Bringing method to the madness: A hedge fund manager and derivative trader's take on behavioural biases

Individuals are imperfect and will continue to be prone to biases. The key to success in markets is to first acknowledge the existence of biases, and then put in place processes to manage biases, especially at exits

Investors often operate based on emotional biases than long-term fundamentals.

Image:Shutterstock

Investors often operate based on emotional biases than long-term fundamentals.

Image:Shutterstock

China recently eased restrictions under the Zero Covid policy and is reportedly going through a large Covid-19 wave. This has started causing concerns amongst financial market participants, which highlights a very important aspect of investor behaviour. Investors often operate based on emotional biases than long-term fundamentals.

“There is always an element of over-reaction in the market to Covid-19 news,” stated a Chief Investment Strategist at one of the broking houses. Uncertain times cloud investors’ judgments, often triggering actions based on emotions. Such instances showcase that the Efficient Market Hypothesis doesn’t always hold and how investors' biases ultimately influence their investment decisions. As stated by Morgan Housel, “Investing is not the study of finance. It’s the study of how people behave with money”.

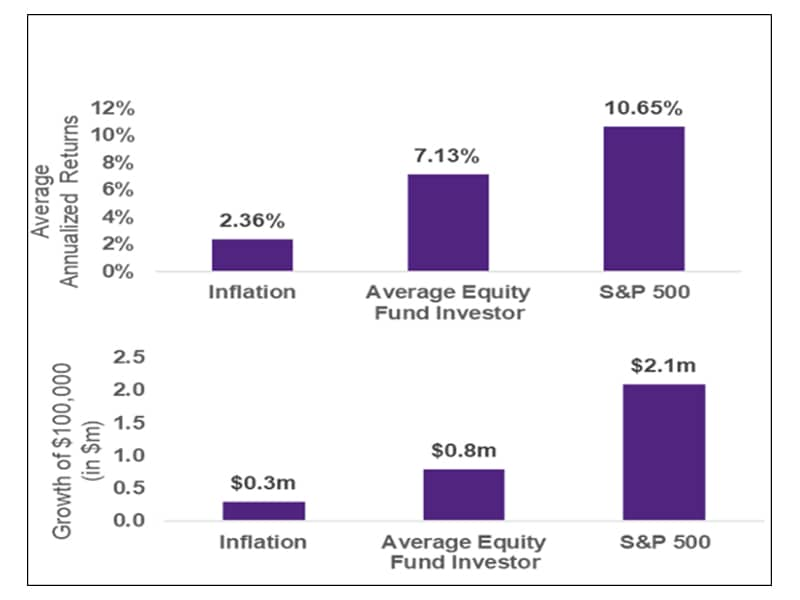

As per a study by Dalbar, a financial-services firm, equity fund investor returns stood at ~7.1 percent p.a. versus ~10.7 percent p.a. for broader market indices such as S&P 500. This difference is attributed to investor biases. Dalbar showcases why investors need to regulate emotions to earn higher returns.

The inability to regulate emotions/biases is termed a ‘Cognitive Error’. In the book ‘The Art of Thinking Clearly’, Rolf Dobelli defines Cognitive Errors as systematic deviations from logic and rational behaviour; barriers to logic that we stumble upon repeatedly. Over time, these deviations aggregate up towards broader market anomalies which lead to bubbles and crashes.

Source: The Dalbar Study

Figure 1: The Dalbar Study: 30 Years of Average Equity Fund Investor v/s Indexes (1992-2021)

Source: The Dalbar Study

Figure 1: The Dalbar Study: 30 Years of Average Equity Fund Investor v/s Indexes (1992-2021)

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]