Capital: The missing piece of climate action in India

Climate tech startups are gaining momentum, but still constitute only nine percent of the total investment deals among all impact-oriented sectors in India, Ramraj Pai, CEO, and Deepanshi Balooni, manager, at Impact Investors Council, write

India’s vibrant innovation and venture capital ecosystem holds strong potential in solving some of these complex climate-related challenges in the areas of energy, water and air pollution, transportation, agriculture and waste management

Illustration: Sameer Pawar

India’s vibrant innovation and venture capital ecosystem holds strong potential in solving some of these complex climate-related challenges in the areas of energy, water and air pollution, transportation, agriculture and waste management

Illustration: Sameer Pawar

India, being the third-largest emitter of greenhouse gases in the world, remains acutely vulnerable to climate change owing to a large base of low-income population coupled with few social safety nets. Thanks to a slew of ambitious climate action commitments made by the Government of India over the last decade (including the National Action Plan for Climate Change and the Paris Agreement), the country has now made some progress in the utility-scale renewable energy sector. However, the size and scale of the climate crisis facing India today necessitate a variety of rapid, affordable and innovative approaches to drive sustained decarbonisation of the economy at various levels—from food production to consumption, manufacturing, retail, transportation etc.

India’s vibrant innovation and venture capital ecosystem holds strong potential in solving some of these complex climate-related challenges in the areas of energy, water and air pollution, transportation, agriculture and waste management. Impact Investors Council’s analysis indicates that, over the past decade, about 600 impact-driven, for-profit early-stage enterprises have positively impacted over 500 million directly.

Tech innovations for climate solutions

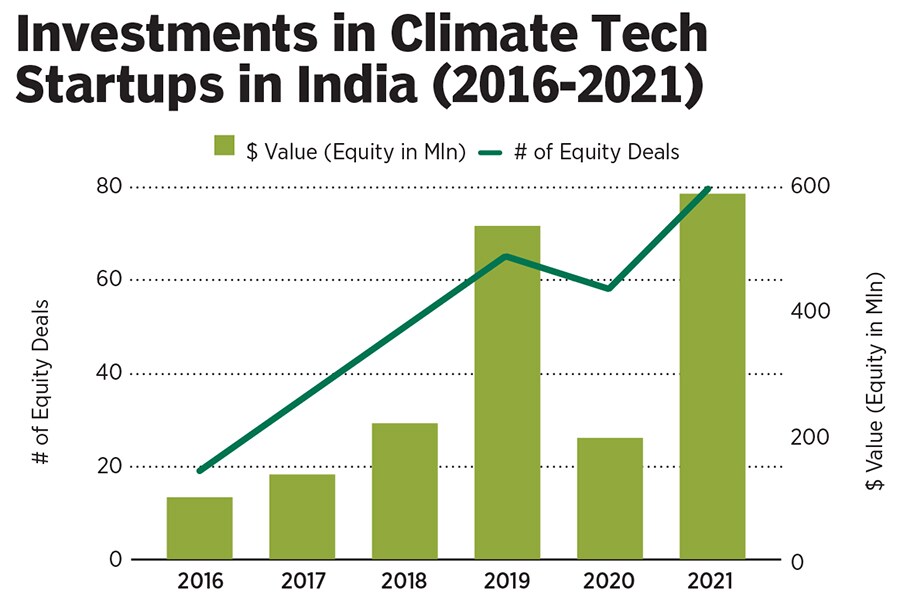

A recent study by Impact Investors Council (IIC), Climate Collective and Arete Advisors, ‘Early-stage Climate-tech Startups in India: An Investment Landscape Report 2021’, highlights the growing momentum of startups in India building innovative and affordable low-carbon technologies to either reduce carbon footprint or help people adapt and build resilience to climate change, also referred to as climate tech startups. According to the report, 120 such startups have attracted $1.8 billion in 284 equity transactions in the period 2016-2021 in India. Since the sector is still in a nascent stage, more than half of the deals are in the ticket size of less than $1 billion.

Sustainable Mobility and Energy sectors dominate investment landscape

Among sub-sectors, sustainable mobility, constituting electric vehicles and clean logistics, continue to be ahead on the maturity curve with the maximum investment activity ($1.1 billion in 124 deals) since 2016. With $354 million in 60 deals, the energy sector (clean energy generation, access, storage and optimisation products), which has traditionally been the mainstay of climate financing in India, is second in line. Both sectors enjoy a reasonable market understanding with a relatively favourable regulatory environment. However, the bulk of innovations are germinating in newer sectors such as climate-smart agriculture, waste management and circular economy, and environment and natural resources, and are gradually coming to the fore in the venture ecosystem. Deep-tech innovations in segments such as clean energy generation (green hydrogen), alternative proteins, energy storage, EV manufacturing, carbon capture etc. are fast ramping up.