The All-Composite Bus Comes To India

A technology that can make passenger buses lighter and more efficient comes to India in its search for mainstream acceptance

Golf enthusiast P.K.C. Bose found himself in a bunker in late 2008. His swing for a deal with Tata Motors, India’s largest maker of commercial vehicles, had just got lost in the dogleg. He had had no illusion that it would be an easy job. As CEO and managing director of Saertex India, he wanted to get bus operators to move away from the gas-guzzling steel-bodied vehicles to a more modern, environment-friendly alternative — buses made from fibre-reinforced plastic composites. For that to happen, manufacturers like Tata must first embrace the technology and invest in new tools. Tata had shown interest but later decided against tying up with Saertex citing other technology partnerships.

For a while, the cause seemed lost, but one cold morning at the Delhi airport, Bose scored a hole-in-one.

R. Seshasayee, the technology-loving (former) CEO of Ashok Leyland, happened to pass through the airport that day. Bose was there too. He introduced himself and his two German colleagues. Seshasayee responded with enthusiasm when told about the plan to bring the composites technology to India’s bus sector. He invited Bose and his team to make a presentation to the senior officials at Ashok Leyland’s Chennai head office. One thing led to another and very soon, Saertex had a 500-bus deal with Leyland.

“The all-composite bus project is a very exciting one not only for us but also for India as a whole,” says Bose. For Saertex India, a little-known company with a plant in Hinjewadi near Pune and largely serving the wind turbine sector, this is a breakthrough into the automotive segment. For its German parent, it is an entry into the world’s second biggest bus market.

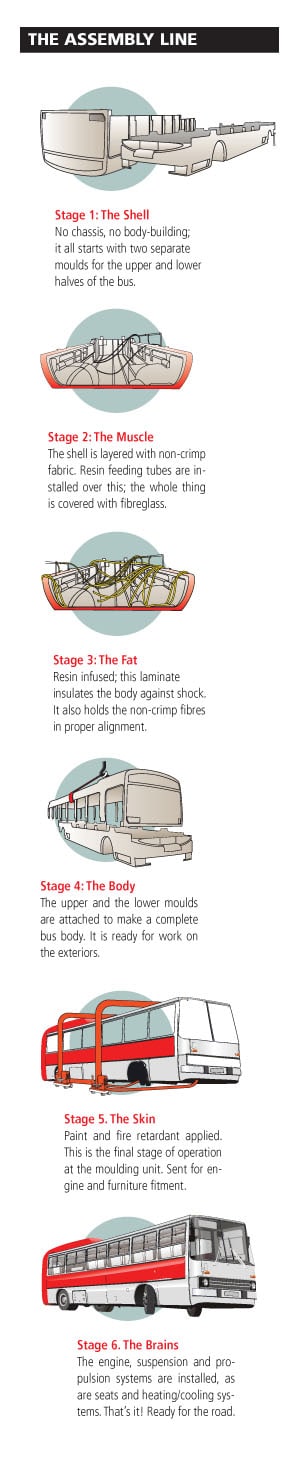

The idea of a composite bus is as simple as it is compelling. In the manufacture of a conventional bus, a chassis or the basic framework to hold all the parts is made with steel. Then, a body is built on it using more steel. A lot of welding goes into binding everything together. In the end, we have a very heavy product that has thousands of independent components.

On the other hand, a composite bus body is just two moulds fused together. Engines, seats and other stuff are fitted into this shell. And voila, the bus is ready. The composite is made up of a non-crimp fabric at its core — the kind of stuff that Saertex makes — with several layers of reinforcements. A composite bus is lighter, consumes less fuel and resists corrosion and damage better than steel-bodied buses. While the initial cost is higher, its maintenance is cheaper making the total cost of ownership attractive.

But the irony is that the all-composite bus is not in the mainstream anywhere in the world. In fact, it has seen wide adoption only in the US state of California. From European nations to Korea, bus operators are warming up to this technology but are yet to make large-scale commitments. Even in the US, success has not been easy. The pioneer, North American Bus Industries (NABI), had to wait for nearly a decade before it got accepted in the market.

So why is Bose trying to bring it to India?

India is on the threshold of becoming one of the hottest markets for buses in the world. Economic growth has led to a whopping increase in public transport needs in its burgeoning cities. For long, the demand was for only about 30,000 buses a year but the graph has now taken a steep turn upwards. In 2010, bus sales in India reached a record 38,000. Industry experts expect the number to reach as high as 60,000 by 2015.

Much of this demand will arise for better quality, high-tech and luxury buses. Till recently, the market was dominated by rickety, noisy buses that broke bones. In many cities, commuting was a nightmare because too many people were crammed into too few buses that were poorly maintained. Cash-strapped state-run bus corporations bought the cheapest models available and never invested in modern technology, emission reduction or passenger comfort.

All that started to change a decade ago when Swedish company Volvo brought its modern low-floor city buses. Initially, transport operators were reluctant because of the high cost but consumer demand swung overwhelmingly towards these buses. “Consider the fact that while it took only a couple of Volvo buses in a customer’s fleet in 2001 to make news, today our largest customer has over 400 coaches in his fleet and no one bats an eyelid,” says Akash Passey, managing director of Volvo Buses India. “A lot has changed in the past 10 years and things will change even faster in the next five years.”

The flip side is that India is also an incredibly difficult market to penetrate. Mindsets that favour steel-bodied buses will not change easily. Big cities are served by state-run bus corporations that are determined to keep the cost of travel low; this skews the economics of bus operations. Manufacturers will be put off by the large capital needed for the basic tooling and the lack of enthusiastic customers.

Bose has indeed taken up an extremely difficult task. But if he succeeds, India’s bus market would have seen the second biggest disruptive progress in less than a decade — after Volvo’s luxury coup.

