Loaded, and reloaded: How BlackBuck turned into a trucking unicorn

The B2B trucking platform built muscle, shed fat and focussed on SMEs to scale rapidly. It leveraged technology and offered solutions that addressed the typical pain points for both truckers and shippers

Rajesh Yabaji, Co-Founder & CEO, Blackbuck; Image: Nishant Ratnakar for Forbes India

Rajesh Yabaji, Co-Founder & CEO, Blackbuck; Image: Nishant Ratnakar for Forbes India

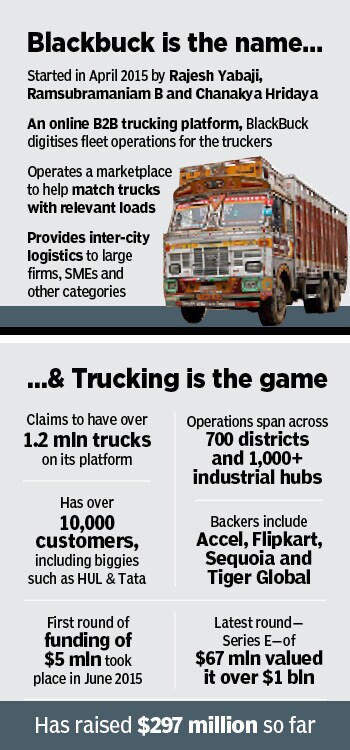

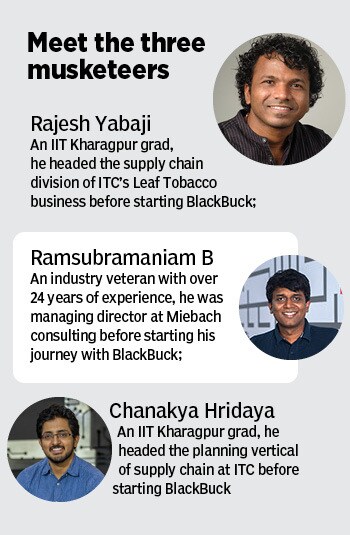

Six years ago, it was a question of muscle versus fat for Rajesh Yabaji. The answer looked like a no-brainer for the IIT-Kharagpur graduate who headed the supply chain division of ITC’s leaf tobacco business before co-founding BlackBuck in April 2015 with Chanakya Hridaya and Ramasubramaniam B. The medium-framed man with a muscular built opted for brawn. “Our gross margin used to be 15 percent,” he recalls, alluding to the performance of his fledgling B2B online trucking platform during the first few months. The flattering business metrics made sense. Reason: Too much operational inefficiency plagued the transportation industry. “We used to make a lot of money on every transaction,” recounts a beaming CEO, who built the business looking to solve the problem of corporate big boys such as Coca-Cola, HUL and PepsiCo. Within a week of starting, BlackBuck raised $5 million in seed round in April.

In four months, the startup started flexing its muscle. “In August, we are an Ebitda (earnings before interest, tax, depreciation and amortisation) breakeven company. Can you imagine!” says Yabaji. The report card looked impressive: Revenue was Rs 3 crore and the cost hovered around Rs 30 to 33 lakh. “We didn’t know we were Ebitda breakeven until an analyst from an investment firm pointed out,” he adds. The promising performance managed to grab more investor interest; BlackBuck got over half a dozen term sheets, and valuation climbed at a crazy pace.

Yabaji, though, could sense an impending muscle pull. Revenue was still small, revenue multiples talked about by analysts made little sense to the first-time entrepreneur and everybody was betting on the team and the promise of a rewarding future. The startup raised another $25 million around September-October in the same year. The trucking venture started lifting heavy weight.

What followed the investment frenzy and unrealistic euphoria was a natural outcome: Fat. Analysts of all kinds started pumping all sort of ‘gyan’ to the new founders. The biggest trucking player in the ecosystem, pointed out one of the high-profile investment gurus, had a 60 percent negative Ebitda. The second in the pecking order, pointed put another intellectual, had 40 percent negative contribution margin. The top guys, Yabaji was made to understand, were focusing on scale. “Hum to bahut galat kar rahe thein (I thought we were not doing the right thing),” he recalls. The entrepreneur, subsequently, opted for fat. It was aggressive scaling at the cost of everything.