The Return of NSE Mid Cap Funds

Since September last year, the NSE Mid Cap Index has recorded a dramatic rise, outperforming the Nifty. Retail and institutional investors are once again turning to mid-cap companies, many of which are riding the coat-tails of growth and optimism of small-town India

A year ago Tridib Pathak, a fund manager at IDFC Mutual Fund, quit his job and went on a road trip across India to observe “real growth” in tier-II towns. “Growth will come from these cities,” says Pathak. “There has been a change in sentiment about the economy as well as the markets in the last six months, and that is factored in the mid-cap segment.” Mid-cap companies in the consumer space are now riding on the growth of small-town India, though a chunk of their market share still comes from metros such as Mumbai, Bangalore, Chennai and Delhi.

Forbes India has compiled a list of 50 stocks that mutual funds have been purchasing over the last three years (see chart). It turns out that a large chunk of these are mid-cap stocks, which are considered to be high-risk and high-growth. But they need a stable external environment to function effectively. In the recent past, goaded by a lethargic economy, they have acquired a bad reputation, leaving scarred retail and institutional investors in their wake.

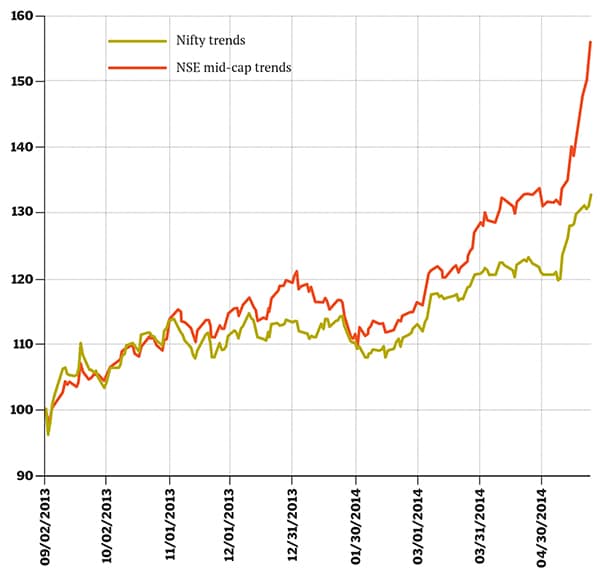

The NSE Midcap Index grew only by about 12 percent between May 2009 and September 2013, barely 2 percent higher than the Nifty, which recorded a 10 percent growth in the period. But this, say investors, is changing for the better. In fact, the market has recorded a meteoric rise since September 2013 when the Mid Cap Index began to rise. As of May 23, 2014, it was up by 56 percent, with the Nifty—which was up by only 33 percent—trailing behind.

Mid-cap firms started gaining traction in the investor community from the middle of last year. A Sebi directive in June added heft to this trend. Mutual funds got an opportunity to invest in mid-cap companies such as DISA Direct, Kennametal India, Styrolution ABS and Honeywell Automation. Under the norm, promoters were told to bring down their stakes to ensure their companies have a public shareholding of 25 percent by June 2013. This created an opportunity for funds to buy into closely held companies.

This eight-month surge—from September 2013 to May 2014—has made up for five years of lacklustre performance by mid-cap stocks, where growth was hampered not only by a slowing economy, but also high interest rates. The stock value of mid-caps such as Finolex Cables, HSIL and Sundaram Clayton has already moved up by 75 percent since January 2014.

The optimism of the stock market is palpable among entrepreneurs in tier-II towns. Businessmen running small manufacturing units are expanding, creating capacities and training workforces that can be utilised in the future. It is what Bharat Agarwal, who runs Clay Craft India, from Jaipur plans to do. The company is a manufacturer and retailer of bone china and ceramic tableware with revenues of Rs 145 crore. Agarwal has built a huge network of about 1,000 retail counters and 150 channel partners. Fuelled by the growth in Indian ecommerce, the company has seen its turnover grow five times in the last five years. Clay Craft is now selling its products on e-platforms such as Snapdeal and Homeshop18. He expects to clock revenues of Rs 300 crore in the next two years and plans to go public thereafter. The main production line is tuned to handle large volumes of bone china crockery that comes in various shapes and combinations.

Clay Craft is the kind of company that would probably do well in the Indian market because of its large dealer network and market share. But had it gone public five years ago, its overall holding by institutional investors would have remained low because of their inclination towards established mid-caps. And the few institutional investors and mutual fund managers who were eager to buy a mid-cap stock treaded with caution: Not many were ready to take risks with new promoters.

Retail investors—the main buyers in the mid-cap segment—were also wary, and had diverted their attention to gold and real estate. According to a Morgan Stanley report published in May, the demand for gold in Indian households has been on a continuous rise since 2008, when it accounted for 10 percent of a household’s savings. This effectively brought down the overall equity holdings of the average Indian middle class home to only 2 percent. (In 2008, it was 6 percent.)

“Financial savings respond to real [interest] rates—as real rates rise, financial savings [deposits, equities among other financial paper] will also rise. Low and negative real rates from the past four years have fuelled the demand for gold and property. Historically, gold demand has not been as high as it has been for the past five years. Now, we think real rates may continue to rise largely due to tempering of inflation—this means property and gold will give up share in total savings,” the report states.

This seems to be happening now, and indicators lend credence to market optimism. For one, the overall growth of the mid-cap index has happened at a beta (a measure of risk) of 0.80 or 80 percent, which is considered very low. Again, the price-to-earnings ratio of the NSE Mid Cap Index is at 17 times its 2013-2014 earnings as compared to the Nifty, which is at a high (20 times its earnings) for the same period.

While Morgan Stanley is optimistic about the return of retail investors, ex-IDFC fund manager Pathak is interested in the specifics of the game. He believes that the consumer discretionary segment is increasingly becoming a staple business. It is a segment that comprises retailers, apparel companies and auto companies, generally considered to

be non-essential consumer items.

But as the economy starts to pick up, this segment will become more important, and growth will be driven from tier-II towns. This is especially true for the real estate business in these cities.

There are more houses being built in India’s top 16 cities, and development is on the agenda of towns such as Ahmedabad, Jaipur, Surat and Nagpur. Housing finance companies, too, are riding the coat-tails of growth in small-town India. It’s one of the reasons why many non-banking finance companies (NBFCs) are venturing into housing finance.

Indians find security in housing, and that explains why some mid-cap housing firms are still trading at a premium. It is this consistent demand in housing that is leading to a rise in the demand for cement, paints and ceramics. “People in tier-II towns are buying costly ceramics. We believe that this growth will continue,” says Agarwal of Clay Craft India.

Retail investors need to keep in mind that fundamentally, mid-caps are more cyclical in nature due to their limited scale of operation and financial resources available to them, says Nobutaka Kitajima, chief investment officer, equity, LIC Nomura Mutual Fund. He also says that one factor that affects the valuation of many mid-caps is liquidity.

“As the institutional participation in this segment increases, valuations can rise further. One caution for retail investors is, there are always both gems and stones, especially after the sharp run-up. One needs to know what he or she is buying, instead of simply chasing what has already gone up,” says Kitajima.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)