Li Ka-Shing's Midas Touch

Asia’s richest man dominates Hong Kong and holds the keys to China, but it’s his brilliant tech investments, including Facebook, Siri and Spotify, that have turned heads recently. In a rare interview Li reveals his new strategy—and where he’s putting his money now

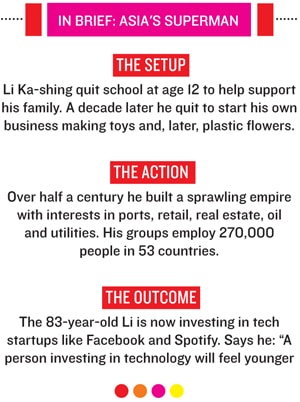

Even at 83, Asia’s richest man, Li Ka-shing, gets more done by lunch than people half his age pull off in a full day. By the time I meet him he’s already mowed through his daily breakfast of congee and vegetables, a thorough read of the international news and a round of golf near the home he has lived in for the past 50 years. Ensconced in his office atop the Cheung Kong Center in central Hong Kong, which boasts a private pool and one of the world’s fastest elevator rides (70 storeys in an ear-popping 45 seconds), he exudes serenity. “A person investing in technology will feel younger,” he smiles, his signature black square glasses dancing on his nose. For the entire quarter-century that Forbes has been measuring global billionaires, Li has controlled a huge swath of the teeming city of 7 million people below. Li’s companies have built one in every seven residences here, handle 70 percent of Hong Kong’s port traffic and hold big market shares in electric utilities and mobile phone service. His success in mainland China—notably retail and real estate—is also impressive.

But for the first time—he hasn’t granted an interview to the Western media in nearly five years—Li is opening up about the most surprising chapter in a remarkable career: The recent technology investments that have catapulted him into the Yuri Milner-like ranks of visionaries whose mere participation can help ensure a startup’s success.

The octogenarian, it turns out, has an uncanny gut for what plays in the digital world. Li says it took him only five minutes in December 2007 to decide to invest in Facebook, even though it barely had any revenues and was seeking investments that valued the young company at a relatively high $15 billion. The opportunity was presented to him by longtime companion Solina Chau, head of his private technology investment company, Horizons Ventures. Li was immediately drawn to Facebook’s growing number of followers and its prospects on mobile phones; he quickly approved spending $120 million for a 0.8 percent stake. He has purchased an undisclosed amount since. With Facebook poised to trade north of $100 billion after its IPO, Li will certainly add a billion or more to his pile.

Li’s Facebook score is just the most high-profile in an enviable streak. Horizons invested in money-losing Skype in 2005 a year before eBay paid $2.5 billion for it. Another Li-backed firm, Siri, was bought by Apple in 2010 after Li invested $7.5 million a year earlier. More recently he has made investments in music site Spotify, crowdsourced car-navigation aid Waze and waterproofing tech outfit HzO.

“One of the coolest things about him and his team is that they have this idea of where they think the world is going,” says Spotify CEO Daniel Ek, who at age 29 is young enough to be Li’s grandson. “From the moment he made the investment, he made sure that Spotify was in his car. This was 2009, before Spotify was a mobile app. He was like, ‘When are we going to be in all the other cars?’ For him it was this given thing that Spotify will be everywhere. He doesn’t see the limitations of technology. He sees where the world should be.”

With its deep ties in Asia, Horizons is also a magnet for young companies looking for help in cracking the market in China, now the world’s second-largest economy. “I knew about them from their investments in Facebook and Skype, not anything else,” says Noam Bardin, CEO of Waze, an Israel-US outfit that received a combined $30 million from Horizons and Kleiner Perkins last year. Quickly, he came to appreciate Li’s global view, speedy decision making and powerful Asian Rolodex. “They are entrenched in China,” adds Yahal Zilka, cofounder of Israel’s Magma Ventures, Waze’s original funder, who says Horizons helps them navigate the Chinese culture and reach potential partners. He has since coinvested with Li on two other Israeli tech startups.

Li’s brilliance isn’t just who he invests in—it’s how. The billionaire has adroitly stepped in to fill the widening gap in the US between projects that are likely to be funded by angel investors and those that are likely to be backed at the next stage, a chasm that Norman Winarsky, a vice president of SRI International, the onetime Stanford University affiliate that helped create Siri, terms “a valley of death”.

“Li Ka-shing stays in the whole game,” says Winarsky, who profited alongside Li when Apple bought Siri. “He is more than a gap-filler. He believes in technology that is disruptive.”

These disruptive startups help make his larger holdings more cutting edge. “Making a business from these investments is secondary,” Li says of his web portfolio. “It is more important that we are learning so much.” For example, Li’s mobile phone interface designer, INQ, got early access to Skype, Facebook and Spotify-ready phones.

