How MR Jyothy hopes to make Jyothy Labs a Rs 5,000 crore company

Started with a humble investment of Rs 5,000 by her father MP Ramachandran, MR Jyothy—now the company's managing director—has set her eyes on a Rs 5,000 crore revenue goal for her company

MR Jyothy, MD, Jyothy Labs

Image: Mexy Xavier

MR Jyothy, MD, Jyothy Labs

Image: Mexy Xavier

MR Jyothy has a simple business mantra: If you can’t build it, don’t spoil it.

She is the managing director (MD) of consumer goods company Jyothy Labs, a company named after her that was started by her father MP Ramachandran with ₹5,000 in 1983. Jyothy, who has an MBA from the Welingkar Institute of Management and Research in Mumbai, had joined the company’s marketing division in 2005. She became the chief marketing officer in 2017 and took over as MD in the wake of the Covid-19 pandemic in April 2020.

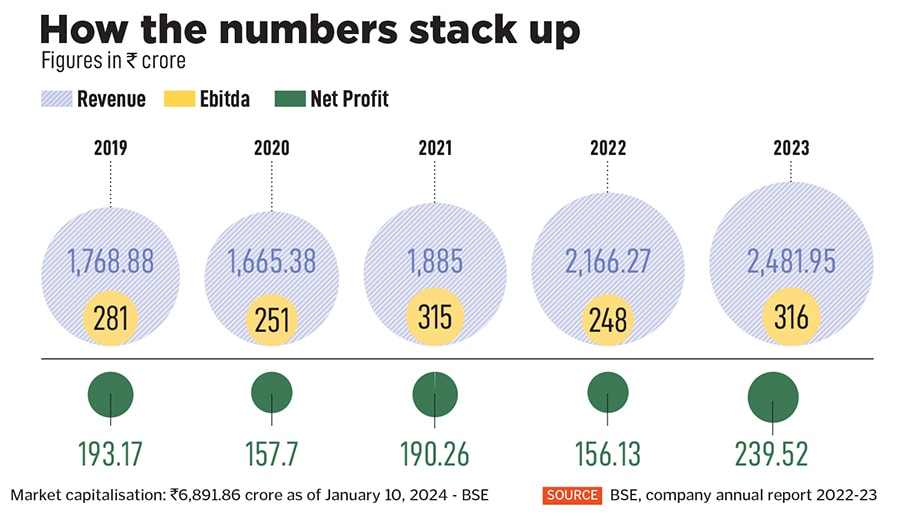

When she took over, the revenue of the company was close to ₹1,700 crore. As of year-ended March 2023, it has grown close to ₹2,500 crore under her leadership. Net profit, as per Bombay Stock Exchange (BSE) data, was at ₹239.52 in FY23, recording an increase of more than 50 percent from the previous year.

Jyothy, 45, has now set her eyes on the ₹5,000 crore revenue goal, which the company has harboured for a few years now. Jyothy Labs was founded when she was five years old. As a little girl, she remembers how her father, who came from a middle-class family in Thrissur, Kerala, painstakingly built it “brick-by-brick”. Seeing an unmet demand for fabric whiteners, he had launched the company with a single product Ujala, which remains a cash cow till date.

The fabric whitening liquid was her father’s own formulation, for which he had even ideated the concept and designed the packaging, Jyothy says. She remembers how he worked late, seven days a week, and did everything himself, from overseeing the loading and unloading of products to writing print advertisement jingles.

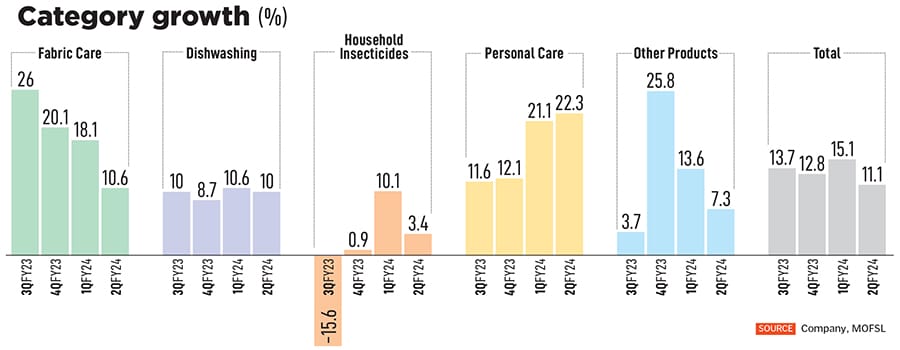

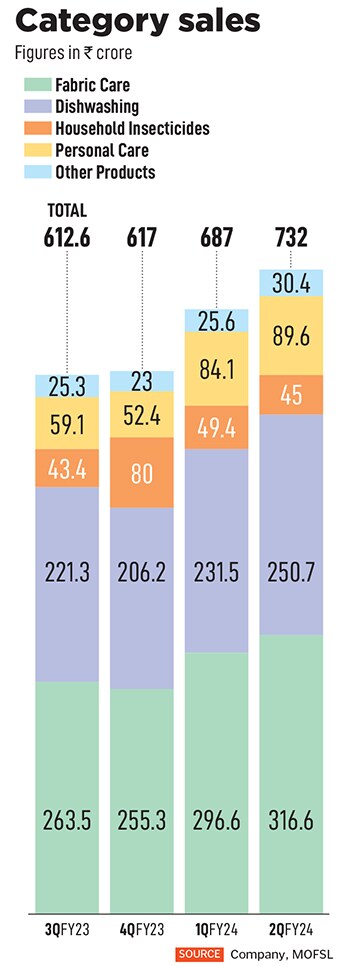

Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years,” she says.

Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years,” she says.