CarTrade is zero-debt, has cash reserves and is profitable. Why is it's stock getting battered?

Vinay Sanghi steered CarTrade to a public listing after over a decade of hustle. Seventeen months later, the stock is down by over 70 percent from its issue price. Sanghi reflects on life after IPO and how it's changed his attitude as an entrepreneur

Vinay Sanghi, Chairman and MD, CarTrade

Image: Neha Mithbawkar for Forbes India

Vinay Sanghi, Chairman and MD, CarTrade

Image: Neha Mithbawkar for Forbes India

Any high-risk decision invariably comes loaded with hyper anxiety. Vinay Sanghi had a tryst with this extreme emotion towards the fag end of 2015. The Mumbai-based entrepreneur started Mahindra First Choice Wheels, a multi-brand used vehicles venture in collaboration with Mahindra Group and HDFC, in 1999. A decade later, he founded CarTrade in 2009. Six years into his solo journey, the entrepreneur spotted a massive opportunity in acquiring strong rival Carwale. Backed by Warburg Pincus, Tiger Global Management and JP Morgan, CarTrade was reportedly valued at around $100 million during its last funding in October 2014. For the founder who inherited the craft and learnt the nuances of the trade from his family’s auto dealership business, Sah & Sanghi, Sanghi was satisfied with CarTrade’s sedate, organic pace of growth.

But, in 2015, Sanghi was left with little choice but to step on the gas. The car deal street started buzzing with action. Another competitor, CarDekho, was in talks to snap up ZigWheels. As other top players also actively looked at pressing the consolidation button, Sanghi too swung into action, and started exploring a stock-swap deal with Carwale, which had a revenue of ₹33.83 crore and a loss of ₹48.65 crore in FY15. “It started as a merger talk, but somewhere down the line, they decided to exit for cash,” recalls Sanghi, who was now in a fix. Reason: He didn’t have money. “It morphed into an all-cash deal, and we didn’t have cash for the buyout,” he recounts.

There was another problem. There was no U-turn for Sanghi as the discussions and diligence entered the final lap. In fact, it was a Catch-22 situation. Sanghi got three months to raise the capital, and if he failed, CarTrade would be staring at the possibility of coughing up a staggering break fee. “The fee would have anyway crippled us,” says Sanghi, explaining his dilemma. There was another issue to deal with. The board of CarTrade was opposed to the idea of an all-cash deal. “You don’t have the cash. And even if you get the cash, will the buyout play out?” was the big question hurled at the entrepreneur, who was excited with the great customer engagement metrics of Carwale and backed his conviction to the hilt. “It was a high-risk bet,” recalls Sanghi, who was battling high levels of anxiety. Luckily, a new investor, Temasek, came to the rescue and Carwale was bought for a staggering ₹672 crore.

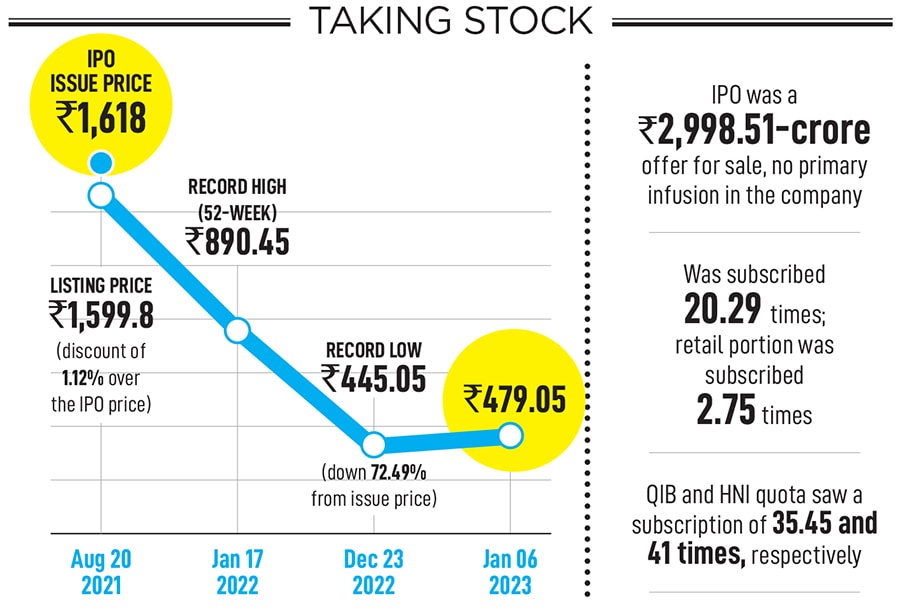

Fast forward to August 20, 2021. Sanghi was coming to terms with another intense emotion. Founded in 2009, CarTrade got listed after close to a dozen years. The moment called for a grand celebration as the company got married to the public market. But there was no honeymoon. “In fact, we did have it, but it lasted for just a minute. It was over the moment we rang the bell,” recalls Sanghi, who couldn’t enjoy the euphoria of the listing. The reason was not hard to fathom. CarTrade got listed at ₹1,599.8, a discount of 1.12 percent over the IPO price of ₹1,618. “The emotion of having a price lower than the IPO was really hard to deal with,” he says in a tormented voice. “It was probably the toughest part of the entire journey of over 11 years to be honest.”