Of late Li has become particularly fascinated by the sweeping potential of artificial intelligence across all his businesses. In addition to his $7.5 million investment in Siri, the now ubiquitous iPhone virtual assistant, he gave $300,000 last December to a startup that uses AI in its summarisation search engine, Summly, run by a 16-year-old. One of the biggest AI impacts, he believes, will come in education, where customised learning will become “closely knitted” to individual devices. “AI has reached an inflection point,” he says. “Combined with the high-speed mobile network, disruption in several industries will be unavoidable.”

To understand Li’s consistent passion for education, it’s instructive to review Li’s early life, a life story as well known in the worldwide Chinese diaspora as Lincoln’s rail-splitting days are here. (Shanghai Book City, the city’s biggest bookstore, carries 10 different unauthorised books on Li and his investment strategies.) Born in Chaozhou in China’s Guangdong Province in 1928, Li and his family had to flee during the Sino-Japanese war. “When I was in elementary school the Japanese dropped bombs on Chaozhou,” he recalls. They settled in nearby Hong Kong. Not long after their arrival Li’s father, who had been a primary school principal in China, died from tuberculosis. “The most terrible experience during my childhood,” recalls Li. “I, too, was infected. The burden of poverty and this bitter taste of helplessness and isolation sort of branded on my heart forever the questions that still drive me. Is it possible to reshape one’s destiny? Is it possible to minimise challenges through lessening complexities? And is it possible to enhance chances for success through meticulous planning?”

Li had to seek these answers and teach himself without the benefit of formal education. At age 12 he quit school and started as an apprentice in a watch-strap factory. By 14 he was working full-time in a plastics trading company to help support his family. In 1950 Li quit to start his own business making plastic toys and everyday items. He retooled his factory to focus on plastic flowers after learning about their popularity in Italy from trade journals, figuring they offered him better business prospects.

He named his first company Cheung Kong, after the great Yangtze River, whose power comes from a confluence of countless smaller streams.

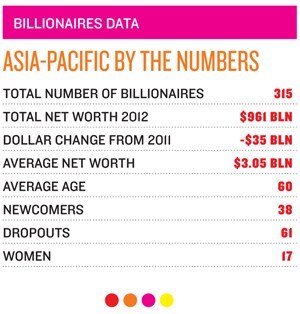

With profits from plastics, Li began buying up apartment buildings and factories throughout the city during the 1960s, a period of intense social unrest marked with Maoist-tinged riots and bombings, and reaped huge returns when the market recovered. In 1979 he became the first Chinese to buy a controlling stake in one of the old British trading houses, then struggling Hutchison Whampoa. In 1987, the year he appeared on our first-ever global billionaires ranking, Li and affiliates paid $500 million for about half of Canada’s moneylosing Husky Oil; it has been through restructurings and mergers, but he still personally has a stake worth over $8 billion. Thriving from large investments in booming China, he has scooped up more profits from its real estate and spending boom. His net worth is $25.5 billion, down slightly in the past year but easily outperforming the Hong Kong stock market and enough for him to move back into the top 10 worldwide for the first time since 2007.

One of the great empire builders of our time, Li continues to push into new territories around the world. In 2010 Li’s Cheung Kong made its biggest acquisition, picking up UK Power Networks for $9.1 billion; it now supplies power to about 8 million Brits. Less than a year later it bought Northumbrian Water, which supplies clean drinking water to 4.5 million people in England and sewerage services to another 2.7 million. Hutchison Whampoa, one of Europe’s largest mobile carriers, paid $1.7 billion in February to acquire the third-biggest mobile phone operator in Austria.

“Businesspeople in general shouldn’t have an overly narrow view of their industry,” he says, explaining his interest in Europe at a time when others see a cloudy future. Rather, they “need a 360-degree perspective and to look at everything from all possible angles”.

That’s in part why even now Li tries daily to read books about science, economics, politics and philosophy. In February, he was deep into a history about an influential political leader during China’s Ming dynasty, Zhang Juzheng. “I know how to find peace within my heart and soul,” he says. “If I have a rare vacation, I will spend it reading.” His curiosity about the world and openness to it is summed up in the spirit of a Chinese-style calligraphy painting behind his desk. “Set your goals high; make friends with different kinds of people; enjoy simple pleasures. Stand on high ground; sit on level ground; walk on expansive ground.”

All this action with his core business explains why Li treats his Western tech investments like a high-stakes hobby. True to that spirit, Li won’t personally make any money from Facebook or any of these other scores. He invests his own money through Horizons. If an investment fizzles, he takes the loss himself. If it pans out, he transfers the shares or proceeds into his Li Ka Shing Foundation, which he calls his “third son,” after his two real-life ones.

