- Home

- UpFront

- Take One: Big story of the day

- Rearview mirror, lost alignment and a leap of faith: How Spinny emerged as a dark horse

Rearview mirror, lost alignment and a leap of faith: How Spinny emerged as a dark horse

After two back-to-back flop ventures, the stigma of being a 'failed entrepreneur', and the third venture, too, hanging by a thread during the early years, Niraj Singh displayed remarkable resilience to stage a comeback and put Spinny on the winning track

Rajiv is based out of Delhi-NCR and writes stories on startups, corporates, entrepreneurs of all kinds, and yes, marketing and advertising world. His ‘historic feats’ include graduation in history from Hansraj College, master's in medieval Indian history from Delhi University, and PG diploma in journalism from Bharatiya Vidya Bhavan. Another forgettable achievement was spending over a decade at The Economic Times as his maiden job. For the first seven years, he learnt the craft on the desk, and the remaining years were spent unlearning and writing for Brand Equity and ET Magazine. What keeps him going, and alive, apart from stories is the heavenly music of immortal legend RD Burman.

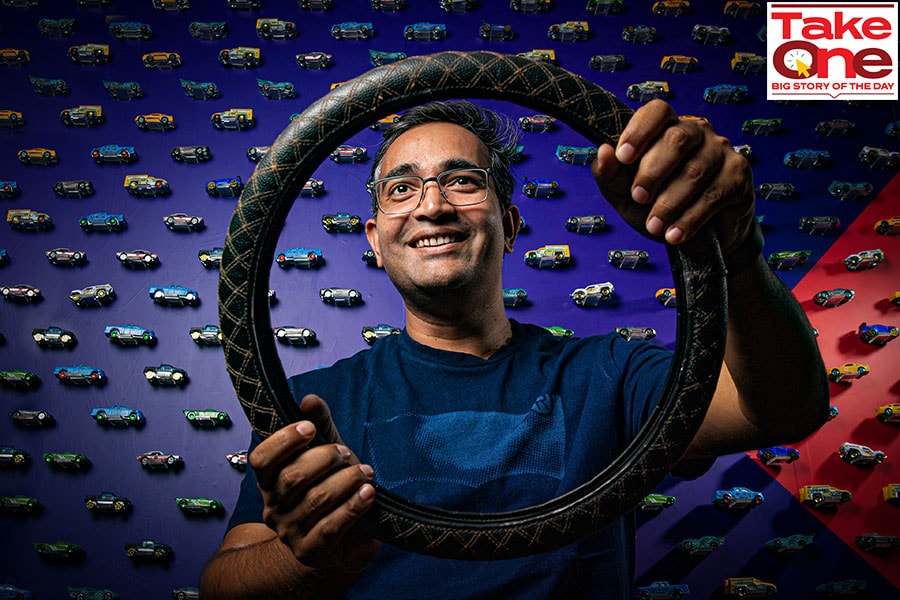

Niraj Singh, CEO & Founder, Spinny, a full-stack used car retailing platform for new-age buyers.

Image: Madhu Kapparath

Niraj Singh, CEO & Founder, Spinny, a full-stack used car retailing platform for new-age buyers.

Image: Madhu Kapparath

January 2015, Gurugram. “How can eight be equal to zero,” pondered Niraj Singh. “Do I really know what I am doing,” he questioned himself. “What if I fail again,” he wondered as he found himself engulfed in a cloud of self-doubt. This was not the first time the IITian was inadvertently slipping into the gloomy introspection zone. “This has to be my last chance. There won’t be any redemption after this,” the electrical engineer realised the gravity of the situation.

