Regional podcasts find their voice

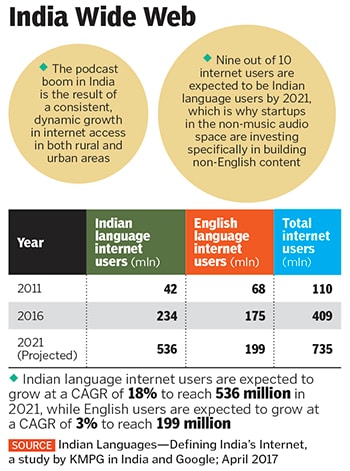

Homegrown non-music audio startups have been seeing a tremendous increase in user base since the lockdown, but getting people to pay for content and becoming self-sustaining are big challenges. According to a new PwC report, the music, radio and podcast industry is expected to have a total revenue of nearly $1.7 billion in 2024

(Left to right) Khabri co-founders Sandeep Singh, Aankit Roy, COO Dushyant Kohli and co-founder Pulkit Sharma. The non-music audio platform, which aggregates content across categories like news, government jobs, philosophy, leadership and motivation, has seen a 350 percent month-on-month growth since the lockdown in March

(Left to right) Khabri co-founders Sandeep Singh, Aankit Roy, COO Dushyant Kohli and co-founder Pulkit Sharma. The non-music audio platform, which aggregates content across categories like news, government jobs, philosophy, leadership and motivation, has seen a 350 percent month-on-month growth since the lockdown in March

Image: Madhu Kapparath

When Yogendra Saini, aka ‘Technical Yogi’, received his first paycheck of Rs 8,300 from YouTube in 2017 for his videos on gadget reviews, technology news and tips for people in small-town India to build a social media presence, it was motivation enough for him to leave a career in journalism to create videos full-time. The resident of Alwar, Rajasthan, taught himself how to professionally shoot and edit videos, “sometimes through continuous trial and error till 3 or 4 am” and invested in a DSLR. He even worked on his performance skills and made an effort to write engaging scripts. As his popularity grew, the 33-year-old had numerous people reaching out to him for guidance on how to launch a digital channel and make money out of it.

Saini felt like he had to teach these people what he knew, but there were several problems: Many people did not have smartphones with good picture quality, the skills or resources to edit videos, or even the confidence required to face the camera. The women from small towns and villages who reached out to him, Saini says, “had the passion, drive and the talent to be successful content creators, but were not allowed by their families to make videos”.

So in late 2018, when he came across Khabri, a recently-launched non-music audio platform, he decided to use the emerging digital medium to expand his audience base, and help people who could not create videos to capitalise on audio instead. The increasing number of people accessing audio platforms became evident when Saini did his first audio live on Khabri. “Within minutes, over 1,000 people joined in and started asking me questions. It was impossible to answer all of them,” he says.

He admits that the visibility received through video and audio is not comparable at present: His YouTube channel Technical Yogi, has a million subscribers as of October, and his most popular videos have received over 2 million views. His podcast channel, on the other hand, has about 12,000 followers, and close to 291,000 listens.

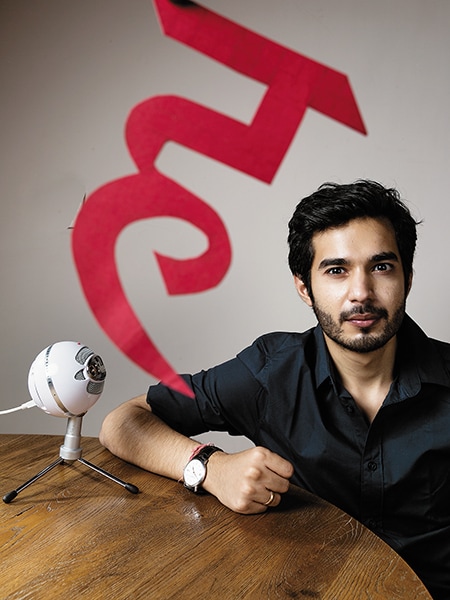

Gautam Raj Anand, CEO of podcast hosting, production and distribution platform Hubhopper, believes audio has an opportunity to capitalise on the time the user is not looking at her phone

Gautam Raj Anand, CEO of podcast hosting, production and distribution platform Hubhopper, believes audio has an opportunity to capitalise on the time the user is not looking at her phone

Jugal Wadhwani, head of audio at audio at Pratilipi FM, which is on-boarding content creators whose text stories have been popular on the main Pratilipi app, apart from engaging independent podcasters

Jugal Wadhwani, head of audio at audio at Pratilipi FM, which is on-boarding content creators whose text stories have been popular on the main Pratilipi app, apart from engaging independent podcasters

Lal Chand Bisu, co-founder of Kuku FM that creates content in Hindi, Marathi, Gujarati, Bengali and English, is now building a paid subscription model for users

Lal Chand Bisu, co-founder of Kuku FM that creates content in Hindi, Marathi, Gujarati, Bengali and English, is now building a paid subscription model for users