Over 600 million Indians have a smartphone. Star India wants Disney+ Hotstar to be on every one of them

Streaming service Disney+ Hotstar has been growing fast, and now the media house traditionally known for producing soap operas is adding to its repertoire to provide original content besides addressing sports and regional audiences

Image: Shutterstock

Image: Shutterstock

On Tuesday, Disney+ Hotstar, the video streaming service from Star and Disney India, announced a new line-up of original content with about 12 new TV shows across genres and four films. The OTT platform, formerly Hotstar, which was owned by Star India, only started producing original content two years ago—a lot later than its international competitors in India—Netflix and Amazon Prime Video.

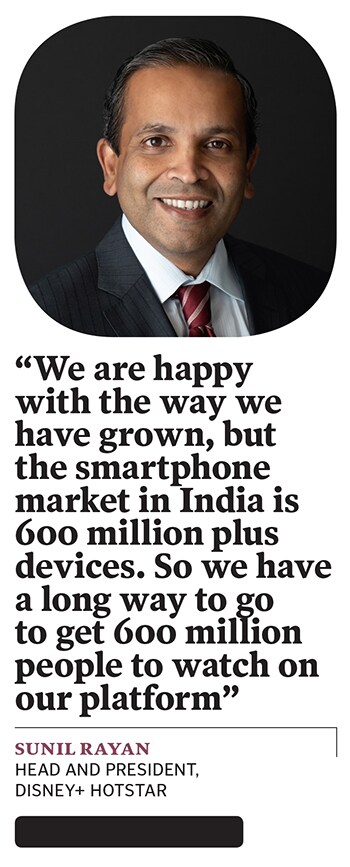

"As we continue growing, it's very critical for us to stand out and come up with compelling and disruptive storytelling products. We are trying to bring diversity by exploring new genres like historical drama with Empire, supernatural thrillers with Fear and medical drama with Human," says Sunil Rayan, head and president, Disney+ Hotstar. They also hope to ride on the success of already existing OTT shows with new seasons, like Aarya, Special Ops, Criminal Justice and City of Dreams.

According to Statista, internet penetration in India is at about 45 percent—still low, but growing fast. And a traditional media house like Star India, so far better known for producing soap operas, is betting big on this. "All the shows that we are developing for Star channels are first on Disney+Hotstar," says Gaurav Banerjee, President, Hindi Entertainment, Star India. Evidently, OTT seems to be the future.

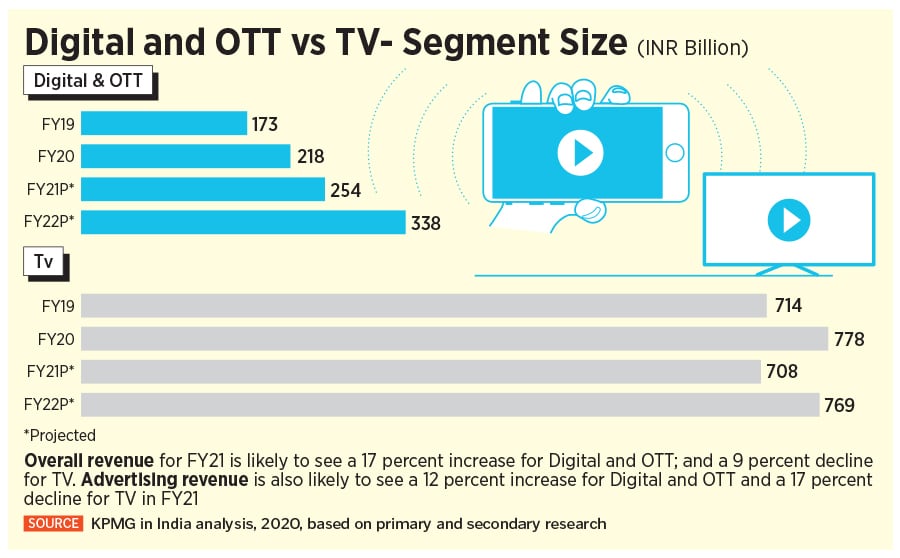

Though industry experts believe that currently broadcasting brings in a majority of the revenue and in the near term this may continue, things are likely to change going forward. “We see both GECs (General Entertainment Category) on traditional TV and OTTs co-existing in the near to medium term. This is due to the fact that the penetration of television is still ~70 percent in India, also exemplified by the 30+ million users of DD Free dish,” says Girish Menon, partner and head—media and entertainment, KPMG in India.

