The technology tribe: Shift from traditional businesses

Though innovations have triggered a gentle new wave in brick-and-mortar businesses, the burgeoning startup culture in India is unequivocally tech-led and valuation-motivated

Enter a cafe, at any time of the day, and chances are you will spot at least a couple of animated huddles taking place over a laptop. It is also quite likely that the endless cups of coffee in these makeshift offices are leading to one endgame: How to make an idea work.

Now this isn’t a random supposition. Consider that the country currently has 3,100 startups, the third largest base in the world, according to industry body Nasscom, and 800 new enterprises have been joining the ranks annually. By 2020, India is likely to have around 11,500 startups, employing over 250,000 people.

“Entrepreneurship in India is definitely on the rise, and goes far beyond traditional business groups,” Nandan Nilekani, Infosys co-founder and former UIDAI chairman, tells Forbes India. “I can see people from different backgrounds and experience getting into startups, and it is now no longer looked at as a risky activity.” And this shift he speaks of, from the “traditional business groups” to a different type of entrepreneur, has also led to a tweak in the cardinal rule of enterprise, ‘first, make profits’. That can now be spun as, ‘make profits, but that can come a little later’. Time was when those who embraced enterprise as a religion, also tended to anoint profit as its god. In the last few years, though, another deity has been added to the mix: Valuation. And, oftentimes, in the new world of venture capital (VC) and private equity (PE), it tends to take precedence over the old god.

Sample this. Late last year, when online retailer Flipkart raised $700 million of funding, the company was valued at $11 billion (nearly Rs 70,000 crore). And despite its continued lack of profitability—a problem of the industry and not specific to Flipkart—the company, in its latest round of funding, has been valued at $15 billion, according to a report in The Economic Times of July 28.

At a young age—it is eight years old—Flipkart has garnered a valuation that its older, traditional brethren still aspire to. Consider Future Retail—founded in 1997 by Kishore Biyani, who is also known as the father of Indian retail—has a market capitalisation of Rs 4,843.66 crore. Future Lifestyle Fashions’ market cap stands at Rs 1,666.81 crore.

This is no longer a brow-raising trend; it is accepted and expected as an off-shoot of new-age enterprise, much of which is internet-based or technology platform-dependent. Most of these ventures don’t show profit. What they have is an idea, which gains investor validation and customer acceptance. This explains the emergence of successful and innovative companies from India like Mu Sigma (big data and analytics solutions), InMobi (mobile advertising), Druva (data protection), Zomato (online and mobile restaurant discovery service) and Freshdesk (cloud-based customer support software) among others.

Brick-and-mortar enterprises also find place though they are few and far between: For example, Mydentist (chain of dental clinics), Magicrete (innovative building material) and Global Consumer Products (food and beverages). Of these, Mu Sigma and Magicrete are profitable, InMobi recently showed profit and Mydentist has a few profitable clinics.

Experts cite multiple reasons for the movement away from traditional businesses. One, the capital needed is higher while “new-age businesses allow you to create new revenue lines and disruption, often without large sums of initial capital,” says Ashish Dhawan, director, ChrysCapital, a PE firm. For example, for mobile apps and online ventures, the capital required is relatively insignificant and the skills required are available at engineering colleges and computer programming institutes. The cost of technology has become cheaper too. Earlier, to start a company, a minimum of $100,000 would have been required, say experts. With cloud computing, the cost of investing in technology to run a company has reduced significantly to as much as $10,000-$15,000.

Two, many of the young entrepreneurs are first-generation, often from families that have no background in business. They, therefore, look beyond conventional domains.

Three, a majority of traditional businesses tend to be highly regulated. And since technology has played a pivotal role in the latest surge in Indian entrepreneurship, the need for government support to grow an industry is reduced.

While 60 percent of venture capital, according to industry sources, may have gone into tech or tech-enabled businesses, brick-and-mortar models are attracting investors too. Take the case of Mumbai-based Total Dental Care Pvt Ltd, which operates dental services chain Mydentist. In 2011, it started with the aim of building a brand in the highly unorganised dental clinics space. The affordable dental care chain now has 100 clinics across Mumbai, Pune, Surat and Ahmedabad. In June this year, the startup raised Rs 50 crore in its third funding round led by LGT Venture Philanthropy, along with existing investors Seedfund and Asian Healthcare Fund. The company’s co-founder Vikram Vora says they will now look at increasing operational efficiency and enter new markets like Vadodara.

Think dentistry, think sweet tooth. And investors have shown one for this FMCG startup. In 2014, A Mahendran, former chairman and managing director of Godrej Consumer Products, saw a business opportunity in selling chocolates. (At the time, India’s chocolate sales were estimated to have crossed the Rs 10,000 crore mark, according to a report by market analyst Euromonitor, growing a solid 24 percent over the preceding year.) He then launched his packaged foods venture Global Consumer Products, which got the backing of global investment firms such as Goldman Sachs and Mitsui Global Investment. In May this year, the company launched its new brand of chocolates called ‘LuvIt’ across nine variants in the southern markets in its bid to cater to varied tastes. The Bengaluru-based company is targeting revenues of $200 million (around Rs 1,250 crore) over the next five years.

