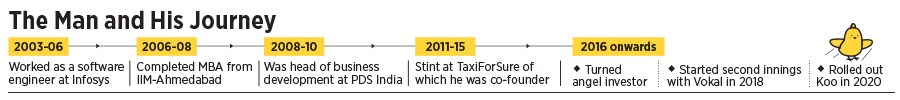

From ride-hailing to micro-blogging, how Aprameya Radhakrishna flew the Koo

In 2015, the founder of TaxiForSure had no choice but to sell the capital-starved startup to rival Ola. The serial entrepreneur learnt his lesson: Start a business that doesn't guzzle capital—and it helps if it's an early (desi) bird

“With Koo, I've got back my underdog status. I have nothing to fear.” Aprameya Radhakrishna, co-founder, Koo

Aprameya Radhakrishna was staring at three realistic options. The first was to raise $40-60 million, and increase the runway for his four-year-old startup TaxiForSure, a cab aggregator that was facing the heat from bigger rival Ola. “We were neck-and-neck despite the difference in funding,” he recalls. Softbank had reportedly pumped $210 million into Ola towards the end of October 2014. “When they raised 10 times what we had done, it became tough to fight that kind of money,” he rues. Radhakrishna started talking to his backers, Accel and Helion, even as he started scouting for new ones. TaxiForSure had funds to last barely four-to-five months. It badly needed a fresh infusion.

The timing, though, was not the best for capital-raising. In December 2014, just two months after Ola got its cheque, a cab driver allegedly raped a woman in the capital. All hell broke loose. There were strong rumours of the government planning to ban cab aggregators. Investors turned cagey. “All of them went into a wait-and-watch mode,” recalls Radhakrishna, who started evaluating two more options—acquisition offers from Ola and Uber. Though he didn’t want to sell, the IIM Ahmedabad alumnus was aware of the stark reality. If the third player lags in funding, it’s better to opt out than to hang in. In March 2015, Ola bought TaxiForSure in a $200 million cash and stock deal.

Cut to May, 2021. Koo, the microblogging platform co-founded by Radhakrishna and Mayank Bidawatka in March last year, raised $30 million in a series B round of funding led by American hedge fund Tiger Global. While existing investors—Accel, Kalaari Capital, 3one4 Capital, Blume Ventures and Dream Incubator—also participated, Koo found new backers in IIFL and Mirae Asset. The latest round takes the total funding raised by Koo to a tad over $34 million. “You actually don't need a billion dollars to build this business,” contends Radhakrishna, who co-founded Vokal in 2018. Billed as ‘Quora with audio’, Vokal is an information sharing platform in 11 Indian languages, wherein subject matter experts answer people’s questions. “This [Koo] is a very different business,” he says.

To be sure, Koo and TaxiForSure are at opposite ends of the spectrum. For starters, taxi aggregation is a cash-guzzling, and high cash burn business. “In social networking, you are not burning on every transaction,” explains Radhakrishna. When WhatsApp, he lets on, was bought by Facebook for $19 billion in 2014, WhatsApp had raised just $20-30 million till then. What’s more, taxi aggregation, he adds, is a black-and-white business. “Social networking has a lot of shades of grey,” he asserts, explaining his point. In a transaction business like ride-hailing, it’s a simple customer journey. A user wants a taxi, books it, completes the journey and pays in cash or online. “The transaction is done,” he says. One just needs to keep the customer happy by doing a few things: Come on time, drive safely, and drop on time.