Chip(s) Thrills: How TagZ is cracking the snacks market

A unique product proposition—popped potato chips with 50 percent less fat—a set of differentiated offerings, and aggressive scale-up has helped TagZ grow 230 times in four years. Can the challenger brand now take on the big boys?

From L to R: Shoumill Tripathi (Head - Ecommerce), Anish Basu Roy (Co-founder CEO) and Sagar Bhalotia (Co-founder) Image:

From L to R: Shoumill Tripathi (Head - Ecommerce), Anish Basu Roy (Co-founder CEO) and Sagar Bhalotia (Co-founder) Image:

Anish Basu Roy started getting tagged quite early in his second entrepreneurial innings. Roy worked for close to four years in various sales and marketing roles at Nokia and Coca-Cola, then co-founded retail distribution platform Shotang in January 2013, hustled there for over five years and eventually exited when the startup pivoted to being a logistics platform. Next, after a short stint of a year at Healtifyme, he co-founded TagZ Foods with Sagar Bhalotia in May 2019, and started his second business stint by rolling out popped potato chips which claimed to have had less than 50 percent fats as compared to the regular counterparts. The price, in contrast, was over 100 percent more than others: Rs50 for 30 gram was what TagZ offered. The idea was to build a healthy and premium brand in healthy snacks’ segment.

The branded journey indeed started on a branded note, albeit of a different kind. “Yet another healthy snacks’ brand is born,” was how TagZ was labelled by a battery of investors, offline retailers and industry observers. Their scepticism, though, was valid and stemmed from a bunch of reasons. First, the chips and wafers market was already hyper-cluttered. On one end of the spectrum lied big national boys like Lays, Hadiram’s, Bingo and Pringles who had a mass appeal. On the other were regional goliaths such as Balaji and Prataap Snacks, which too had a pan-India presence. And somewhere in between was a cluster of healthy snacks. ‘Was there room for one more in the between’ was the right question to ask.

Second doubt originated from the price positioning of the rookie snacks brand. When TagZ was rolled out in February 2020, a 30-gram pack carried a price tag of Rs 50. ‘Will prohibitive pricing give it a mass appeal’ was another question hurled at the co-founders. Third layer of scepticism had its roots in the dismal track record of a lot of healthy snacks brands that started with a bang but soon got popped out. ‘Will TagZ survive or can it change the history’ was also a right query. Last, the co-founders had made their intention clear to defy the conventional marketing wisdom, which was grounded in the logic of ‘less is better’. Roy, for his part, had made it crystal clear that he won’t make TagZ a one-product and solo-category brand. “If you want to grow big, then you can’t be just one product or segment,” he argued. The argument, interestingly, didn’t have many takers. ‘They will end up biting more than what they can chew’ was the concern of the critics.

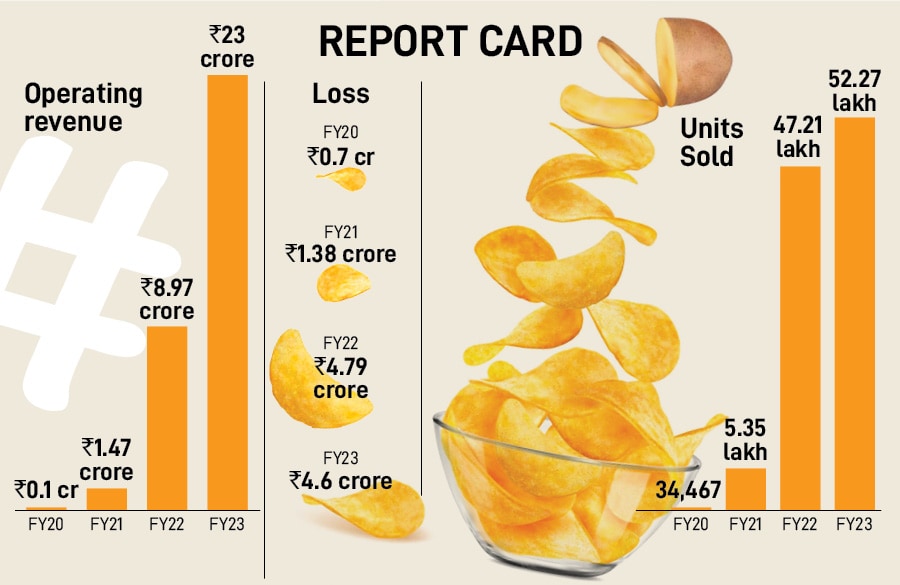

Cut to May 2023. TagZ has clocked Rs 23 crore in operating revenue and has a loss of Rs4.6 crore. Though apparently small, the numbers look impressive if one views them in the context of where the brand was when it started. Let’s start with the revenue bit. It has jumped from Rs10.34 lakh in FY20 (and this was a truncated fiscal year as the brand was rolled out in February) to Rs1.47 crore the next fiscal and then Rs8.97 crore in FY22. Overall, in four years, the brand has grown by 230 times. In contrast, the losses during the same period have an interesting trend of pole-vaulting in the first two years and then not ballooning: From Rs70.22 lakh it went to Rs1.38 crore and to Rs4.79 crore. “It’s snacks’ time, folks,” says Roy, who has so far raised $3.2 million from a bunch of investors such as Dexter Angels, 9 Unicorn Ventures, Agility Ventures, Namita Thapar, Ashneer Grover and Ranvijay Singha.