Co-branded credit cards: The battle for the top spot

Co-branded credit cards have gone beyond the fuel and travel segments into fashion and food delivery. But with reward points and cashbacks a given, the challenge for issuers will be to keep their card the top-of-the-wallet one

Most corporates, in the form of airlines, hotels, online shopping merchants or oil refiners, which have a large customer base, are realising that a co-branded credit card builds customer loyalty and helps them boost their spends

Most corporates, in the form of airlines, hotels, online shopping merchants or oil refiners, which have a large customer base, are realising that a co-branded credit card builds customer loyalty and helps them boost their spends

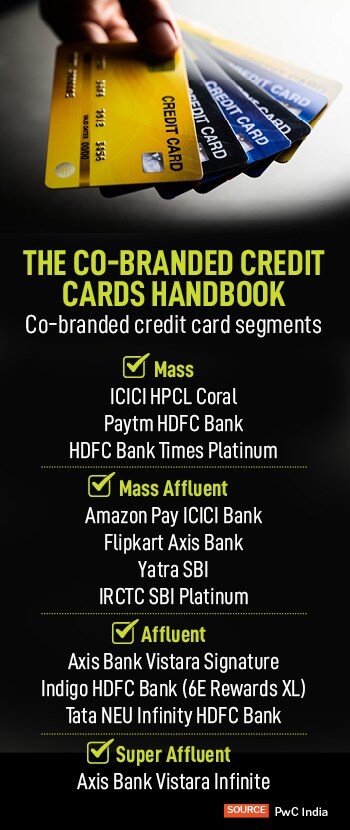

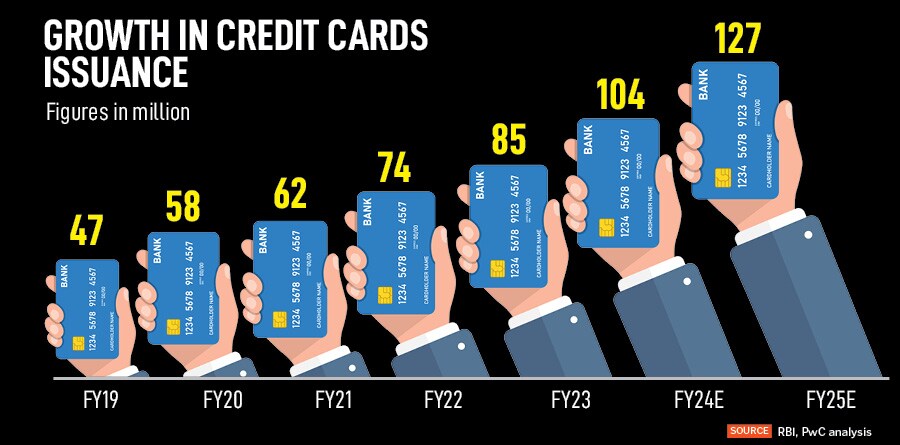

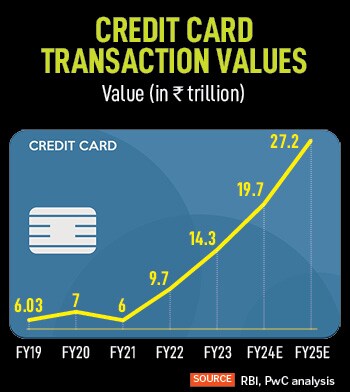

As credit lines for individuals continue to grow and consumer spending activity moves into an uptick in 2023, the issuance and usage of credit cards, particularly the co-branded types, has started to increase. Last month, food delivery platform Swiggy launched its first credit card, co-branded with private sector lender HDFC Bank, on Mastercard’s payment network.

Earlier in June, Kotak Mahindra Bank, in association with Myntra, launched a co-branded digital fashion and lifestyle co-branded card, a first of its type, with customers being boarded onto Myntra’s loyalty programme.

On August 24, HDFC Bank—seen to be the market leader of active credit cards issued in India at 1.83 crore—is set to announce a new co-branded partnership with Marriott Bonvoy, the loyalty programme of Hotel Marriott. This is seen to become India’s first co-branded hotel credit card launch.

AU Small Finance Bank too is planning to enter into partnerships for co-branded credit cards in the next one year, its credit card business head Mayank Markanday has said. Industry experts suggest there could be a possible tie-up with a jewellery-based merchant, which could be the first-of-its-type in the co-branded credit card segment.

Most corporates, in the form of airlines, hotels, online shopping merchants or oil refiners, which have a large customer base, are realising that a co-branded credit card builds customer loyalty and helps them boost their spends. “Many large and iconic brands may come together to form co-branded alliances in future,” an ICICI Bank spokesperson told Forbes India in an emailed response.

Most corporates, in the form of airlines, hotels, online shopping merchants or oil refiners, which have a large customer base, are realising that a co-branded credit card builds customer loyalty and helps them boost their spends. “Many large and iconic brands may come together to form co-branded alliances in future,” an ICICI Bank spokesperson told Forbes India in an emailed response.

HDFC Bank’s Rao says: “Dining and grocery is an extremely critical daily spending category and we needed a strong customer proposition to complete our product offerings. As a brand, Swiggy follows a solution first approach to consumer demands that is in line with our experience that we intend to offer on our co-branded programmes.”

HDFC Bank’s Rao says: “Dining and grocery is an extremely critical daily spending category and we needed a strong customer proposition to complete our product offerings. As a brand, Swiggy follows a solution first approach to consumer demands that is in line with our experience that we intend to offer on our co-branded programmes.”  The bank makes revenues on the card based on three modes: Interchange income—usually 1.8 percent on every transaction spend, plus fee income (annual, renewal, late or processing fees) on credit cards; interest income—the money seen as revolving credit where customers will carry forward outstanding dues and not repay the entire outstanding amount. The third is EMI interest, where the bank prompts the customer to convert the amount due in a large transaction into EMIs and pay a lower percent interest to the bank.

The bank makes revenues on the card based on three modes: Interchange income—usually 1.8 percent on every transaction spend, plus fee income (annual, renewal, late or processing fees) on credit cards; interest income—the money seen as revolving credit where customers will carry forward outstanding dues and not repay the entire outstanding amount. The third is EMI interest, where the bank prompts the customer to convert the amount due in a large transaction into EMIs and pay a lower percent interest to the bank.