Will the Centre's national monetisation pipeline plan succeed?

Its new approach to monetising national assets might hold promise, but questions remain about its implementation

Illustration: Chaitanya Dinesh Surpur

Illustration: Chaitanya Dinesh Surpur

Since the Minister of Finance Nirmala Sitharaman announced the National Monetisation Pipeline (NMP) plan on August 23 to raise nearly Rs 6 lakh crore, memes have been abuzz on how the nation’s jewels are up for sale. Opinion is still divided on whether India is trying to emulate Australia’s model of monetising assets, or whether some projects will head the way they did in Germany where power utilities were privatised in the 1990s, but were eventually nationalised again. Is this the only way out for the Indian government to fill its coffers for new capital expenditures?

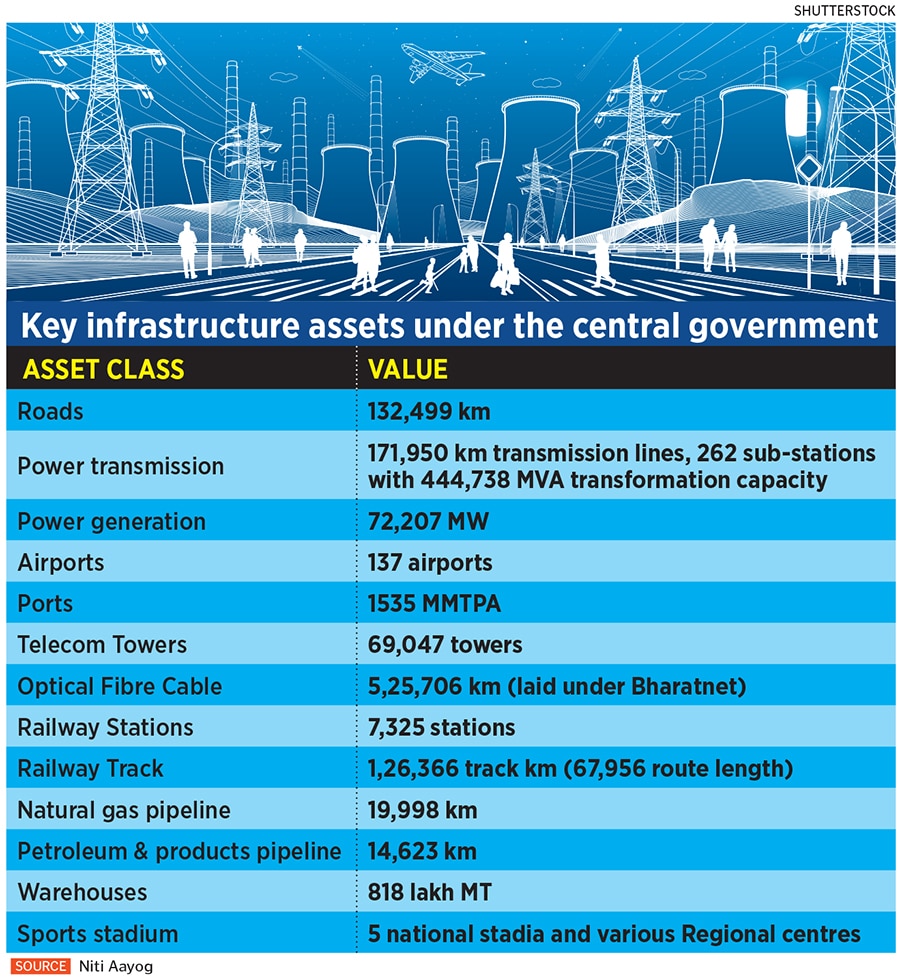

Simply put, the government has identified a pipeline of brownfield infrastructure assets across ministries that will be given on long-term lease to private companies. The highest bidder can charge consumers whatever it wants to recover its returns during the lease tenure, and will pay the government upfront capital at the end of the tenure. The asset will then go back to the government. The plan is to monetise assets through an Operate Maintain and Develop (OMD) model. In cases where significant capex may be involved over the transaction life towards building or rehabilitation of the assets, the estimated capex amount will be taken as the monetisation value.

The process is expected to serve as a medium-term roadmap (FY22-25) for the government to raise capital to fund its other projects. The Niti Aayog presentation about the plan does not shy away from admitting that the monetisation plan was “developed in the backdrop of the unprecedented Covid-induced economic and fiscal shocks”.

Vinayak Chatterjee, chairman at Feedback Infra, says, “It is principally a big and bold move and financially it is the logical thing to do to generate cash to build new infrastructure.”

He cites the examples of how other governments have also tried to monetise assets and that the current one isn’t alone. For instance, the privatisation of the distribution arm of the Delhi Vidyut Board in 2002, when the Delhi government sold a majority stake in three distribution utilities. Although the total operational and commercial losses of the electricity board were around 50 percent, the government managed to offload the assets to BSES Rajdhani Power Ltd and Tata Power.