Sustainability-Linked Loans: A primer for CFOs

Sustainability-Linked Loans (SLLs) allow CFOs flexibility around fund deployments, provide liquidity, and further opportunities to diversify the lender base while ensuring a good alignment of interests among borrowers and lenders about ESG. Here's a basic round-up of the financial tool

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings

Image: Shutterstock

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings

Image: Shutterstock

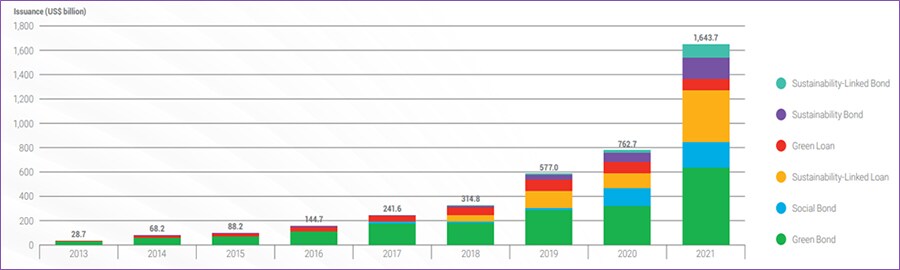

The global sustainable debt issuance set a record of surpassing $1.6 trillion in 2021 and exceeded $700 billion during the first half of 2022. Corporations are leveraging sustainability-linked finance instruments to further their Environmental, Social, and Governance (ESG) agenda, reduce the cost of borrowing, and diversify the lender base.

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings. Despite a mere 4-year track record, SLLs have shown the strongest growth among various sustainable debt issuances. Starting with $49 billion in 2018, SLLs have crossed $350 billion in the first half of 2021—with 614 percent growth (Figure 1). So, it has now become imperative that all CFOs and Treasurers understand SLLs.

Figure 1: Annual Sustainable Finance Growth (USD$ billion), 2013-2021

Figure 1: Annual Sustainable Finance Growth (USD$ billion), 2013-2021

Source: BloombergNEF, Bloomberg L. P.

History of SLLs

Formerly known as Positive-Incentive Loans, SLLs are loan products that incentivise borrowers to achieve pre-defined Sustainability Performance Targets (SPTs) related to environmental, social, and/or governance aspects. The targets measure improvements in a borrower’s sustainability performance and include pre-defined Key Performance Indicators (KPIs), external ratings, and/or equivalent metrics among others. If a company achieves its pre-defined SPTs, it benefits from a reduced interest rate, and a failure to do so leads to higher rates. For instance, JSW recently raised ₹400 crore from MUFG Bank India as SLL. According to the reports, JSW plans to deploy the funds as capital expenditure to achieve its annual capacity target of 25 million tonnes by FY25.[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]