How Equitas survived the MFI crisis to become a small finance bank

Diversification and best practices helped Vasudevan PN's firm keep its head above water in 2010. Now, as a small finance bank, it is in an exciting, yet tough phase

Image: P Ravikumar for Forbes India

When Vasudevan PN started Equitas Micro Finance Ltd in 2007, he was anything but the storied millennial entrepreneur. He was all of 45 and had 17 years of experience in the financial sector behind him. He had stumbled into entrepreneurship after he was forced to cut short an 18-month stint as head of consumer banking operations at Development Credit Bank (DCB) in Mumbai. His daughter’s ill health, after they moved to the city in 2005, forced him to return to Chennai, where he had spent the previous 14 years working for Cholamandalam Investment and Finance, part of the Murugappa Group.

In search of a job and being an old hand in the lending space, Vasudevan—Vasu to friends—was driven by the thought of financing low-income people who were underserved by banks, and also those at the bottom of the pyramid, such as slum dwellers and the homeless. At the time, microfinance institutions (MFIs) were the flavour of the season following Sequoia Capital’s $11.5 million investment into SKS Microfinance (now Bharat Financial Inclusion). Experience met passion and the idea took off in 2007 with seed funding from old friends MA Alagappan, then executive chairman of the Murugappa Group; M Anandan, Cholamandalam’s former managing director and Manappuram Finance’s Chairman and Managing Director VP Nandakumar. (These strategic investors exited in 2010-11.)

In the decade since, the business has grown by leaps and bounds. Equitas, in 2010, diversified into a non-banking financial company (NBFC), with interests in housing (Equitas Housing Finance) and vehicle finance (Equitas Finance). The diversification was necessary to survive the deluge that swept the MFI industry that year following allegations of unfair loan recovery practices and the subsequent suicides of borrowers in Andhra Pradesh.

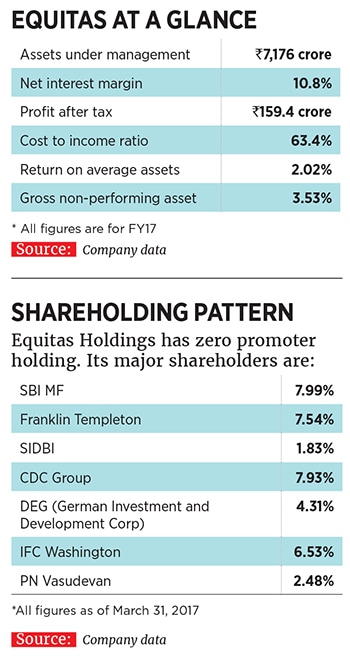

Equitas has now further evolved into a small finance bank (SFB). Vasudevan has also brought in a diverse cast of investors into Equitas Holdings, the listed parent company, in which he holds a 2.5 percent stake (see Shareholding Pattern).

Equitas Small Finance Bank, of which Vasudevan is MD and CEO, got its final approvals from the Reserve Bank of India (RBI) in July last year and commenced operations in September after the merger of Equitas Micro Finance, Equitas Housing Finance and Equitas Finance.

In FY17, Equitas Holdings, now a listed entity, reported an income of Rs 969.5 crore and a profit of Rs 159.4 crore.

Recounting his first meeting in March 2008 with Vasudevan and his Cholamandalam colleague S Bhaskar who joined Equitas Micro Finance as its chief financial officer, Rai says: “We started talking and I told them that we could move very fast [towards taking an investment decision]. And he told me, ‘You people only talk, but do not invest’.” Rai asked Vasudevan how much funding he required and how soon. Vasudevan wanted Rs 10 crore in four days. The next day, Rai got his company to invest $1.5 million (around Rs 6 crore at the time) in Equitas Micro Finance India.

Vasudevan, recalls Rai, was already talking about disruption—centralising the microfinance business, becoming an urban-focussed microfinance company and building scale. Even in the early years, Vasudevan had the vision of building his MFI into an NBFC. Other early private equity investors in Equitas Micro Finance were Caspian Private Equity, MicroVentures and International Finance Corporation (IFC).