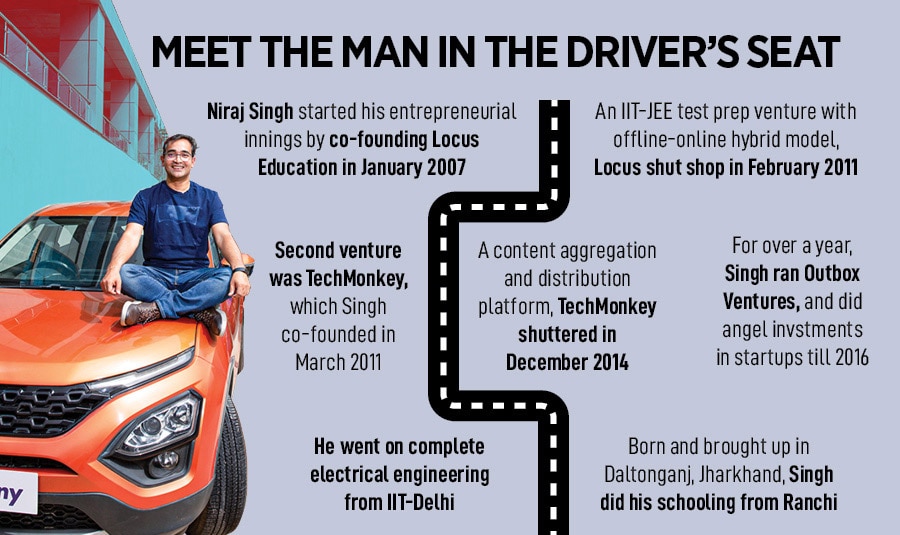

Related stories

Born and brought up in the sleepy town of Daltonganj in Jharkhand, Singh had a raving academic report card. He always excelled in his class, topped his school, cleared IIT in his maiden attempt, and enrolled himself in architectural engineering at Roorkee in 2002. A year later, he again sat for engineering exam, joined IIT-Delhi as an electrical engineering student. For somebody who had always had success as his roommate while studying, knowing a new flatmate—failure—in the professional life was traumatic. “I never had any room for failure,” he recalls. Ironically, failure remained his constant companion since February 2011, when Singh’s first startup—Locus Education—got shut down. “My venture was too ahead of the time,” he rues.

Even in early 2015, Singh was told his timing was off, and he was late to the party. “Why do you want to commit suicide,” asked one of the venture capitalists who knew Singh from the days of his second venture, which too failed and got shut down in December 2014. “Don’t be stupid enough to do what even stupids won’t do,” counselled the concerned VC, who was aghast to hear that Singh was planning to start his third venture in the used-car market space.

The funder was right. The pre-owned car market was overcrowded, overfunded and seemingly saturated. There were big boys like Cars24, CarDekho, Droom, CarTrade, and a bunch of other fringe players who were jostling to find space. “Be realistic. David versus Goliath won’t work here,” taunted another VC. Singh’s friends and colleagues, too, were alarmed with the ‘outrageous’ idea of the serial entrepreneur, who had nothing much to showcase towards the end of eight years of his entrepreneurial journey.

Two failures, and starting from scratch

Singh was again starting from scratch, odds were massively stacked against him, and he was getting ready to try his luck in a segment where nobody gave him a remote chance. “Don’t forget,” cautioned one of the angels, who had cut a small cheque in Singh’s second venture TechMonkey, a content aggregation and distribution platform, “you have spent eight long years, and all you have earned is zero.” The caustic assessment was hard to digest for Singh. “How can eight be equal to zero,” wondered Singh, who went ahead and rolled out Spinny in June 2015.

Two years later, in March 2017, Singh was gripped with a sense of déjà vu. Started as a certified listing C2C (consumer to consumer) marketplace for used cars, Spinny decided to pivot to a full-stack B2C (business to consumer) platform model, which entailed selling refurbished certified cars. The reason was obvious. Singh’s urge to get into the used car market was to solve for pathetic consumer experience and lack of trust in buying such cars. While most of the players in the market had been built to take care of the supply side—which meant any startup offering the best price used to attract the sellers—Singh realised that the magic lied in solving for the demand side. Unfortunately, a listing model turned out to be ill-equipped to fix the problem as there was zero control over quality, experience and trust.

Two years later, in March 2017, Singh was gripped with a sense of déjà vu. Started as a certified listing C2C (consumer to consumer) marketplace for used cars, Spinny decided to pivot to a full-stack B2C (business to consumer) platform model, which entailed selling refurbished certified cars. The reason was obvious. Singh’s urge to get into the used car market was to solve for pathetic consumer experience and lack of trust in buying such cars. While most of the players in the market had been built to take care of the supply side—which meant any startup offering the best price used to attract the sellers—Singh realised that the magic lied in solving for the demand side. Unfortunately, a listing model turned out to be ill-equipped to fix the problem as there was zero control over quality, experience and trust.

