How Mindtickle wooed customers and investors to turn unicorn

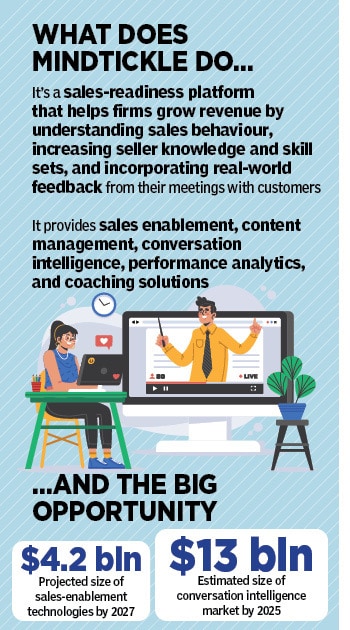

After five years of 'selling petrol to cyclists' in India, Mindtickle pivoted in 2015 to target 'bike riders' in the US. Six years later, the sales-readiness Saas platform has turned unicorn

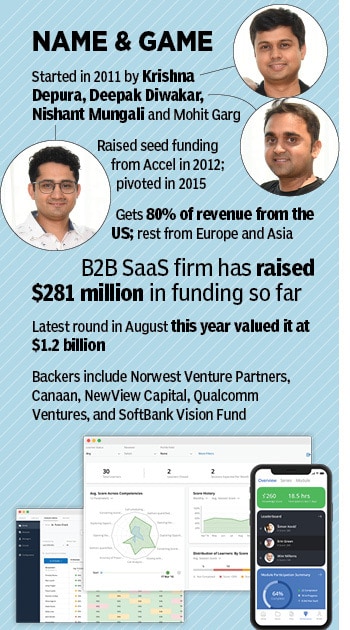

(From left) Nishant Mungali, Co-founder & CPO; Krishna Depura, Co-founder & CEO; Deepak Diwakar, Co-founder & CTO, Mindtickle

(From left) Nishant Mungali, Co-founder & CPO; Krishna Depura, Co-founder & CEO; Deepak Diwakar, Co-founder & CTO, Mindtickle

A decade back, four engineers started a virtual treasure hunt for fun. In fact, it was more of a part-time hobby for Krishna Depura, Deepak Diwakar, Nishant Mungali and Mohit Garg. The idea was not only to do something interesting, which could be at the intersection of fun and learning, but also transform the boring life of corporates. Tickled with the tantalising prospects of making a business out of their passion, the grads went to a bunch of investors in 2011, pitched them the idea of Mindtickle, and positioned the startup as a sort of gamification platform for corporates. “We thought we had figured out the sweet spot for the B2B product,” recalls Depura.

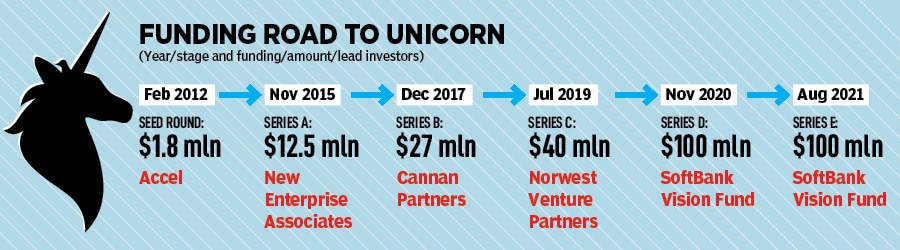

The four co-founders did find bounty quite early on their trail. Mindtickle managed to grab the attention of marquee venture capitalist (VC) fund Accel, which led a seed investment round in 2012. Then came companies like Yahoo and InMobi, which backed the gamification gambit and started doing employee on-boarding using Mindtickle. The corporate life was getting spiced up. Like players in treasure hunts, employees would get points, learn more about the company, and then move on to the next level.

Over the next five years, though, business kept trickling in, and the B2B startup failed to grab the mindshare of investors. The Mindtickle gang, and the treasure hunt, was running out of steam. And nobody had any clue why. “Everybody was cheering us from the ringside. But nobody was willing to take a bet on us,” rues Depura, alluding to the reluctance of VCs to back the venture. Every knock on the funders’ door was met with a polite snub: Come after six months. “They wanted more data, more customers,” he recounts. Though the co-founders didn’t go ‘wrong’ in their approach, what they couldn’t figure out was the elusive ‘right’ that was needed to excite the guys who needed to write the cheque.

Then came the ‘aha’ moment in 2015. Depura figured out what was going horribly wrong. “We were trying to sell petrol to people riding cycles,” he laughs, explaining what was missing in their approach. Mindtickle, he lets on, had the hammer—gamification—but the startup was wooing people who really did not need the product. The market, Depura figured out, was not in India. There was another thing that the co-founders discovered. The product, to begin with, was about employee engagement, and companies were not averse to trying it. “But it was vitamin for them. It was not a pain killer,” he says.