How PE firms are becoming bullish on startups in India

Private equity firms, which previously favoured safer IT and BPO companies in India, are increasingly willing to go after newer internet-based startups

Image: Shutterstock.com

Image: Shutterstock.com

When Aneesh Reddy, founder of Capillary Technologies in Bengaluru, was trying to raise money in 2015, there weren’t that many venture capital companies operating in India that could hand out cheques of $30 million to $50 million — the range Reddy was looking for, to buy out another company he was interested in.

“Most VC folks would dry up at $20 million or even $15 million, and PE firms started at $75 million,” he recalled in a recent interview with Forbes India. Reddy then became one of the rare Indian tech exceptions at the time, who successfully raised money from a private equity firm instead, at a stage when PE companies usually didn’t move in.

“Most VC folks would dry up at $20 million or even $15 million, and PE firms started at $75 million,” he recalled in a recent interview with Forbes India. Reddy then became one of the rare Indian tech exceptions at the time, who successfully raised money from a private equity firm instead, at a stage when PE companies usually didn’t move in.

In fact, it was actually because New York’s Warburg Pincus came in with a “VC mindset” that he was able to raise the money from them at the time, Reddy recalls. He’s repaying the PE firm’s patience — as well as additional capital along the way — by turning his software company profitable and beginning to expand to the US. An IPO is not imminent, but is certainly an aspiration for the not too distant future.

“I think the ecosystem has changed significantly in the last five years,” Reddy says.

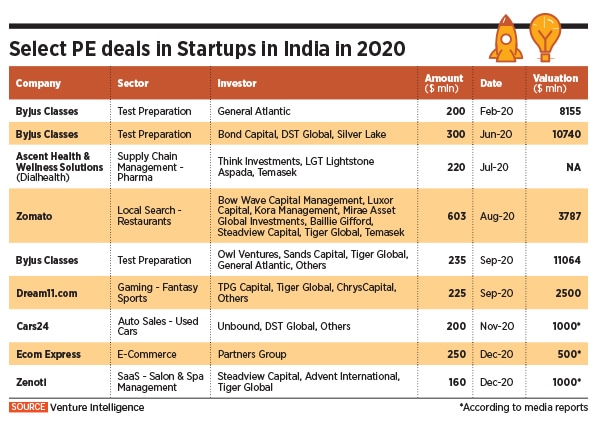

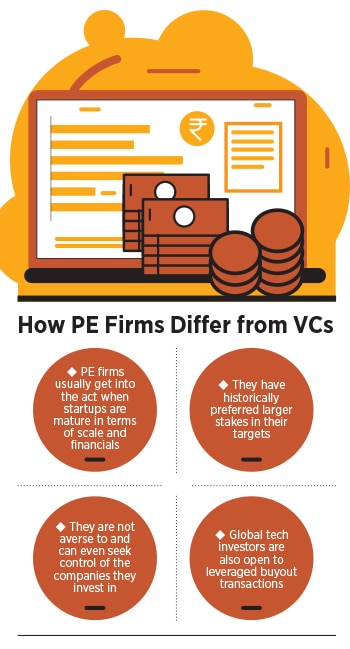

Today, PE firms are taking a much closer look at India’s startups, and investing earlier than they have been known to historically. From large, global names such as General Atlantic to smaller Indian PE firms such as Stakeboat Capital, there is growing appetite for opportunities in India’s tech and tech-enabled startup scene.

“Anything that starts in the world of venture capital at some point ends up in the world of private equity, as scale and financial maturity increase,” says Gopal Jain, managing partner at Gaja Capital. And that is happening at many Indian startups today. The Covid-19 pandemic has accelerated the process, compressing about three years of change into one year, Jain says. The pandemic has forced startups to take a hard look at their businesses and ruthlessly prioritise, as a matter of sheer survival.

“Anything that starts in the world of venture capital at some point ends up in the world of private equity, as scale and financial maturity increase,” says Gopal Jain, managing partner at Gaja Capital. And that is happening at many Indian startups today. The Covid-19 pandemic has accelerated the process, compressing about three years of change into one year, Jain says. The pandemic has forced startups to take a hard look at their businesses and ruthlessly prioritise, as a matter of sheer survival.

That more founders like Patel are emerging, with the combination of deep domain expertise and hard-earned experience of having already successfully built and sold previous startups, is another factor that makes it easier for PE firms to consider Indian startups today. The pedigree of the founders is so much higher today than 10 years ago that there is greater chance of them succeeding.

That more founders like Patel are emerging, with the combination of deep domain expertise and hard-earned experience of having already successfully built and sold previous startups, is another factor that makes it easier for PE firms to consider Indian startups today. The pedigree of the founders is so much higher today than 10 years ago that there is greater chance of them succeeding.

LeadSquared was the fourth investment that Stakeboat made from its first fund, which closed in 2019. “You might look at it as a CRM company, but they are probably a category leader in the sub-segment of lead management,” says Chandrasekar Kandasamy, managing partner at the PE firm, which led the $3 million Series-A investment into LeadSquared in 2019.

LeadSquared was the fourth investment that Stakeboat made from its first fund, which closed in 2019. “You might look at it as a CRM company, but they are probably a category leader in the sub-segment of lead management,” says Chandrasekar Kandasamy, managing partner at the PE firm, which led the $3 million Series-A investment into LeadSquared in 2019.