Axis Bank's message is clear: Bank more to gain more

The bank might have irked customers after its recent devaluation of reward points on its credit cards but it wants customers to spend more to see benefits. The bank's need to improve its share in card spends is driving this

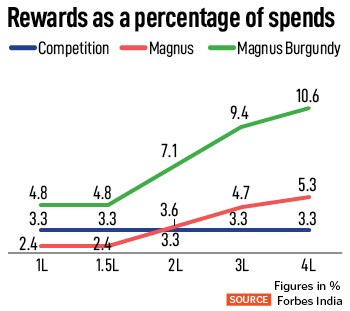

The bank’s changes in the rewards points are focussed towards the high spender. The product benefits have got diluted but if the customer is willing to spend more, then the rewards are decent.

Image: Reuters/Danish Siddiqui

The bank’s changes in the rewards points are focussed towards the high spender. The product benefits have got diluted but if the customer is willing to spend more, then the rewards are decent.

Image: Reuters/Danish Siddiqui

Private sector bank Axis Bank has a deeper and wider expectation from its credit card customers. The bank has faced criticism from its credit card customers in recent weeks, after it decided to devalue some features on five of its cards. This meant the benefits, rewards and advantages offered on that specific card will diminish over time.

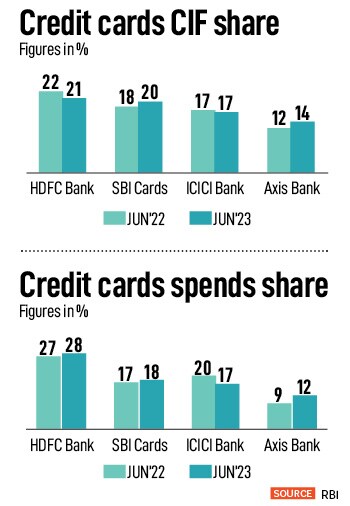

But the bank has a clear perspective on how it wants to engage with its customers. In the post Citi-acquisition of its consumer banking business—including credit cards, its reach and customer base of cardholders has grown. But it now needs to climb up the ranks in terms of share in card spends (see chart), which is why the restructuring of rewards and points had to take place, analysts say.

Some of the measures for the Axis Bank Flipkart co-branded card will start to kick in from August 12 while others for the Axis Bank Magnus card will come into effect on September 1, 2023.

In the case of the Axis Bank-Flipkart card, one can earn a cashback of 1.5 percent by using the card to pay for travel-related expenses on Flipkart. But one cannot earn a cashback on fuel purchases, gift card purchases made on Flipkart and Myntra and EMI transactions from this date onwards.

In the case of some of the features on the Axis Bank Magnus card, the bank also saw “very high usage” which got the bank to think that this accelerator burn would be difficult to sustain for a long term. And hence it introduced some changes.

“Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more,” Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame.

“Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more,” Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame.  So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them.”

So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them.”