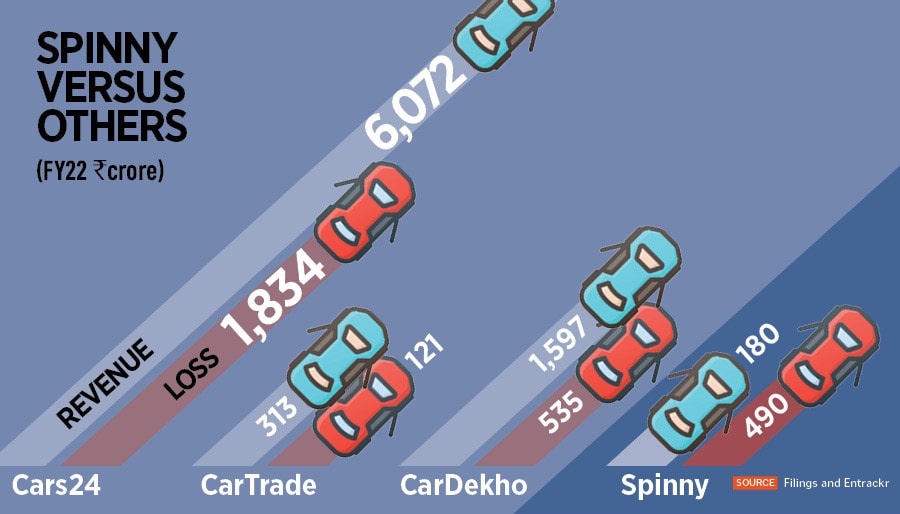

Spinny’s stunted growth in the first two years too amplified the need to pivot. While its operating revenue inched from Rs0.1 crore in FY16 to Rs4.6 crore the next fiscal, Cars24 was cruising at Rs417.64 crore in FY17. Rivals CarDekho and CarTrade, too, were much ahead of Spinny at Rs114 crore and Rs52.52 crore, respectively. In terms of funding too, Spinny was eclipsed by others. CarDekho had reportedly raised Series A funding of $15 million in 2013, and two years later mopped up $65 million in Series B in 2015. Meanwhile, Cars24 reportedly had three rounds—$7.7 million, $7 million and 27.2 million—in 2015 and 2016. In the solar system of used cars, Spinny was nothing less than the farthest planet Pluto.

In 2017, Spinny was again trying again to rotate and revolve. The job, though, was arduous now. Reason? Singh, who miraculously managed to raise a quick seed round of a meagre $1 million in 2015, galloped to exhaust the money. Losses had climbed from Rs2.5 crore in FY16 to Rs6.3 crore in FY17, and two years into the business, VCs shied away from betting on the horse which was last on the track. In terms of raising money, what made things even more complicated was the shutting down of rival Gozoomo, a used car marketplace founded by a team of three IITians. The two-year old startup reportedly raised $7 million from a bunch of VC funds, and shut down operations in August 2016.

Also read: CarTrade is zero-debt, has cash reserves and is profitable. Why is it's stock getting battered?

Stress, alignment and business model rejig

Mukul Arora recalls how Singh was waging a lost battle. “He mortgaged his house and took a personal loan to manage expenses,” recounts the co-managing partner at Elevation. Arora had backed Gozoomo, and the failure of the startup meant that the VC was not taking a kind look at any used-car listing platform. “I have seen why the listing model couldn’t work,” says Arora, who met Singh for the first time in 2016. The founder pitched his case but the VC remained non-committed. “I knew his background of two failed startups,” underlines Arora, who was impressed with Singh’s grit, bottoms-up approach and deep understanding of the used-car market. “It was just that I was not convinced with the model he was pursuing,” he adds.

The conversation, though, didn’t end. Despite being aware of Arora’s lack of interest, Singh didn’t give up. He would meet the VC after every six months or so and update him with the numbers.

The conversation, though, didn’t end. Despite being aware of Arora’s lack of interest, Singh didn’t give up. He would meet the VC after every six months or so and update him with the numbers.

Arora was not alone to politely decline Singh’s plea. Over 100 pitches to countless VCs got rejected over the first two years.

Also read: Exclusive: Online used car platform Spinny buys out rival Truebil

Meanwhile, Singh’s struggle to run the operations was becoming painful with every passing month. “I sold my Fortuner, and whatever I could,” he recalls. Selling cars and other assets, though, were quick fixes. The bucket was leaking from multiple holes, and the repair work was patchy.