Like with most entrepreneurs, Vasudevan’s early days in business were not easy. To start Equitas Micro Finance, he had to mortgage a house in Anna Nagar in Chennai. Also, there was no office. “I would tell my wife each day that I was going for meetings. I would step out of the house around 9 am, drive around, park under a nearby tree and research on my laptop,” says Vasudevan. (It was only in 2013 that he was able to acquire a fully-furnished office of his own in Anna Salai in Chennai. The space, which now wears a colourful look with ‘Banking is fun’ posters and bean bags for seats in the lobby, is currently the headquarters of Equitas SFB.)

Besides researching, Vasudevan would meet experts from the Institute for Financial Management and Research (IFMR), Unitus Seed Fund, cold chain arm Microsafe Express, the Indian Institutes of Management and ratings agencies to understand the sector.

One thing led to another and UPDB Micro Finance (Upliftment of Pavement Dwellers and Beggars) was formed in 2007, which Vasudevan soon renamed Equitas (Latin for equitable).

S Bhaskar, chief executive officer of Equitas Holdings, says the vehicle financing segment helps the company achieve its aim of financial inclusion

Image: P Ravikumar for Forbes India

Image: P Ravikumar for Forbes India

Equitas Micro Finance started off at a time when there was hardly any difference between microfinance and moneylending. But the company exercised best practices from the start, Vasudevan claims, offering its first loan in Tamil Nadu at an interest of 25.5 percent, against the prevailing industry average of 35-40 percent.

Vasudevan introduced fair practices and transparency into the business. “We were the first MFI in India to introduce printed stickers, which were pasted on the passbooks of borrowers, as proof of receipt of money collected at centres.” The company also had a centralised back office and a real-time collection monitoring system.

Equitas Micro Finance gave its first loan on December 15, 2007, and by March 2008, its loans outstanding had touched Rs 16 crore. This jumped 18-fold in a year’s time to Rs 288 crore, even though it had operations only in Tamil Nadu. “There were huge margins at the time,” says Vasudevan.

To be sure, in this period, growth in the microfinance sector as a whole was healthy, as non-government organisations sought to expand their operations. “Between 2005 and 2008, there was sharp growth, capital was not a constraint due to private equity participation and banks were also willing to lend,” says Vasudevan. He recalls meeting a real estate builder who came to him for advice to grow his capital after being told that the microfinance industry offered the best returns.

However, Vasudevan had a sense of the problems lurking around the corner for the industry. There was over indebtedness, with no records of how much and how many times customers had been lent to by various MFIs.

To tackle this, in 2008, Vasudevan tried to get all Tamil Nadu-based MFIs to share their databases to understand who was borrowing how much and arrive at a norm to not overexpose customers to loans. “But this did not materialise,” he says.

In October 2009, Vasudevan tried to mobilise the industry to form a credit bureau that would create a comprehensive database of all microfinance customers. In 2009, he convinced the industry to form a company, Alpha Micro Finance, which picked up a stake in what has now become CRIF High Mark Credit Information Services, an information provider across all segments of microfinance. In 2009-end, the industry created a self-regulatory association of NBFCs and MFIs called MFIN (Microfinance Institutions Network) of which Vasudevan was the first vice president.

However, this could not stop the over-indebtedness and coercive collection practices. The sector came to a standstill after the Andhra suicides in 2010 as banks were unwilling to lend to MFIs.

Hit by the crisis, Vasudevan learnt the hard way that his company had to diversify to survive. In 2010, Equitas started offering housing finance through Equitas Housing Finance and in 2011, it entered used-vehicle financing through Equitas Finance, targeting those with limited access to the formal financial system. The vehicle financing segment, according to Bhaskar, now CEO of Equitas Holdings, helps the company achieve its aim of financial inclusion by financing truck drivers who wish to become truck operators.

