Milk, Pan Masala & Catch-22: DS Group & its sugar-coated FMCG gambit

From bringing Swiss luxury chocolate brand to India to buying desi candy brand LuvIt to aggressively expanding confectionary and dairy products to ramping up its hotel business, DS Group has been steadily diversifying over the last few decades. But can the maker of Rajnigandha pan masala beef up its non-tobacco FMCG play in terms of revenue?

Offerings by the DS Group

Offerings by the DS Group

April, Bengaluru

There were eight contenders in the fray. And with most of them having a hefty background in hospitality, it was supposed to be a close call. The winner, though, was a Noida-based company, which reportedly paid Rs300 crore and bought Viceroy Bangalore Hotels, which owns the Marriott-managed five-star Renaissance Bengaluru Race Course Hotel, and was in debt of Rs1,100 crore.

Back in December 2022, Radisson Hotel Group inked a deal with an FMCG company from Uttar Pradesh to bring two of the properties it owned—Namah Resort in Jim Corbett, and The Manu Maharani in Nainital—under its portfolio of brands. In 2014, the homegrown FMCG major had joined hands to open Radisson Blu Hotel in Guwahati.

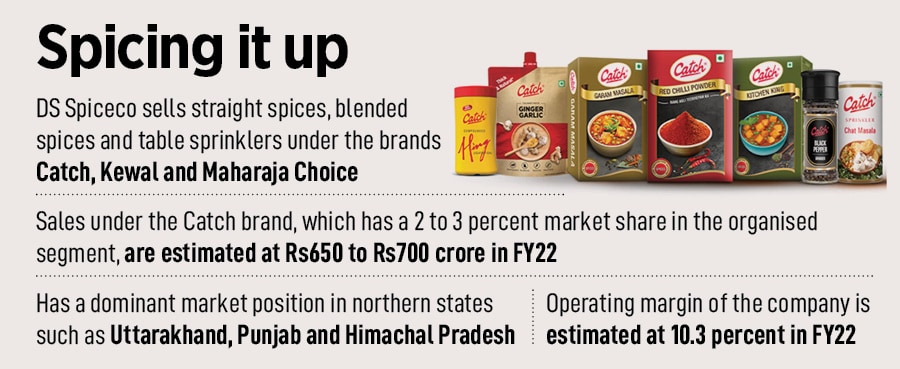

Meanwhile, in 1987, a small family-owned business in North India—which traces its origin to 1929 when it set up a small perfumery shop in Chandni Chowk, Delhi—was making its debut into foods and beverages by rolling out the ‘Catch’ brand of salt and pepper sprinklers. The launch was followed by an introduction of a range of spices, pastes and grinders. Over a decade later, the same company started selling beverages—Catch Natural Spring, mixers, clear flavoured water, soft drinks and juice beverages.

