Tata Motors bets big on SUVs

Tata Motors, the maker of India's first SUVs, is back in the game with its aggressive line-up

Mayank Pareek, Tata Motors president, with the Harrier that was launched to compete with MG’s Hector and Kia’s Seltos

Mayank Pareek, Tata Motors president, with the Harrier that was launched to compete with MG’s Hector and Kia’s SeltosImage: Abhijit Bhavsar

The 1990s ushered in a new era in India’s passenger car industry. There were just a handful of vehicles to choose from till the 1980s, but a freshly-minted liberalised economy brought winds of change that rapidly took shape in the form of numerous new models and options across new segments.

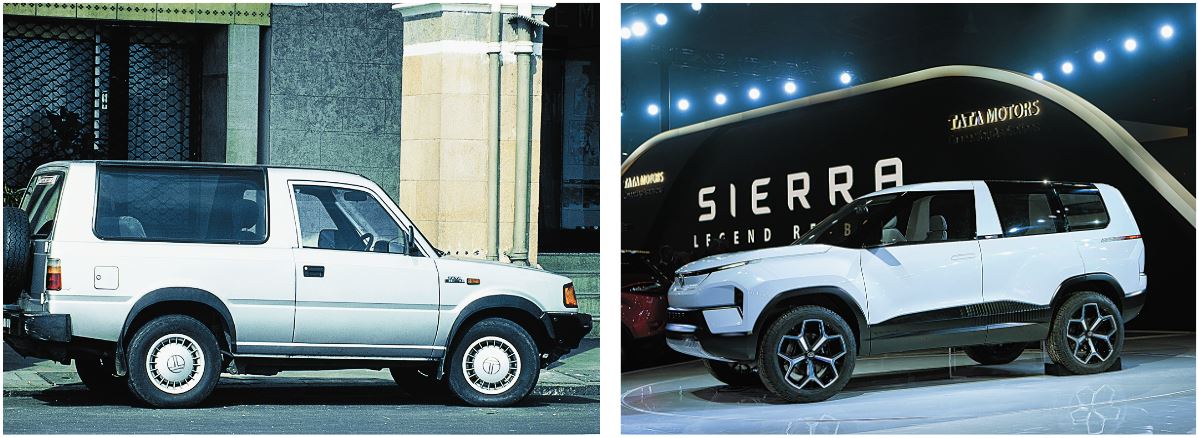

It was the decade that saw the launch of three cars that would go on to become popular icons. Tata Motors, known as the maker of trucks and heavy vehicles till then, took its first step towards becoming a maker of passenger cars with the launch of the Sierra, an off-road utility vehicle, in 1991. The Sierra was the first car produced in India with electric windows, air-conditioning and adjustable steering wheels; it was also the vehicle that saw the tachometer for the first time, now a ubiquitous feature in cars. The Sierra was followed by the Estate, a station wagon, in 1992, the Sumo in 1994, and the Safari in 1998. All four models were based on the Tata Telcoline, a commercial pick-up launched in 1988. The only other comparable vehicle launched in the 1990s was the Mahindra Classic.

“If you go back to the 1990s, there used to be only two car segments: Cars with a box and cars without a box. That was such a simple life actually,” remembers Mayank Pareek, president of Tata Motors. “But as the industry matures, segments and sub-segments creep in, catering to the different choices and preferences of customers.”

“Till about early 2000, the sports utility vehicle [SUV] segment was very nascent, with a limited number of people buying them,” adds Pareek. “There was a perception that these cars were used in semi-urban and rural areas. But by early 2010-11, the new segment occupied about 10 percent of the market; there was a sharp jump.” And hence, 26 years after the launch of Sierra, Tata Motors launched its first crossover SUV, the Nexon, in 2017, in a market that was dramatically different from the one in which it had launched its first SUV. An indication of this is the fact that the current year will see the launch of at least 20 SUV models, new and revamped versions, from companies such as Mahindra, Maruti Suzuki India, Hyundai, Kia, Skoda, Toyota, MG, Citroen and Volkswagen.

As the Indian auto industry has matured, its customers too have evolved. They can be segmented into those buying cars for the first time, those purchasing for their families and ones who are replacing their older cars. “The first-time buyers, which I would put at 40 percent of the market, usually purchase small cars,” says Pareek, “but those who are buying an everyday car for their families or replacing their existing cars, prefer UVs.”

He adds that UVs of today are not like those in the past. “Old UVs were tough to drive and difficult to manoeuvre. But technology has evolved, and UVs today are as good, if not better, to drive than high-value cars.” Pareek attributes the rise of the segment to two factors: Aspirational reasons and convenience. “There is more space inside, the driving position is high, so you glide into the vehicle instead of crouching in it, and it makes you feel more confident because of the height, which makes visibility much better.”

According to a business intelligence report released in February by Data Bridge Market Research, the global SUV market is expected to register a CAGR of 12.23 percent in the 2019-2026 period. It attributes this rise to higher levels of investments by manufacturers to develop innovative and technologically advanced vehicles, along with consumer preferences for safety, infotainment systems and comfortable off-roading options. The report says the global market is expected to be significantly driven by growth in the Asia-Pacific region, which is witnessing higher living standards.