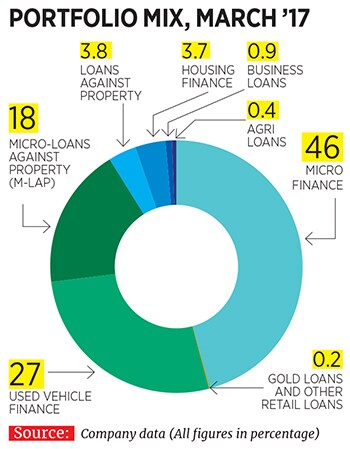

The company also introduced loans for ‘tiny’ and micro entrepreneurs in 2012-13 (see Portfolio Mix). While the total household income for an MFI borrower was around Rs 1 lakh per year, tiny and micro business segments had annual revenues of Rs 2.5 lakh. In the tiny loans segment, Equitas lends to 90,000 customers, 95 percent of whom are ‘new-to-the-bank’. In FY15, microfinance constituted 53 percent of Equitas’s total loan book. It stands at 45 percent currently and Vasudevan expects this to fall to 25 percent of the gross loan book by FY18, a clear sign of the extent of diversification.

Equitas’s decision to cap the risks arising from the MFI space is seen as a positive move. “The focus now is likely to be on existing and good credit record borrowers,” says Alpesh Mehta, banking analyst at Motilal Oswal Securities.

Post the central government’s decision to demonetise high value currency notes in November last year, the microfinance sector was plagued by lower collections. Equitas’s consolidated net profit plunged by 85.2 percent to Rs 6.9 crore for the fourth quarter of FY17, compared with Rs 46.8 crore a year earlier.

Going back to June 2016, the next stage of growth came when Equitas, as an NBFC, had assets under management of Rs 6,559 crore and the RBI had firmed up plans to introduce small finance banks into India’s banking sector. As opposed to banks, SFBs are meant to serve local areas and meet credit and remittance needs of small businesses, the unorganised sector, low-income households, farmers and the migrant workforce, all of whom are Equitas’s traditional customers.

An MFI business would typically restrict Equitas to ‘horizontal’ businesses, where it can acquire more clients but offer them only limited products. An SFB is an opportunity to sell to the same person different types of products.

Besides the ones that Equitas has historically lent to customers, the SFB has introduced three new products: Agri-loans, gold loans and working capital business loans for small and medium enterprises (SMEs). The combined loans outstanding for these three segments stand at Rs 100 crore as of March 2017.

In September last year, Equitas SFB was among the first small finance banks to start operations, ahead of peers Janalakshmi, Suryoday, Utkarsh and Ujjivan that started only this year.

“This [early entry into the business] helped us in a major way during demonetisation,” Vasudevan says. Despite overall collections getting hit during the demonetisation exercise, the bank did garner Rs 250 crore, through the collection of scrapped Rs 500 and Rs 1,000 currency notes.

Being an early entrant, Equitas SFB was also able to participate in PSLCs (priority sector loan certificate), which are tradeable certificates issued against priority sector loans of banks.

Now that it has become an SFB, the focus is on rolling out bank branches. Prior to becoming a small finance bank, Equitas had 572 branches, where lending activities were carried out, with 2.7 million customers. Of these, 284 branches have been converted into full bank branches. With a licence to open 412 branches, Equitas plans to touch the figure of 375 by September 2017 and the remaining in 2018.

This expansion, though, is no cakewalk. The cost to set up a bank branch is about Rs 35 lakh, which includes the cost of technology, staffing, compliance and risk management costs, according to Vasudevan. Equitas’s cost-to-income ratio has risen to over 80 percent in the fourth quarter of FY17 (from 54.5 percent a year ago) as a result. It is expected to dip in the coming quarters, analysts say. To expand at a lower cost, Equitas is in the process of rolling out business correspondents (BCs).

The bank now also needs to ramp up its deposit mobilisation to compete with universal banks and build its book. Attracting talent will be a battle too as eight of India’s ten SFB licencees have started operations in the country. Equitas does not give guidance, but the management expects a loan growth of 15-20 percent for FY18 and a three-year loan growth exceeding 30 percent CAGR.

Aavishkaar’s Rai says of Vasudevan that he does not like to be dictated by things over which he has little control. In the immensely challenging world of banking in India, Equitas has built its strategy well: Being well diversified and constantly lowering its risks.

“Sometimes you run fast not necessarily knowing if there is any benefit in doing so. But still you run. You may have no clue on what you can gain by doing something today, rather than keeping it for tomorrow,” says Vasudevan. He is clearly an entrepreneur who will not tire in the long run.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X