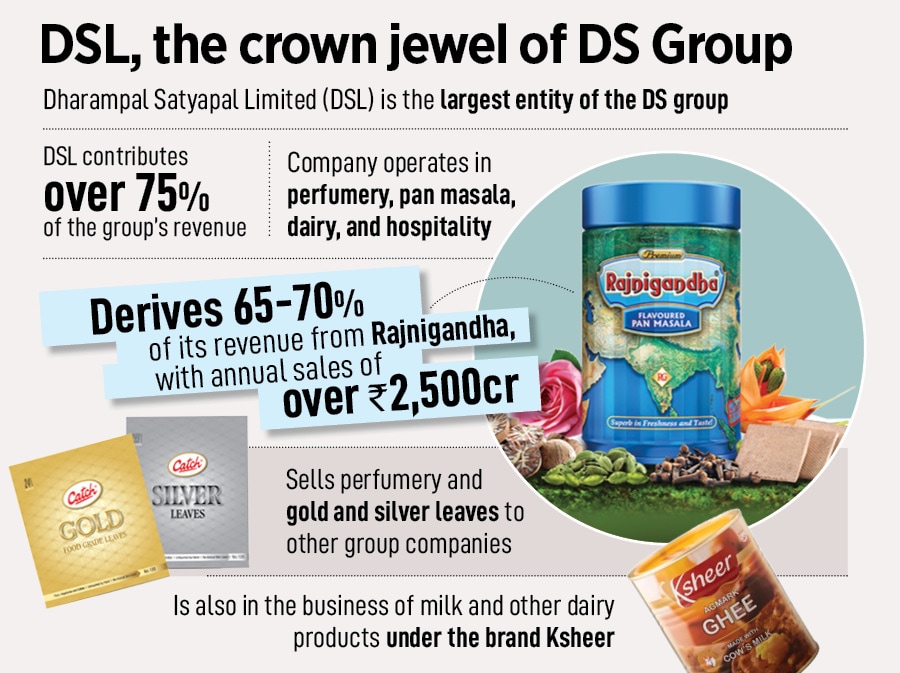

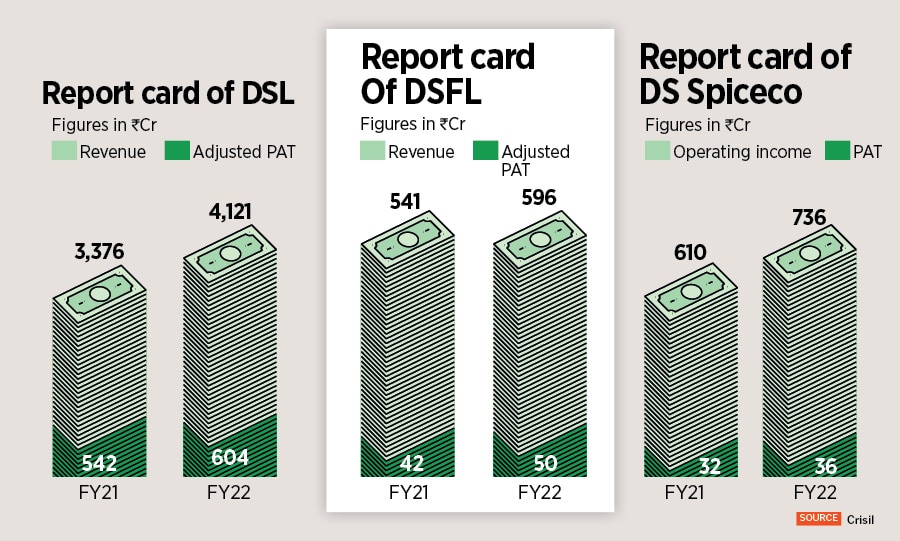

Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

Dharampal Satyapal Limited (DSL) happens to be the biggest entity within the DS Group. With operations in perfumery, pan masala, dairy and hospitality, DSL posted a revenue of Rs4,121 crore and an adjusted PAT (profit after tax) of Rs604 in FY22. While DSL contributes over 75 percent to the group’s revenue, it gets over 70 percent of its sales from pan masala brand Rajnigandha, according to a recent rating report by Crisil.

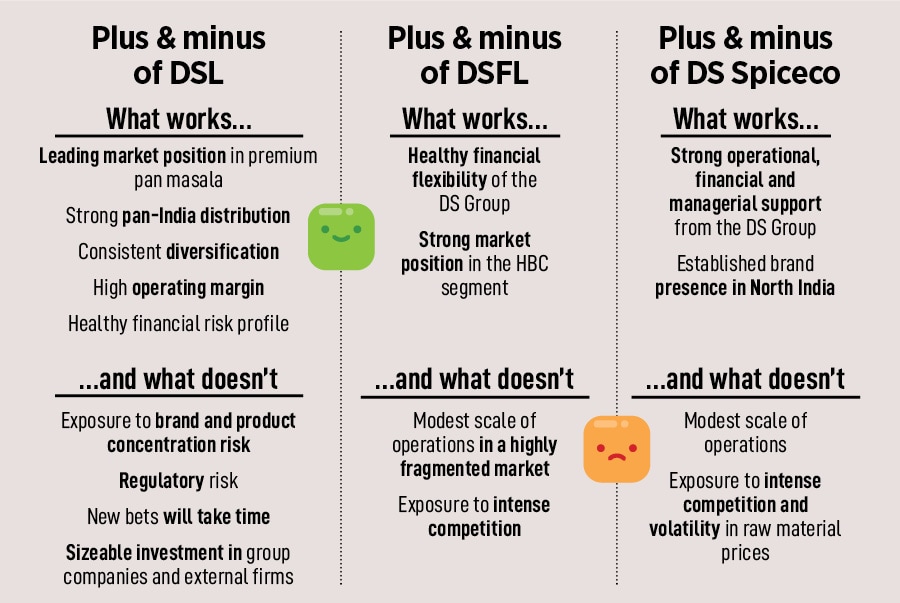

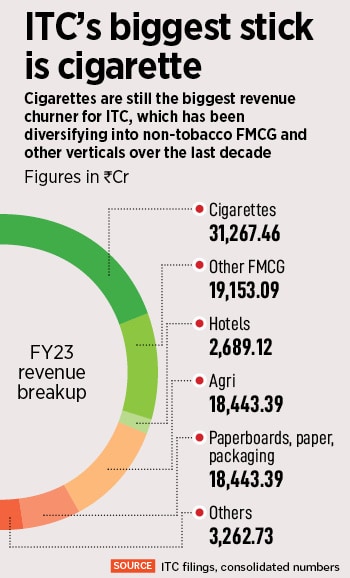

The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.

The biggest issue, though, affecting the transformation is something that has made the group: Pan masala and tobacco. The lucrative nature of the business, the hesitancy on the part of the government to clamp down on tobacco and liquor products due to their high contribution to the tax kitty, and the inability to play the new game—read non-FMCG—with a high sense of urgency might haunt the legacy tobacco and liquor players, says an FMCG analyst with one of the top brokerage houses. You can definitely be an FMCG and cigarette or liquor conglomerate, but then you will be biased towards the categories which will give you the most and easy money, he says, requesting not to be named.