Though industry experts believe that currently broadcasting brings in a majority of the revenue and in the near term this may continue, things are likely to change going forward. “We see both GECs (General Entertainment Category) on traditional TV and OTTs co-existing in the near to medium term. This is due to the fact that the penetration of television is still ~70 percent in India, also exemplified by the 30+ million users of DD Free dish,” says Girish Menon, partner and head—media and entertainment, KPMG in India.

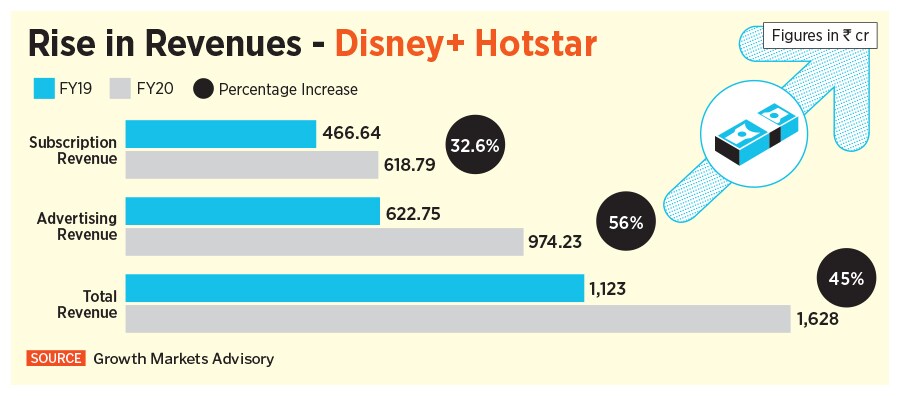

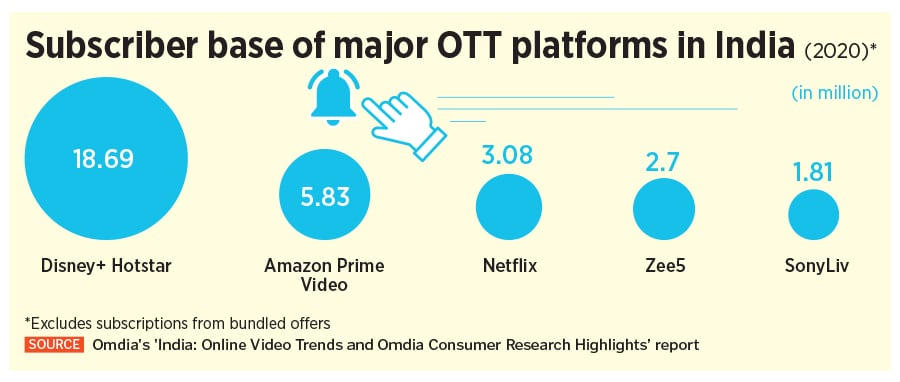

However, he adds, “India had 475 million+ OTT video viewers as of FY21 and are estimated to reach 600 million+ by FY23.” According to KPMG's Media and Entertainment report 2020, the overall revenue for FY21 is likely to see a 17 percent increase for digital and OTT and a 9 percent decline for TV. Currently, the Indian video OTT market is around $1.5 billion and is expected to reach $12.5 billion by 2030, according to a report by RBSA Advisors.

In May 2021 the platform released its first regional language series November Story, a Tamil show—dubbed in Hindi—which saw half its viewership come for the Hindi version of the show. “Going forward, we don’t want to be constrained by one region. We want to continue focussing on making content that is cross-region, like November Story, which did well both in Hindi and Tamil,” says Banerjee. They have released a number of original movies across seven regional languages. Disney+Hotstar also airs the regional content produced by Star’s regional channels including that of Star Jalsha (Bengali), Star Vijay (Tamil), Star Maa (Telugu) and Star Pravah (Marathi). Six months ago, they announced that they would be getting a lineup of four Tamil shows and there are some Telugu shows under production too.

In May 2021 the platform released its first regional language series November Story, a Tamil show—dubbed in Hindi—which saw half its viewership come for the Hindi version of the show. “Going forward, we don’t want to be constrained by one region. We want to continue focussing on making content that is cross-region, like November Story, which did well both in Hindi and Tamil,” says Banerjee. They have released a number of original movies across seven regional languages. Disney+Hotstar also airs the regional content produced by Star’s regional channels including that of Star Jalsha (Bengali), Star Vijay (Tamil), Star Maa (Telugu) and Star Pravah (Marathi). Six months ago, they announced that they would be getting a lineup of four Tamil shows and there are some Telugu shows under production too.