Vodafone Idea: Fresh external capital infusion useful, only if substantial

A deeper focus on enhancing 4G networks in the short-term will help VI more than attempting an unending catch-up with market leaders Reliance Jio and Bharti Airtel on a hard-to-monetise 5G technology, say experts

With the cash-strapped telco closer than ever to clinch a deal with investors for capital infusion, is this the game-changing moment for it to finally become a competitive third -player? This will happen only if the investment is hefty.

Image: Anushree Fadnavi / Reuters

With the cash-strapped telco closer than ever to clinch a deal with investors for capital infusion, is this the game-changing moment for it to finally become a competitive third -player? This will happen only if the investment is hefty.

Image: Anushree Fadnavi / Reuters

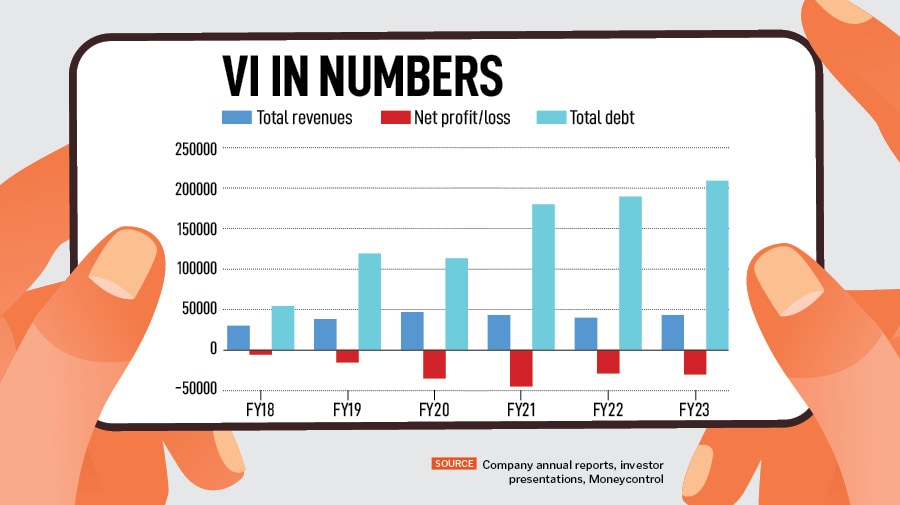

After several months, the Vodafone Idea (VI) stock has started to show meaningful gains to individuals who are betting on the stock, gaining 39.5 percent in the past four weeks and 71 percent in six months to Rs11.3 at the BSE on September 11, backed by positive news. With the cash-strapped telco closer than ever to clinch a deal with investors for capital infusion, is this the game-changing moment for it to finally become a competitive third -player? This will happen only if the investment is hefty. Or if the government decides to lower the net present value (NPV) of the liability VI owes to it. Both these cases appear remote.

In June, VI said its promoters UK’s Vodafone Group Plc and the Aditya Birla Group were likely to infuse up to Rs9,000 crore of fresh capital into the company to revive its business.

The company, which is majority government-owned, is also expected to clear its dues of Rs2,400 crore to the Department of Telecommunications (DoT) by September, VI officials have said.

In August, VI CEO Akshaya Moondra told the DoT that VI has term sheets from several potential investors for capital infusion. He said discussions with multiple groups of investors on both equity and equity-linked instruments had progressed. ….”particularly in the last one month where some of these discussions have started progressing to a level of due diligence or proposals being discussed with these investors,” he told analysts at an earnings call on August 16. Moondra said he expects “to conclude these discussions in the coming quarter” [Oct-Dec].

The telco has a total gross debt excluding lease liabilities and including interest accrued but not due of Rs2,117.6 billion as of June 30, 2023, VI’s CFO Murthy GVAS has said. The company owes the government Rs41,300 crore each year as regulatory payouts, from October 2025 onwards, after the four year moratorium ends.