The foundation has donated more than $1.6 billion to date; its total assets are $8.3 billion. Unsurprisingly, especially after you spend a lot of time talking with him, a lot of the money has gone to education. He has given $690 million to create Shantou University, named after his hometown. In February the university and Li Ka Shing Foundation sponsored the Prometheus Project that brought 100 high school students together with mentors from the best US colleges to talk about biomedical research. On the other side of the world, in California, he donated $40 million to the University of California, Berkeley for a new biomedical research facility named after him that opened in October. (Medical research is another field close to his heart. Not only did his father die too young, a heart attack killed his wife of 27 years in 1990 at age 56; he never remarried.) His rock star status transcends the Pacific: A throng of 300 gathered outside the Berkeley chancellor’s house during a thank-you lunch, hoping to meet him.

For all this emphasis on formal education, Li’s golfing partner and fellow Hong Kong real estate billionaire Henry Fong Yun Wah, 87, maintains that merely listening to Li’s thoughts about business reminds one of the Chinese expression: “Listening to enlightening words is better than studying for 10 years.”

Yet some of the fervour that once compelled Hong Kong stock investors to stand in the street by the thousands to wait in line for shares in Li-connected IPOs has cooled. Spinoffs from his conglomerate companies have disappointed lately, including Li’s first internet public offering, Tom Group, whose stock price has lost more than 90 percent of its value since it went public in Hong Kong in 2000. (Li maintains that the lessons from Tom awakened him to the mobile technology revolution that he has since profited from.) There has also been growing public criticism of Hong Kong’s wealth gap in recent years, though Li’s large-scale giving helps keep him above that fray. Some people wonder what will happen to his grand empire when he eventually retires. In terms of the public companies he controls, Li has designated his older son, Victor, as the heir apparent. The 48-year-old already serves as deputy chairman and managing director at Cheung Kong and deputy chairman at Hutchison Whampoa. “If I were to tell Victor two minutes before I depart that I was going on vacation for two months, I would have confidence that the company would operate as smoothly as normal,” he says. “I have been teaching him by example how to be a leader since he was a boy.”

Li’s younger, more high-profile son Richard has a stake in a family trust but runs his own telecom empire. He says he follows two of his father’s business lessons. The first is to “leave something on the table for the other side” in business transactions because that will help to bring deals back to you in the future. The second is a message his father wrote down for him when he was younger: Success is all about planning, study ing downside risk and execution; “arrogance leads to failure.” For his part, Li senior went out of his way to emphasise to me his confidence about the outlook for his own businesses, and that having a succession plan shouldn’t be interpreted to mean he has any immediate plans to retire. “I am not saying that I have a timetable for retirement—I am very healthy,” he says, almost needlessly, right before I leave him. And even if he does retire, he adds, he will remain at his foundation, keeping himself as young as he can by continuing to keep an eye on technology and the future.

With reporting by Steven Bertoni and Luisa Kroll.

Global Outlook

Li Ka-shing shares his views on China, Europe, democracy and hard work.

FORBES: What's ahead for the global economy?

LI: I’m definitely concerned about the present state of the global economy. Both the US and Europe are dealing with economic and political issues. Inevitably, all Western countries and even some countries in the East are democracies, with their leaders elected by popular vote. This is what our world values. Any political party that aspires to power as president or prime minister must take into account the will of the people, which means finding the means to provide excellent welfare benefits and shortened working hours. This results in a larger and larger deficit. This will make recovery more difficult and extend the time frame for a full economic recovery. Asia is faring better, but it will also be affected. The coming few years won’t be easy, with GDP growth slowing. Yet our group provides products and services for the masses, not luxury products.

In the midst of tough times for Europe you made some big investments in the UK last year. Why are you optimistic about its economy?

Although the UK is part of Europe, the British pound remains separate from the euro currency. The British currency is relatively stable. The UK has good law and order. I trust that this country has accountability. The UK has greater flexibility, which is why I am not as concerned about the UK as I am about other European countries.

There are a lot of worries about China’s economy. What’s your take?

I believe China can maintain GDP growth of at least 6-8 percent. The increase in wages for laborers outpaced inflation, which contributes to the stability of society. Purchasing power is also strengthening. Every year about 10 million people are moving from rural areas to urban areas for employment. In 10 years it will be 100 million. Average wages in urban areas are higher than those in rural areas. I expect wages will continue to rise in double digits in the coming 10 years. As for housing, the demand will still be there. Profit from property projects is not astronomical, but we can make a reasonable profit.

So those talking about a hard landing are wrong?

It will be a soft landing. We will slow our pace of land acquisition in China, but we will continue to buy.

What advice would you give a young entrepreneur or young person about how to find success in life?

Starting a business is not easy. I started my business in 1950 with only $8,700. It wasn’t a lot. You could buy a Cadillac or a Lincoln with it. For a young entrepreneur today, hard work is more important than opportunities. If you don’t work hard, opportunities will slip away.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)