company.

Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position,” adds Poddar.

Havells’s stock price hasn’t moved much in the last year due to its muted earnings growth. On the other hand, Polycab’s stock price has doubled in the last year due to a combination of robust performance in its core cables and wires segment, and price-to-earnings (P/E) re-rating. “Havells remains the most expensive stock in the peer set due to its diversified business, strong management, distribution and brand pull, and high cash flow generation. Havells is among the top three players in many of its key product categories. While it remains a strong brand in the mid-premium segment, expansion into the mass-mid segment will be key to determining the sustenance of its market share position,” adds Poddar.