Mahendran doesn’t believe in categorising his business as online or offline; he says the need of the hour is using all channels of sales. “Ecommerce and online business is only a channel of the modern retail. We will see more of omni-channel retailing, but customers will still go to a kirana store to buy goods,” he says, adding that multiple channels of sales is the new face of retail in the country.

Innovation in its brick-and-mortar business—quite literally—is driving investor interest, Motilal Oswal Private Equity in this case, in Mumbai-based Magicrete. Set up in 2008, the startup is engaged in producing innovative building material and pre-fabricated construction technologies and makes lightweight concrete blocks and panels. Sourabh Bansal, chief executive and co-founder of Magicrete, says concrete bricks are more effective and disaster resistant than clay bricks. Magicrete—in a challenging business cycle where manufacturing growth has slowed—is estimated to have shown a 25 percent rise in volume growth in sales for FY2015, Bansal says. In value terms, the company is likely to have seen a 10-15 percent rise in sales from Rs 135 crore in 2014.

Over the next two months, the company will launch an online platform, where customers can browse for designs and take buying decisions. “The biggest challenge that brick-and-mortar companies face today is getting attractive valuations compared to ecommerce firms,” Bansal says. When he graduated from IIT-Kharagpur, Bansal had ecommerce opportunities to look at, for one, in the logistics space. But IT and internet expansion was much lower 7-8 years ago, he says, so he “chose a sector which had a Rs 50,000-crore potential”.

But not only has technology evolved since then, preferences have too. The well-travelled, aware and globally exposed customer demands the best and is ready to pay for it. That change in consumer behaviour is one of the biggest reasons for the rise of new-age businesses was the common view expressed by everyone Forbes India spoke to. The success of certain business models in other markets has also established a pattern for Indian entrepreneurs. The concepts of online retail and education, niche health care verticals, digital payment gateways, analytics and business intelligence and niche food products have been validated successfully in Silicon Valley. This is inspiring Indian entrepreneurs who want to offer similar offerings and convenience here. And this, in turn, has fuelled a robust ecosystem: Large institutions such as IITs and IIMs have incubation centres to support business ideas. Experienced talent from the IT industry is homing in on startups too.

There is more capital as well. In the last 10 years, the number of angel and seed funds has increased significantly. In 2014, VC funds invested $2.1 billion across 1,108 deals, an increase of 47.7 percent from 2013 when VC funds invested $1.4 billion across 246 deals, according to data compiled by VCCEdge, the financial research arm of VCCircle.com.

The rise of the angel investor has also played a big role in the country, especially over the last decade. And people from the industry, who are already entrepreneurs, are becoming investors and mentors now. The likes of Rajan Anandan (India’s Google chief), K Ganesh (serial entrepreneur), Kunal Bahl (Snapdeal co-founder) and the Bansals of Flipkart are funding multiple companies and breeding a new class of entrepreneurs with the first crucial pool of capital to start with. Investors are seeking out ideas to support, and regularly visit the IITs in that search.

It helps—and is fitting—that the entrepreneur is getting younger. A majority of them are in the 18-35 age bracket. “Young entrepreneurs today don’t have the fear of failure. But if you looked at entrepreneurs 10-15 years ago, they all had that fear. The Indian entrepreneurship culture is similar to that of the US now where failure is not seen as a disadvantage. They think, if I have failed two times, the third time I will be successful,” says V Balakrishnan, chairman, Exfinity Venture Partners, an early-stage fund focussed on investing in technology startups. He is also a former chief financial officer and board member of Infosys.

New-age entrepreneurship is also driven by competition and courage. “Now people say, I was better than him in college; if he could do it, so can I,” says Sasha Mirchandani, founder, Kae Capital, an early stage investment firm. He adds that investors are spoilt for choice. “Now we have a problem of too many.”

No wonder startups are creating ripples in the job market and giving stiff competition to established firms. Competitive salaries, employee stock ownership plans (ESOPs), a growth path, wide exposure and non-formal work environments are making startups an attractive option. And these young companies are ready to pay top dollar too. Recently, Zomato was in the news for seeking a day-one slot to recruit students during IIT-Delhi’s placements season, usually a privilege extended to technology giants such as Google and Microsoft.

“Today jobs will not come from traditional players but from companies such as Ola, Flipkart, Snapdeal, BigBasket and others. It will be in the areas of ecommerce, transportation, logistics and food delivery,” says K Ganesh, co-founder and chairman of Portea Medical, which provides affordable home health care services to customers.

