The 10 big questions for 2019 - Part 2

Here's a look at the most important issues plaguing different sectors in the country, and the possible scenarios that may play out in the coming year

Image: Joshua Navalkar

Image: Joshua Navalkar

6. Will residential real estate see better days?

Indian residential real estate developers, grappling with the worst slowdown in a decade, will take any lifeline they can get. Unfortunately there aren’t too many of those coming their way. They’ve been struck with the triple blow of demonetisation, the implementation of GST on under-construction projects, and the recent tightening of liquidity. At rock bottom, things can only get better.

“In the second half of 2019, we could see stability come back into the market, subject to a majority government coming into place. The consolidation process among developers would be largely completed, and we expect some initiatives from the government, such as the reduction of GST rates, to help catalyse the sales momentum,” says Anuj Puri, chairman, Anarock Property Consultants.

Expect a lot of consolidation to take place. Well capitalised developers will have their pick of projects that have stalled due to lack of funds. Traditional developers who have built a brand name with customers, with timely deliveries and financial discipline, will continue to do well. “It will be the weaker developers who will start consolidating,” he adds.

This year will witness a slew of corporates, like the Aditya Birla Group and the Hero Group, launch their real estate business, and more corporates with larger balance sheets and execution ability enter the space. Expect a lot more financial discipline in the industry.

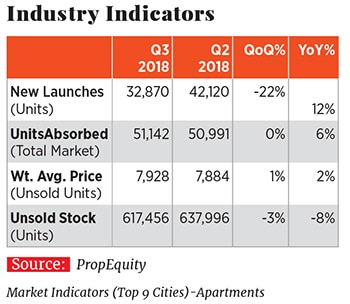

Fewer players and lesser supply, along with stable prices, mean that end users may have no choice but to return to the market. According to data by PropEquity, in Q3 of 2018 new launches across key cities decreased by 22 percent, compared to the previous quarter. Unsold stock fell marginally—by 3 percent—compared to the previous quarter owing to fewer launches and higher sales.

“A lot of projects are expected to be delivered in 2019, although there would be some delays in project completion due to the liquidity crunch,” says Samir Jasuja, founder and managing director at PropEquity, pointing out that this could finally lead to a demand-supply equilibrium in the market.

—Pooja Sarkar

7. Will GST revenue touch ₹1 lakh crore a month run rate?

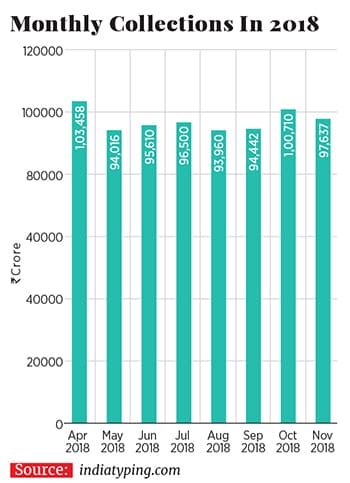

Add and then subtract seems to be the mantra of the administrators of India’s Goods and Services Tax (GST). A five-slab tax regime was never going to be efficient, but the frequent rate cuts have made it that much harder to get to the figure of ₹1 lakh crore a month in tax collections.

Since the GST was introduced in 2017, there have been at least six instances of rate cuts on items as varied as washing machines, cinema tickets and soaps. Lower slabs have meant that even as consumption has increased, tax revenues have declined. The GST Council estimates that the rate cuts have resulted in a revenue loss of ₹80,000 crore. As a result, in 2018 there were only three months with collections above ₹1 lakh crore, and with a slowing consumer economy it’s unlikely to happen again in 2019.

The frequent rate adjustments have also created huge uncertainties for both the government and businesses, according to Arun Singh, lead economist at Dun & Bradstreet. The sooner the government settles GST slab rates the better.

For now the government plans to converge most goods under the 12-percent and 18-percent slabs with luxury goods remaining at 28 percent. (A small number of everyday use items, mainly packaged food, is at 5 percent.) Other reforms such as the implementation of the interstate expressway bill and the matching of invoices are also likely to plug revenue leakages but would still not be enough to consistently make tax collections cross ₹1 lakh crore a month.

One easy, yet politically fraught, way to get there: Include alcohol, crude oil and aviation fuel within the GST’s ambit.

—Samar Srivastava

8. Will there be a grand alliance against the BJP?

It remains to be seen if Rahul Gandhi can form an anti-BJP front; Image: Rajendra Jadhav/ Reuters

It remains to be seen if Rahul Gandhi can form an anti-BJP front; Image: Rajendra Jadhav/ Reuters