For over a year or so, Singh banked on the distressing ritual of collecting whatever he could manage. The first five days of every month were spent knocking on the doors of family, friends, and well-wishers. “I took money from them, paid salaries, and ran expenses,” he recalls. The shame and guilt of consistently asking money for a prolonged period was demeaning for the founder who knew that his family and friends were equally exasperated but they didn’t want his last entrepreneurial dream to die. “They were hoping against hope,” recalls Singh, who somehow managed to extend his runway for four years.

Back in early 2019, the dynamics of the market had changed. Rivals were still zooming at a frenzied pace. Let’s start with Cars24, which was still the biggest player, and had closed FY19 with a revenue of Rs1,687 crore, had a presence across four dozen cities, and was in talks to raise a hefty funding round of $100 million. CarDekho, meanwhile, closed FY19 at Rs260 crore, and raised $110 million in Series C round in 2018. It was also in talks to raise another round of $70 million. CarTrade, third in the pecking order, posted an operating revenue of Rs243.28 crore and happened to be the only profitable company in the fray.

Spinny, in contrast, was still a speck in the larger scheme of things. It had a revenue of Rs16.4 crore, a loss of Rs0.5 crore, and managed to sell 952 cars in FY19. Though relatively tiny, Spinny finally managed to grab the attention of VCs. In April 2019, it raised $11 million in Series A round, got Elevation and Accel as backers, and was valued at $26 million. Eight months later, it raised another round of $38 million in December 2019, and was valued at 138 million. Just to put things in perspective, the biggest player—Cars24—was still miles ahead. A year later, in December 2020, Cars24 raised a staggering $200 million, entered into the unicorn stable by getting a valuation of $1.1 billion, and had operations spanning over 130 cities.

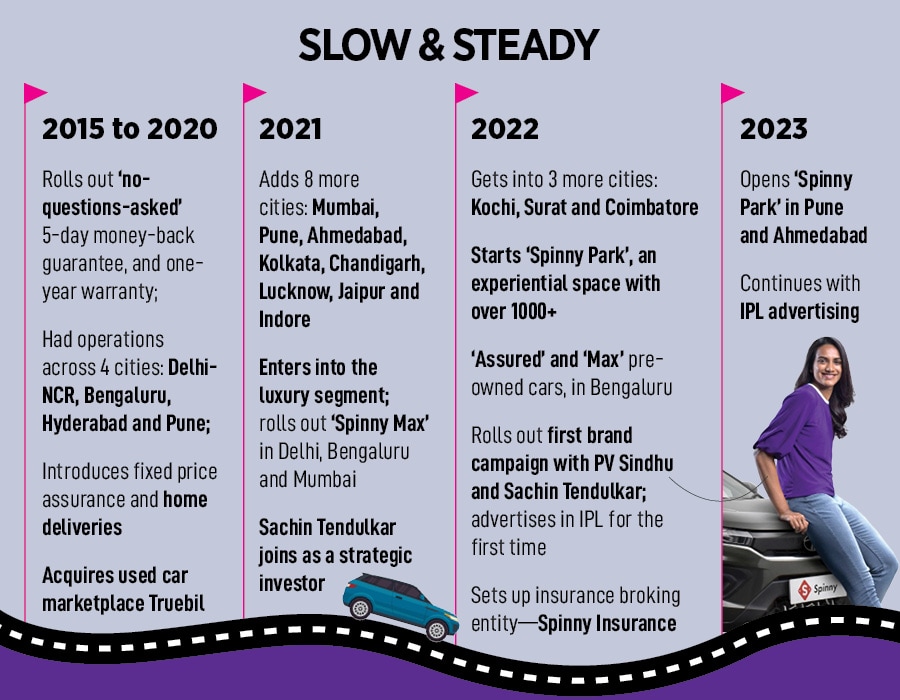

Spinny, meanwhile, was confined to just four cities—Delhi-NCR, Bengaluru, Hyderabad and Pune—till 2020. “We never had the gas to expand furiously,” rues Singh, who was now convinced that his startup had more than an outside chance of overtaking the much bigger rivals. The reason for his exuberance was not hard to find. From just 350 cars sold in FY16, the numbers jumped to 3,754 in FY20.

The onset of the pandemic came as a strong tailwind for the beleaguered founder who aggressively pressed on the pedal. There was another pivot and change in the accounting norm from July 2021. While, earlier, Spinny used to charge only service fee from the partners owning the inventory, now it started buying directly, built inventory, refurbished them and then sold to its partners.

