DBS Bank India: Gaining muscle with LVB

Once focussed on corporate banking, DBS Bank India will now compete with larger retail-focussed banks and acquire more business by integrating with the businesses of traditional small business lender Lakshmi Vilas Bank

Lakshmi Vilas bank: Pradeep Gaur/SOPA Images/LightRocket via Getty Images; Development Bank of Singapore: Image by ROSLAN RAHMAN / AFP

Lakshmi Vilas bank: Pradeep Gaur/SOPA Images/LightRocket via Getty Images; Development Bank of Singapore: Image by ROSLAN RAHMAN / AFP

The contours of the new DBS Bank India—into which failed private sector Lakshmi Vilas Bank (LVB) was amalgamated into eight months ago—are being put into shape. DBS Bank India, the wholly owned subsidiary of Singapore’s largest lender DBS, is strengthening its retail lending to acquire new customers by leveraging on LVB’s original strengths, banking with small businesses and retail consumers.

In coming months, the revised loan book of DBS Bank India will look like this: Corporate lending, once nearly 75 percent, will come down to around 55 percent, while lending to small- and medium enterprises (SMEs) would be just below 25 percent. The balance will constitute consumer banking (gold loans, mortgages, consumer loan against property and unsecured personal loans).

DBS Bank, which pre-merger offered SME banking to its clients in 25 cities, will now expand this to 100 cities nationwide, on LVB’s network in the next four months. “The plan is to further expand this to a total of 200 towns and cities,” says Surojit Shome, DBS Bank India’s managing director and CEO. In consumer banking, DBS—which already offered mortgage loans on its own –is now restarting LVB’s secured small business lending business through LVB’s branches. This would constitute lending to individuals, proprietorship and partnership firms against self-occupied or commercial property.

DBS Bank has already revitalised the gold loan business of LVB and this will remain one of the growth areas for the bank.

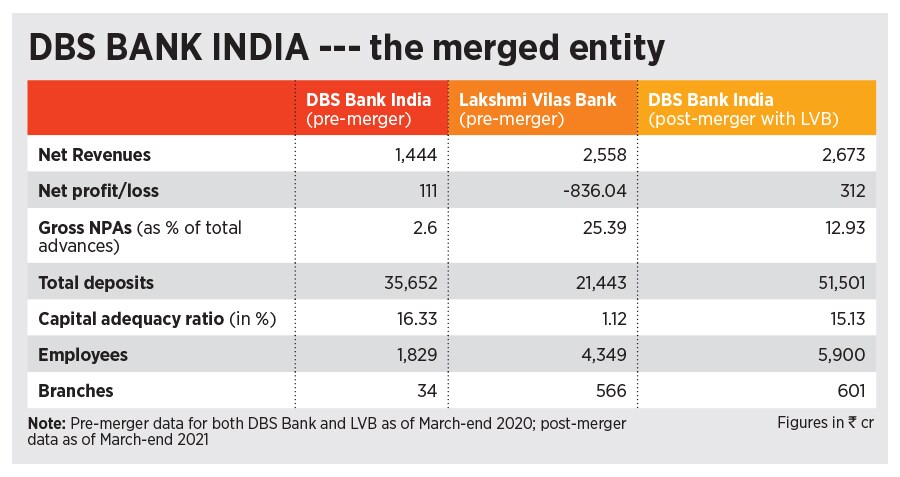

By the end of 2021, DBS Bank India plans to launch a co-branded credit card along with non-banking financial company (NBFC) giant Bajaj Finance. After that, the bank also plans to launch its own proprietary credit card to service its overall 3.2 million customers (see table). DBIL already has a debit card presence through its digital Digibank platform.