Cashback, flashback, a while back: How Paytm ended up with a deserted Mall

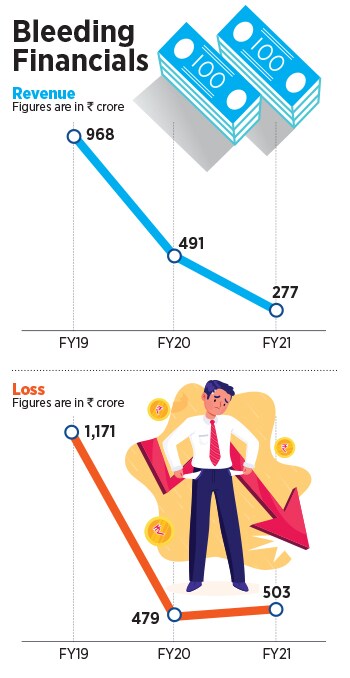

Paytm Mall aspired to topple Flipkart and Amazon in 2017. Five years later, the valuation has crashed, revenues have dipped and losses have mounted

A file photo of the founder and CEO of Paytm, Vijay Shekhar Sharma, from 2017, the year Paytm Mall was launched. Image: Sajjad Hussain / AFP

A file photo of the founder and CEO of Paytm, Vijay Shekhar Sharma, from 2017, the year Paytm Mall was launched. Image: Sajjad Hussain / AFP

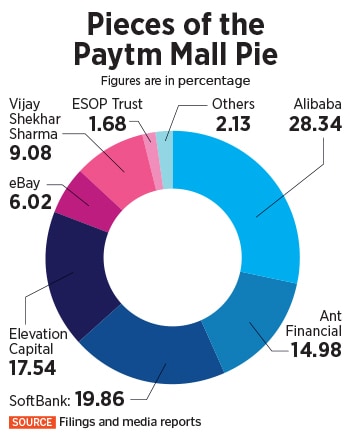

It was a good time for Vijay Shekhar Sharma. In April 2018, the poster boy of fintech payments in India reportedly raised a staggering $445 million (about Rs2,900 crore) from SoftBank and Alibaba for Patym Mall. This gave the ecommerce marketplace of Paytm, which had started operations in 2017, a valuation of $2 billion.

The online retail fight was getting brutal as the ecommerce upstart bared its aspirations to topple Flipkart and Amazon. The weapon identified to cause maximum damage was cashback. While Flipkart, Amazon, Snapdeal and ShopClues focused on discounts, Paytm Mall tried to outsmart all by using the cashback card. With ewallets losing steam, cashback looked like a nice way to play the volume game.

The mood in the Paytm camp was upbeat. “Paytm Mall is eyeing $9 billion in gross merchandise value (GMV) by the end of 2018,” Amit Sinha, the then chief operating officer of Paytm Mall, reportedly said. The reason for his bullishness was understandable. In 2017, Paytm Mall had $3 billion in GMV.

After the funding, Paytm Mall planned to step up aggressively over the next twelve months. First, it created an ambitious blueprint to increase the seller base from 75,000 to over 3 lakh. Second, it wanted to expand the same-day and next-day delivery coverage from six percent of the country to almost 30 percent of the pin codes. “Deeper shopkeeper and seller penetration in all pin codes, return customers, stronger logistics network are a few of the things we are working on,” Sinha reportedly added.

The founder of Patym also sounded exuberant, and he had all reasons to. The biggest learning, Vijay Shekhar Sharma had remarked in 2018, is that grocery is the fastest growing category in ecommerce. “The consumers come back again. We have a daily needs section in Paytm Mall for that reason,” he reportedly said, claiming that around 25 percent of the GMV at Paytm Mall comes from grocery. He projected that the numbers will shoot up to 40 percent. “Groceries would contribute around $3 billion GMV by end of the year (2018),” Sharma predicted. Cashback was in full swing, consumers were coming back to the platform, and there was no reason for Sharma to look back and devise any new strategy.

With a firm commitment from deep-pocketed investors, there was no need to slow down. In its description of Paytm Mall on its website, Elevation Capital summed up the reason for backing it. Paytm Mall is a horizontal, B2C ecommerce platform enabling next ‘revolution’ in commerce, the VC

With a firm commitment from deep-pocketed investors, there was no need to slow down. In its description of Paytm Mall on its website, Elevation Capital summed up the reason for backing it. Paytm Mall is a horizontal, B2C ecommerce platform enabling next ‘revolution’ in commerce, the VC

Industry experts paint a different picture. The fall of the Mall, they reckon, has to be understood in the game of valuation, and what Sharma was trying to build. “He aspired to be Alibaba of India,” says Ankur Bisen, senior vice president (retail & consumer products division), Technopak. The irony, though, is the aspiration was flawed.

Industry experts paint a different picture. The fall of the Mall, they reckon, has to be understood in the game of valuation, and what Sharma was trying to build. “He aspired to be Alibaba of India,” says Ankur Bisen, senior vice president (retail & consumer products division), Technopak. The irony, though, is the aspiration was flawed.