The results are dramatic. “From a revenue of Rs180 crore in FY22, we have leapfrogged to Rs3,000 crore,” claims Singh, sharing the unaudited financial numbers for FY23. The number of cars sold, he adds, has jumped from 29,873 to 66,564 in FY23. Interestingly, losses too have ballooned from Rs490 crore to Rs650 crore during the same period.

The backers, understandably, elated with the performance.Spinny's team, reckons Adam Valkin, the managing director of General Catalyst, has demonstrated exemplary leadership focusing on outstanding customer experience and operational efficiency. “They have a clear line of sight to profitability in a complex category,” says Valkin. Spinny, he underlines, is aiming to reshape the experience of owning a car, particularly for a generation of first-time car owners in India who seek a more trusted and predictable experience that includes access to returns, financing, and insurance. “Spinny has the potential to be a major catalyst supporting the rising middle class,” the VC adds.

Also read: Small to Mall: How CarDekho is giving a new-car experience to used-vehicle buyers

The big picture, and road ahead

For used-car players, the opportunity is indeed massive. The used-car market in India is projected to jump from 4.6 million units in FY23 to 8 million in FY27. During the same period, the new market will increase from 3.7 million to 4.8 million. What, though, is heartening for all players is the abysmally low penetration of cars in India. For every 1,000 people, there are only 24 cars as compared to 116 in China, 229 in Mexico, 350 in the US, and 470 in the UK. The headroom for growth is massive.

Elevations’ Arora explains what has helped Spinny grow at a staggering pace. First, Spinny’s transition to a full-stack model helped it in building the brand. While others focussed on beefing up supply, which means platforms offering best price to consumers won, Spinny took a contrarian bet and focussed on demand. “It meant that the ones offering the best consumer experience would win user love,” he says, adding that a company, which till four years ago was a fringe player, has emerged as the biggest in the full-stack model business. “Everyone started to emulate them,” he says. The biggest plus for Spinny, he reckons, is having a founder who is obsessed with consumers.

Marketing and branding experts, meanwhile, point out Spinny’s biggest differentiator. “They built a brand by not talking about the product,” says Ashita Aggarwal, professor (marketing) at SP Jain Institute of Management and Research. When others flaunted product features in their advertisements, Spinny was smart enough to just let its brand endorsers—Sachin Tendulkar and others—focus on the journey. “Being the only used-car player to advertise in IPL also helped them grab all eyeballs,” she adds.

Singh, for his part, reckons that advertising and marketing—which many might find aggressive because of the way they are repeatedly aired during the IPL—has helped build the brand and awareness, but the growth has not been aided by such spends. “We came on TV for the first time in 2022 IPL,” he says, adding that for the first six years, the brand largely relied on word-of-mouth advertising. The expenses shot up from last year. According to the filings made by the company, Spinny’s promotional and advertising expenses jumped from Rs32.2 crore in FY21 to Rs220 crore in FY22. Meanwhile, for Cars24, advertisement expenses and contractual manpower costs jumped from Rs114 crore to Rs413 crore in FY22. “We have concentrated on just one property—IPL—to advertise,” says Singh.

In spite of the fairytale turnaround by the company, challenges remain. The biggest one for Spinny is not to let losses spin out of control. Another task is to ensure the company doesn’t expand furiously across the country. “Now that they have entered into the big boys’ club, they might be tempted to take others head-on and prove a point,” reckons one of the VCs, requesting anonymity. “The temptation not to scale and be seen everywhere is hard for any founder to resist,” he says, adding that VCs, too, would root for an aggressive approach.

Singh, for his part, points out what he reckons as his biggest challenge. “I can’t think of lowering the bar even a bit on quality, trust and transparency,” he says. But what about staggering losses? Doesn’t he find a bulging bottom line alarming? Singh contends the core category of the company is already contribution margin positive. “Profitability is no longer a question mark for us,” he says, claiming that older cohort markets—which contribute more than 2/3rd of the business—are contribution-margin positive. “I believe this business can operate at a 5.5-6 percent Ebitda level,” he says. Spinny, he adds, has not expanded into any new market in 2023. “We have seen the merit of being slow and steady,” he says. “Over-speeding thrills but it also kills,” he smiles.

Spinny, Singh signs off, is in no rush. “We are enjoying the ride, and this is what matters the most.”