Should you invest in the stock market right now?

Geopolitical conflict, rising inflation, rising oil prices, and the surge of Covid-19 in China have played a part in enhancing the volatility of the stock markets across the world. Dr Hemant Manuj - Associate Professor, Finance at Bhavan's SPJIMR checks the historic trends to figure out the next course of action

The common question on everyone’s mind is—when will the bonds, emerging market (EM) currencies, and equity markets bottom out?

Image: Shutterstock

The common question on everyone’s mind is—when will the bonds, emerging market (EM) currencies, and equity markets bottom out?

Image: Shutterstock

A majority of the asset markets, including bonds, equities, and currencies, across the world, have been declining over the last few months. The withdrawal of the quantitative easing (QE) and hike in Federal funds rate, the war in Ukraine, and the fresh outbreak of Covid-19 in China are the main factors cited by analysts for this decline. The common question on everyone’s mind is—when will the bonds, emerging market (EM) currencies, and equity markets bottom out? No one has a crystal ball for looking into the future. That’s why predicting the markets is often called a dud’s game. Yet, we can’t give up trying as a lot of our financial as well as real-world outcomes depend on how the financial markets behave.

The year gone by

Here I attempt to forecast where the Indian equity market is heading. The S&P BSE Sensex and the Nifty50 formed a top on October 18, 2021. Then they hit the bottom on June 17, 2022, with a decline of about 17 percent from the top. They have since moved up by six percent in about three weeks. This is quite a roller coaster ride.

Also Read: NSE holiday calendar 2023: list of NSE stock market trading holidays

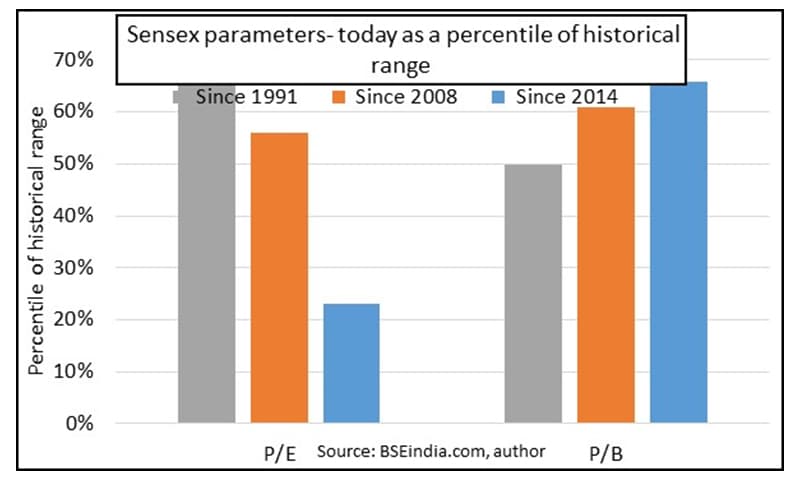

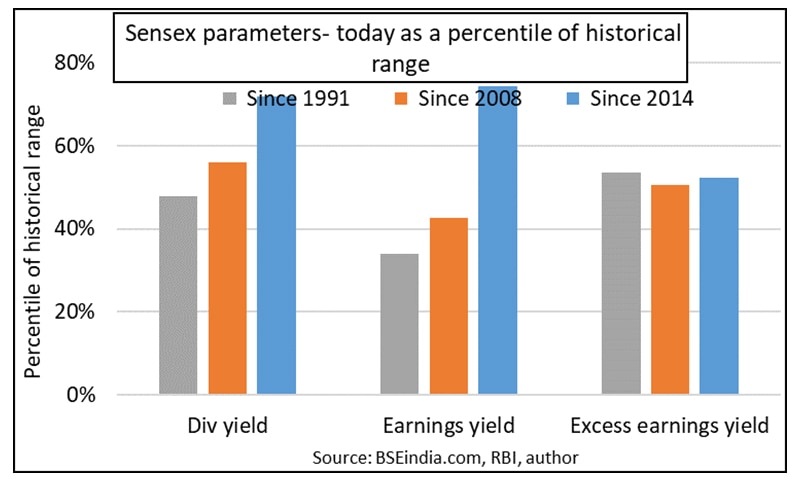

The market parameters

Multiple fundamental factors affect the market prices and expected returns. Here I focus on the historical behaviour of a few key market parameters to see what they are telling us about the future. I look back at three time periods –

a) since 1992, when the foreign portfolio investors (FPIs) began investing in India, till date,

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]