Wall Street Wakes Up to New Sleeping Drugs

Merck’s potential rival to blockbuster Ambien is big medical news, but Wall Street’s reaction has been snoozy so far. That’s a big, big problem for drugmakers

Starting with the creation of beer over 7,000 years ago, human sleep aids have all worked the same way: By stimulating brain receptors that turn off brain cells. Newer drugs like Valium, Halcion and the bestseller Ambien are all just improvements on this ancient mechanism.

Now John Renger, a sleep researcher at Merck, thinks his team has created the first new way in millennia to help people get their z’s.

Merck has done studies in almost 3,000 patients comparing Renger’s pill, suvorexant, with a placebo. The drug helps patients get to sleep perhaps 10 minutes faster and stay asleep 20 minutes longer—not that far out of line with existing therapies and not that much of a marketing advantage.

But there are tantalising signs as the Food and Drug Administration (FDA) prepares to review suvo-rexant that this drug may be fundamentally different from current sleeping pills like Ambien, Lunesta and Sonata, lacking their rare but troubling side effects, like memory loss and sleepwalking.

“What we’ve done here is really turn the medical approach to insomnia on its head,” says Renger, “because for the first time in our history we are beginning to understand how the brain controls sleep and waking. Showing that blocking wakefulness allows patients to go to sleep more quickly and to sleep throughout the night, it’s really a sea change.” Renger’s boss, Merck Senior Vice President Darryle Schoepp, calls this “some of the most exciting science I’ve ever been involved in”.

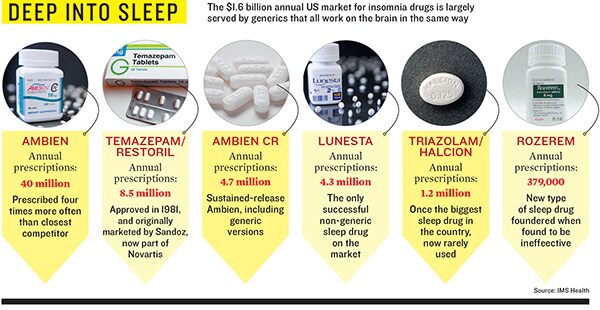

But if this seems like a clear big pharma success story—creating a breakthrough pill in one of the most- prescribed categories ever—think again. Analysts doubt suvorexant can make a dent now that Ambien, which was prescribed 39 million times last year, is a cheap generic that costs under $2 per pill, 21 percent of the price of branded sleep drugs. Mark Schoenebaum at ISI Group, a fan of Merck shares, forecasts suvorexant sales of just $350 million in 2016, only 0.8 percent of Merck’s sales that year.

What happens if new medicines for common ailments like insomnia can’t succeed in a world where 78 percent of drug sales by volume are for cheap generics and where health insurers and government plans alike are increasingly worried about costs?

Most of Merck’s rivals have voted already, moving toward premium-priced areas like cancer and autoimmune disease. Merck is continuing not only in insomnia but also heart disease and diabetes.

The sleeping pill market is par- ticularly ripe for innovation. When Ambien was launched in 1992, Time was running a story, ‘The Dark Side of Halcion’, which raised a slew of questions about whether the sleeping pill was addictive and dangerous. When the Drug Enforcement Agency classified Ambien as less addictive than Halcion, sales hit $1.8 billion by 2005 before the patent expired.

Now it’s Ambien’s turn. In 2001 Peter Buck, the guitarist of the socially responsible jangle-pop band R.E.M., went crazy on a British Airlines flight and nearly went to jail; he was saved partly by the defence that Ambien had caused his behaviour. In 2006 Patrick Kennedy, driving on Ambien, had a terrible car crash that made headlines. Shortly thereafter the FDA added warnings to Ambien’s label saying that the drug did indeed make people go for drives without remembering what they had been doing.

Image: Ambien, Ambien CR, lunesta: Getty Images

Doctors and regulators say these effects are rare, but the reports keep coming. A story this September in Marie Claire documented cases where sleep-driving on Ambien resulted in DUI arrests—or in drivers escaping vehicular manslaughter charges because they had taken the drug.

Why might suvorexant be better? All the older drugs turn on brain switches called GABA receptors, present in half of the 1 billion neurons in the brain, causing whole-head drowsiness. Instead, suvorexant turns off a different set of switches, known as orexin receptors, which are involved in waking people up and are only present in 70,000 neurons in a particular place in the brain.

These orexin cells were discovered from the study of narcolepsy, a disease in which people cannot stay awake, in the late 1990s by a Stanford researcher Emmanuel Mignot, who found that dogs with a defective orexin receptor gene developed the condition. In humans narcolepsy is an autoimmune disorder that destroys the orexin neurons. Merck is one of a handful of drug companies to try to turn this insight into a sleep drug.

Suvorexant does have critics. Daniel F Kripke, a doctor at Scripps Research Institute points out that of 521 patients who took the drug in a safety study, two had forms of sleep paralysis, which can be a symptom of narcolepsy. Merck says the real severe paralysis that occurs with the disease has not occurred in its trials.

Mignot says he is “not as worried” as Kripke: “It is always good for patients to have a new drug that works completely differently.”

But in an age where cost contain-ment is the dominant issue in medicine, better drugs just may not be as profitable as they used to be.

“It’s a theoretically huge market,” Schoenebaum says. “That said, competition will be generic, basically free drugs, and insurance companies will likely make life as difficult as possible for Merck.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)