In the Indian auto industry, which has been in the doldrums for more than a year, the UV segment has been a beacon of hope for manufacturers grappling with falling sales figures. Data from the Society of Indian Automobiles Association (Siam) shows the sale of cars in 2016-17 was at 21,03,847 while the sale of UVs was 761,998. By 2018-19, the sale of cars was at 22,18,549, an increase of 5.45 percent, whereas the figure for UVs was 941,461, an increase of 23.55 percent.

(From left) The earliest model of Tata Sierra launched in 1991; the electric concept model of the car on display at the Delhi Auto Expo 2020

(From left) The earliest model of Tata Sierra launched in 1991; the electric concept model of the car on display at the Delhi Auto Expo 2020Image: Nitin Kelvalkar / Dinodia Photo

“Historically, we were big and established as manufacturers of SUVs,” says Pareek. “Even when the market was not there, we had iconic brands like the Safari… and now we are coming back big time into this segment again.” Starting 2016, Tata Motors has launched three models in the UV category: The subcompact crossover SUV Nexon in 2017, the mid-size SUV Hexa in the same year, and the five-seater compact SUV Harrier in 2019. At the Delhi Auto Expo this year, it showcased the seven-seater SUV Gravitas and also a concept electric version of the Safari. “We understand that this market will get divided into sub-segments, and it will not be a one-shoe-fits-all situation. People have different tastes, and we need to provide a vehicle for every market and taste,” he adds.

“Since the SUV segment has been the fastest-growing one in the auto industry, it makes sense for original equipment manufacturers to launch new products in this market,” says Puneet Gupta, associate director, automotive forecasting, IHS Markit. “Tata Motors brings out fully loaded products, and with demand back in the ₹10 lakh to ₹20 lakh category, especially in the urban markets, the Nexon is a good attempt to initiate people into the SUV category.”

With the Nexon, Pareek says, the company really pushed the envelope where its design was concerned. “In India, people buy cars 50 percent for themselves, and 50 percent for their neighbours. We wanted people to see the Nexon, and say ‘Wow, what a car’.” The subcompact SUV also became the first car from India to achieve the coveted five-star crash test rating from Global NCAP (New Car Assessment Programme) in 2018. “This car was entirely engineered in India and so it’s not like it required technical expertise from elsewhere,” said David Ward, secretary general, Global NCAP. “It shows you what the Indian automobile industry is capable of.”

“The Harrier, which is designed along the lines of the Land Rover—the gold standard of SUVs—has also done well, and is No 2 or 3 in its category. Now with the launch of the automatic and the petrol variant, we should be able to get the No. 1 position in this segment,” says Pareek.

Gupta adds that Tata Motors incorporates a lot of value in its products, thanks to localisation and frugal engineering. “It has also been tying up with global players for navigation systems and music systems to make its products better.”

While the company has made a re-entry in the SUV segment, Mahindra & Mahindra has maintained a relatively steady stream of models in the category for almost two decades. With the launch of the Scorpio in 2002, the Bolero in 2004, the XUV 500 in 2011, the TUV 300 in 2015 and KUV100 in 20116, the auto manufacturer—also one of the country’s largest makers of heavy vehicles—has launched models that cater to varying price brackets and requirements.

However, Gupta says both these makers were caught off guard with the rise of the demand for urban SUVs. “The demand that we see now is for urban vehicles… they are not real SUVs that are meant to have serious off-road capabilities,” he says. “This is not the segment in which Tata Motors and Mahindra earlier operated. The product life cycles of their earlier models were very long because customers also owned the same vehicles over several years. But now customers frequently want something new and different, and Tata Motors and Mahindra have had to change their game.” This has required significant investments in research and development, and production facilities. For carmakers like Hyundai, it has been relatively easier since they work at a global level.

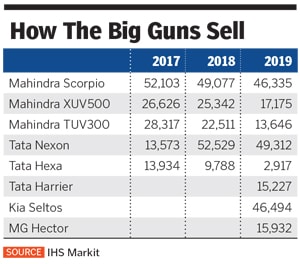

Tata Motors’ push in the SUV segment comes at a time when the market has become highly competitive. For instance, Gupta adds, the Tata Harrier launch happened when the Indian market saw the entry of South Korean Kia Motors with the Seltos and Chinese MG Motor with Hector. Both entrants succeeded in creating significant excitement among customers, with the Seltos selling almost as much as the combined sales of Mahindra XUV 500, Tata Harrier and MG Hector (see: How the big guns sell).

Tata Motors is continuing its aggressive push in the UV segment, with new models and variants lined up for the year. The Gravitas generated buzz about competition in the seven-seater SUV segment, with upgraded versions of the Hyundai Creta, Mahindra XUV 500 and the Jeep ‘D-Low’ expected later this year or in 2021 whereas the Nexon EV has spurred Hyundai to start building its own electric options in the UV segment. Mahindra also has its eXUV300 waiting to be launched.

Has Tata Motors come full circle with its UV play? “The UV market then and now are different, with all the sub-segments that we now have,” says Pareek. “We now want to build a relationship with customers who can start in this segment with the Nexon, and move up as their requirements change. It’s about acquiring customers for life.”

For some loyalists who never let go of their Safaris from the 1990s, that would be a familiar feeling.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)