This entrepreneur wants India to make its own lithium-ion cells for electric vehicle batteries

Rajat Verma already recovers raw materials from used cells at his venture, Lohum Cleantech. He wants to close the loop by making cells in India as well

Image: Amit Verma; Illustrations: Sameer Pawar

Image: Amit Verma; Illustrations: Sameer Pawar

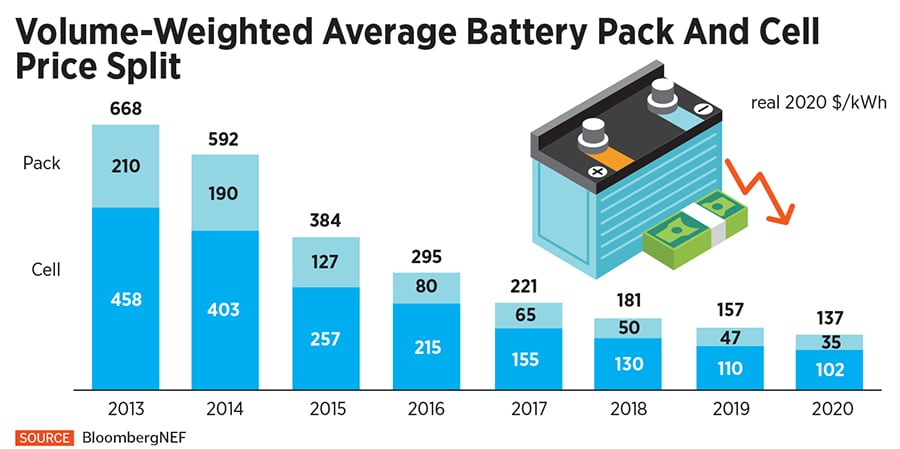

Most countries don’t make their own lithium-ion cells for the batteries that power their electric vehicles (EVs) or energy storage systems. They import the cells from China, mostly, but also Korea and Japan and then assemble those cells into battery packs for various applications.

In India, even the battery packs are imported if one looks at applications like cars, other four wheelers and buses, although, of course, there are very few of these in the country. In case of two-wheelers or three-wheelers, however, a fair amount of local assembly of battery packs happens. And there are various companies doing this.

Rajat Verma’s Lohum Cleantech in Delhi stands out in two respects. One, in addition to making ‘first life’ or new batteries, the entrepreneur is also building a strong line of business out of ‘second life’ batteries — separating out the still viable cells from used batteries and repurposing them into batteries for suitable lower power applications. And two, he runs perhaps the only enterprise in the country that is involved in commercial extraction of the raw materials from the cells.

For now, Lohum extracts lithium, cobalt, nickel and manganese (from the cathode of the cell), and graphite (anode) and ships them to the commodities market. “Our hope is, in a couple of years, either we or one of our partners will actually provide a complete closed-loop solution,” Verma tells Forbes India in an interview. That means, the raw material recovered would go back into a cell manufacturing process, new cells would be made and put back into new battery packs — all within India.

Thus far, one of the reasons that companies in the electric vehicle sector in India have focused only on battery assembly and not cell manufacturing is that China is sitting on massive cell-making capacity that it supplies to the world. Competing with it is tough. Currently, China has about 250 GWh (gigawatt hours) of annual capacity, which is about three-quarters of the global capacity. And China has plans to raise its capacity to nearly two terawatt hours by 2025-26, Verma says.