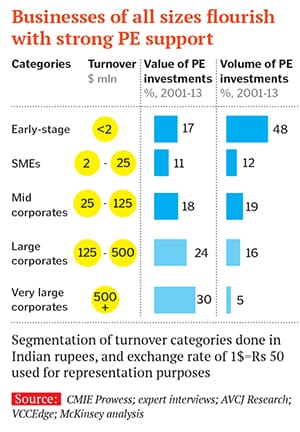

Besides customers, investors also tend to validate a business model as they cherry-pick ideas that have scalability and growth potential. Between 2001 and 2014, the PE industry invested over $103 billion in the country, establishing itself as a stable source of equity capital across several business cycles, according to a report, ‘Indian Private Equity: Route to Resurgence’, released by McKinsey and Co in July 2015.

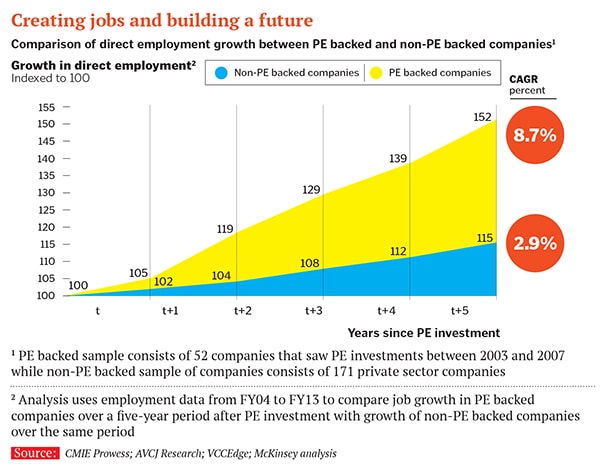

“Between 2001 and 2013, the number of jobs at companies backed by private equity posted a compounded annual growth rate on average of almost nine percent during the first five years after investment. The annual growth rate at comparable companies without private equity funds was just under three percent,” according to the McKinsey report.

All indications are that entrepreneurship in India will continue to be technology-led for the next decade too. And while internet in India is a copy-cat model, inspired by success stories in the US, Software as a Service, or SaaS, will be the next big thing. “SaaS has a huge opportunity and we don’t have the same problem of customisation for each client. It’s an area that’s a bit ignored by investors so far but it has huge scalability,” says Dhawan of ChrysCapital. SaaS, sometimes also referred to as ‘on-demand software’, is a software distribution model under which applications are hosted by a vendor and are available to multiple customers over a network.

Innovation is slowly finding its way in financial services too. The Reserve Bank of India is allowing various models, including payments banks and banking licenses to NBFCs. The sector, however, continues to be heavily regulated. Also, the bulk of money is made in banking, insurance, NBFCs and asset management; therefore it is least open to innovation as human intervention is constantly needed. “The core revenue streams are not disrupted as easily by the internet in financial services,” says Dhawan. “While India has e-brokerages, we are yet to see extremely fast trading platforms and data retrievers, or free webinars to teach prospective clients about profitable trading strategies or even apps for mobiles.

But the fact is, entrepreneurship is imperative for India and not just from the point of view of innovation. “Entrepreneurship is our only option; India has to generate 150 million new jobs in 10 years. Worldwide most jobs are generated through the enterprise space,” says Tarun Khanna, the Jorge Paulo Lemann Professor at the Harvard Business School, who has not only studied emerging markets, but also worked with entrepreneurs and investors there. Khanna is also chairman of India’s NITI Aayog committee on entrepreneurship and innovation and has authored several books, including Billions of Entrepreneurs.

For a ten-fold increase in entrepreneurship, Khanna says public sector involvement is essential to lay the foundation on which the private sector can build businesses. “India’s government will say that they have done a lot of stuff— through committees, commissions, allotment of space—but there is no focus on output measures, it’s all been input. The state has to not only plough in more resources but also has to do it effectively,” he says.

In this context, the overt focus on technology entrepreneurship can be a hindrance. The majority of the Indian population is rural and with all the attention around technology startups, 90 percent of the opportunity that lies beyond the urban market is getting ignored, Ganesh says. “For example, sectors like education are getting neglected. It is very difficult to raise money for an education startup. Businesses focussed on the bottom of the pyramid and the non-tech savvy population are getting ignored and unable to attract funding,” he says.

Aspirations also seem a bit misplaced among budding entrepreneurs, who view startups as a game of multi-billion dollar valuations. In June, IIM-Bangalore conducted an 18-day programme for 30 women entrepreneurs, whose businesses were up and running. The most common question they had after the course was, “how can we become the next Flipkart”?

“I had trouble telling them it is respectable to run a lifestyle business. No need to feel apologetic or ashamed about what you do. Entrepreneurship is about producing a good service, solving problems in society and being profitable,” says G Sabarinathan, associate professor at IIM-Bangalore. “It is not about getting a $10 billion valuation.” Sounds like sound advice, but who can blame them for thinking aloud in their heads: “But isn’t it?”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)