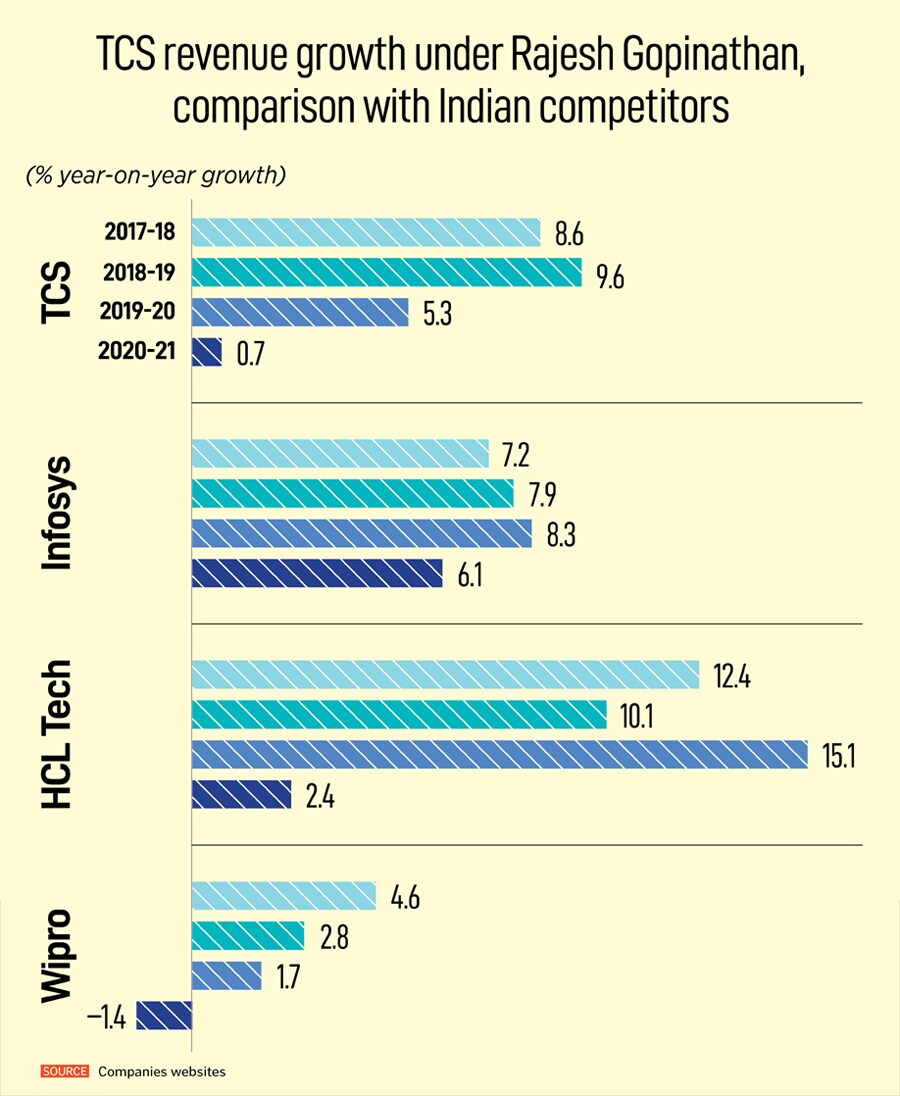

Cover story: Can Rajesh Gopinathan transform TCS and shed its outsourcing legacy?

On CEO Rajesh Gopinathan's watch, Tata Consultancy Services, one of the world's top IT companies, is ready to shed the outsourcing legacy and embrace symbiotic transformational journeys with its biggest customers

Value should be associated with the complexity of the problem, not the elegance of the solution: TCS CEO Rajesh Gopinathan

Value should be associated with the complexity of the problem, not the elegance of the solution: TCS CEO Rajesh Gopinathan

Image: Mexy Xavier

A couple of years before Covid-19 struck, some of the top executives at Tata Consultancy Services (TCS) travelled to Silicon Valley, and met technologists at Google, Microsoft and other companies. They also went to universities like MIT. Some visited China and Israel as well. Everywhere, they met some of their most important customers and returned with several takeaways that would have a lasting impact on the future course of the company. One was: “AI [artificial intelligence] was for real,” recalls NG Subramaniam, COO and executive director. “We saw AI coming into everything that we do, and everything that our customers wanted us to do.”

While that was a little bit in the future, software-led automation of IT was already here, and customers were looking for solutions. The idea of an AI-driven future that would start with increased automation led CEO Rajesh Gopinathan to decide that TCS, India’s biggest software services provider, and one of the world’s largest, had to systematically take a “machine-first approach”, Subramaniam recalls. That meant, “giving technology the first right of refusal in every solution we were crafting”. It was the birth of the company’s ‘machine-first delivery model’ that is now well-known in the industry.

Their customers were looking at new ways of working too, to break down silos between teams. They were trying out both physical changes, like incorporating more open office spaces and changes in software development with methods such as ‘agile’ and ‘devops’—to write and deliver code faster, and to facilitate more collaboration between those who wrote the software and those who installed and maintained them. More often, those roles were blurring or overlapping, with cloud computing becoming much more mainstream.

Even before the pandemic, there was change on the horizon, at both the workplace and in the workforce. Cloud computing had made it easy to create an environment in which software and business teams could collaborate better than before to quickly develop solutions, deploy them, test them and iteratively improve them, add features and functionalities and so on.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

And sophisticated, self-contained packages of software called containers were being embraced by more IT teams to push more applications onto the cloud than ever.

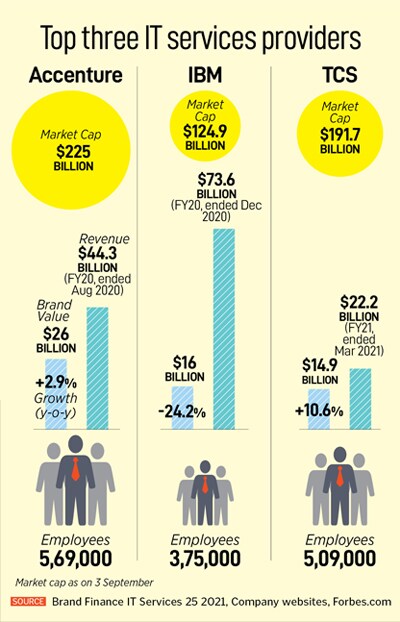

And sophisticated, self-contained packages of software called containers were being embraced by more IT teams to push more applications onto the cloud than ever. Through all this, TCS has been steadily showing clients one other facet that Gopinathan sees as critical for the company’s future—that it has been ready for some time to participate in its biggest clients’ most complex problems at a much more big-picture, abstract level even, than ever—and therefore competing even more directly with its two biggest IT services rivals, Accenture and

Through all this, TCS has been steadily showing clients one other facet that Gopinathan sees as critical for the company’s future—that it has been ready for some time to participate in its biggest clients’ most complex problems at a much more big-picture, abstract level even, than ever—and therefore competing even more directly with its two biggest IT services rivals, Accenture and

“This was a big shift because it has to first start inside and we start appreciating the value of what we did,” Gopinathan says.

“This was a big shift because it has to first start inside and we start appreciating the value of what we did,” Gopinathan says.