Sun Has a Better Shot Than Most at Ranbaxy Turnaround

There are apprehensions on whether Dilip Shanghvi's company can help India's largest but troubled pharma major turn around. However, analysts, while sceptical, also point out that Sun Pharma has a better shot than most

On April 7, a Monday morning, Sun Pharmaceutical Industries, India’s second largest drugmaker, surprised everyone by announcing a merger with the troubled Delhi-based pharmaceutical firm, Ranbaxy Laboratories because the two companies have very different personalities.

Sun’s portfolio is dominated by the high margin and niche therapeutic segments of psychiatry, neurology, cardiology and orthopaedics, while Ranbaxy is biased towards primary care and over-the-counter drugs, many of which earn low margins. More importantly, Ranbaxy is the ‘bad boy’ of the Indian generics industry; the scale of its regulatory compliance problems in the United States is unprecedented, and it has been unable to fix them so far. In January this year, a fourth of its manufacturing plants was banned from exporting to the US market, bringing down its operating margins to 6-8 percent—a figure so low that it is “unheard of” in the generics business, says Anshuman Gupta, a pharmaceutical sector analyst at Edelweiss Financial Services.

Little wonder then that there are serious apprehensions about whether Sun will be able to turn around Ranbaxy. Yet, there is also a belief that if anyone can rescue Ranbaxy, it is Sun. The latter has an illustrious history of acquiring distressed companies and reviving them. Starting with Caraco Pharmaceutical Labs in the 1990s, it has made several acquisitions, out of which the Israel-based Taro Pharmaceuticals saw the most stellar turnaround. When Sun acquired a controlling stake in Taro in 2010, its operating margins were just over 20 percent. Three years later, drastically improved operating efficiencies have bumped up its margins to over 60 percent. “Their stand was vindicated,” says Sarabjit Kour Nangra, an analyst at Angel Broking.

Ranbaxy, though, is nothing like Taro. First, it is much larger; its revenue in the last 12 months was close to $2 billion, whereas Taro’s revenue when Sun took over, was $400 million. Second, Ranbaxy is present in multiple geographies—the US, the UK and the emerging markets, all of which come with different challenges.

However, Sun’s track record makes investors hopeful. In 2009, its Detroit subsidiary Caraco Pharma entered a consent decree with the US Food and Drug Administration for multiple quality issues at its plants. Within three years, the firm was able to resolve them and resume manufacturing, indicating Sun’s ability to successfully address compliance issues. Still, Sun will have to reckon with the vastly different cultures of the two companies. While it is a Gujarati-owned firm traditionally focussed on specialty drugs, Ranbaxy is a Punjabi-owned firm that was once the largest maker of antibiotics in India. Such cultural differences are the reason why Daiichi Sankyo could never revive Ranbaxy, and had to sell its stake. Sun has a better shot at reviving it, but nobody is placing any bets yet.

Though regulatory issues have brought down Ranbaxy’s margins, it has always been a relatively low-margin company. Apart from the commoditised nature of its products, this is because of the way it has managed its businesses. Its overheads are high and the productivity of its salesforce is low. Missteps have marked its foray into emerging markets, such as Romania, where it is making losses. “They went into emerging markets without a proper strategy,” says Bino Pathiparampil, an analyst at IIFL Capital.

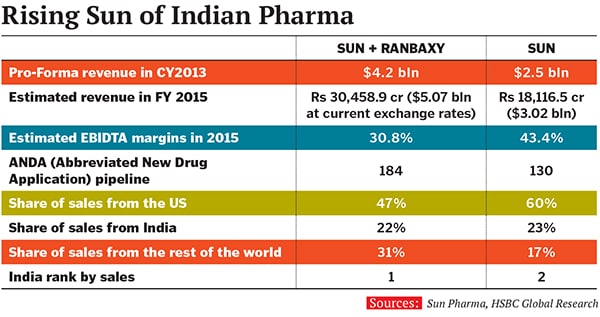

Will Sun be able to overcome all this? “From a long-term perspective, one can’t really say. This could make it interesting,” says Girish Bakhru, an equity analyst from HSBC Global Research. Regardless of these challenges, the deal makes Sun Pharma the fifth largest generics company in the world, in an industry where size matters. It gives it access to newer markets such as Romania, Africa and Russia, where Ranbaxy has a strong presence. It also allows it to dominate newer therapeutic segments, such as dermatology and controlled substances in the US. “Don’t forget the Japan angle,” Gupta adds, “With Daiichi coming in, Sun could launch itself in Japan.”

There is much to be gained if Sun is able to do a repeat of its overhaul at Taro. As in Taro’s case, if it succeeds in infusing a culture of efficiency into Ranbaxy, this will become Sun’s biggest and most successful turnaround yet.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)