From Mould to Sold

One day, a composite bus of the Los Angeles County Metropolitan Transportation Authority (LACMTA) was cruising along its route when a Toyota Corolla traveling at 56 kilometres per hour collided with it. Given the mass of the bus and the combined velocity of the accident, the car was severely damaged. A conventional bus would have taken heavy damage too but the impact on this one was non-consequential. “We replaced the front bumper and the windshield at a total cost of $8,000. In a conventional bus, the total cost of repair for the front-end right-hand side and the door, which are the weak points, would have been very expensive to repair costing us almost $50,000,” says John Drayton, manager of vehicle technology at LACMTA.

While a layman may wonder how a plastic bus might escape being damaged in an accident, the truth is that a composite bus is actually sturdier than a steel one. Drayton says the LA bus service spends 90 percent less on maintenance and repair of its composite buses compared to the conventional buses in its fleet. But durability is not the only virtue of the composite bus. It can also be lighter and consume less fuel, provided the engine power, too, is scaled down accordingly. That means more money for the bus operator and less smoke on the road. In LA, composite buses carry 20 percent more passengers compared to steel buses of the same weight.

In fact, making lighter buses is a key aspect of Ashok Leyland’s deal with Saertex. “The bus we looked at was expected to be lighter by about 18-26 percent compared to an equivalent bus built to the conventional standards,” says M. Natraj, who was executive director of the Indian company’s global bus programme when the deal was struck.

Saertex claims that a composite bus puts less pressure on the tyres. Stephen Misencik, chief technology officer, says a composite bus could be 25-29 percent lighter than metal frame buses and still lighter if it is fueled by natural gas.

The composite frame, based on a technical fabric instead of steel, also offers corrosion resistance and noise reduction. “The composite bus has a longer life than the metal bus. It will survive for 18-19 years,” Misencik says.

The noise level is so low that it once foxed a bunch of engineers working on the air-conditioning unit of one of the buses in Los Angeles. A NABI engineer got a frantic call from the technicians who said they couldn’t start the bus. The engineer went to help only to discover the engine had all along been running. He congratulated the guys for starting it on their own and went back to his work, says Drayton.

If the technology is so good, then why has it still not seen wide adoption? And what are the chances that India will take to it when the rest of the world is still mostly undecided?

A Bumpy Ride Ahead

A composite bus is three to seven percent costlier than a conventional metal-frame bus. This upfront cost keeps bus operators that are focused on short-term bottom lines from taking the plunge. However, Saertex argues that they must look at the product’s lifecycle costs that compare favourably with those of metal-frames because of lower running costs. “The payback period for a composite bus can be as low as 18 months,” says Bose.

But in India, government tenders do not look at total cost of ownership but only the cost of acquisition. State transport undertakings award bus contracts through competitive bidding where they have to go in for the lowest bidder. The costlier composite buses may lose out on such orders.

Despite the growth of the luxury bus segment, India remains largely a market for cheap buses priced between Rs. 7 lakh and Rs. 20 lakh. About 80-90 percent of all buses sold are in this category, says Volvo’s Passey. “If you put in the composites technology in such buses, then the initial cost of procurement will be high and it may not be immediately viable for operators,” he says.

Another drawback of this technology is the speed at which these buses can be made. It takes about three days to produce a composite bus from start to finish. That’s nearly a day more than the time taken for a conventional bus. The composite uses a special resin to bind together the layers as well as distribute the stress from the road efficiently. “Quite frankly, we have to have time for the resin to cure and that takes some time,” says Misencik. The extra day increases the cost of capital and labour adding to the final price.

It will not be easy to convince the industry to replace steel with a composite material. Steel is a material that is well understood. It is easy to work with, available in large volumes and can be recycled. “Steel offers good strain rate sensitivity, meaning that the strength will rise as high as 43 percent under crash loading,” says Vikram Amin, executive director for sales and marketing at Essar Steel. “Steel can be substituted but not replaced.”

The manufacture of composites would need a separate plant and heavy investment in tools. Without the guarantee of enough orders, no bus maker would want to take that risk. For this reason, Ashok Leyland has asked Saertex to make an initial batch of 500 vehicles at the latter’s joint venture plant (with composite materials maker Kemrock in Baroda, Gujarat). If the entire plan succeeds and Leyland is able to predict steady demand, only then it will think of a plant.

A practical problem with composites is that they don’t lend themselves to different configurations. Each utility has a different need when it comes to things like windows and seats. It will be difficult to customise composite buses to each of those needs. “Composites are particularly useful for cookie-cutter buses because they are made of a mould,” says V. Sumantran, director at Ashok Leyland and executive vice chairman of Hinduja Automotive UK.

Questions have also been raised over the weight-saving promise of composites. Many of the examples in the market have failed to achieve their full potential on this score. Manufacturers need to go in for lighter engines with composites. If they continue to use the same engines they would use in a steel-frame bus, there would hardly be any savings. In fact, US manufacturers like Proterra are making the transition to cleaner fuels for this reason.

India doesn’t really have a great record in adopting cleaner, modern technologies ahead of advanced countries. In fact, there has long been a crying need for the use of composites in vehicle parts, which the manufacturers have been resisting. R.K. Verma, former managing director of Delhi Transport Corporation, cites his attempt to get the fuel cylinder in CNG buses to be made of composites than the heavier metals. Each time, his request was declined by Tata Motors and Ashok Leyland on the grounds that they didn’t have the technology or the suppliers and that such a change would increase the final price of the bus substantially.

“Till date, nothing has been done about it. I don’t see any company trying anything for the future. We are stuck in the muddle of great tradition and modernity,” says Verma. It is up to Saertex and Ashok Leyland to prove him wrong.

(With inputs from Anirvan Ghosh)

Edited by S. Srinivasan

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)