From flying to soaring: Falcon and its BaaS flight

Priyanka Kanwar and Prabhtej Bhatia have found high-growth trajectory with Falcon. Can they sustain the flight?

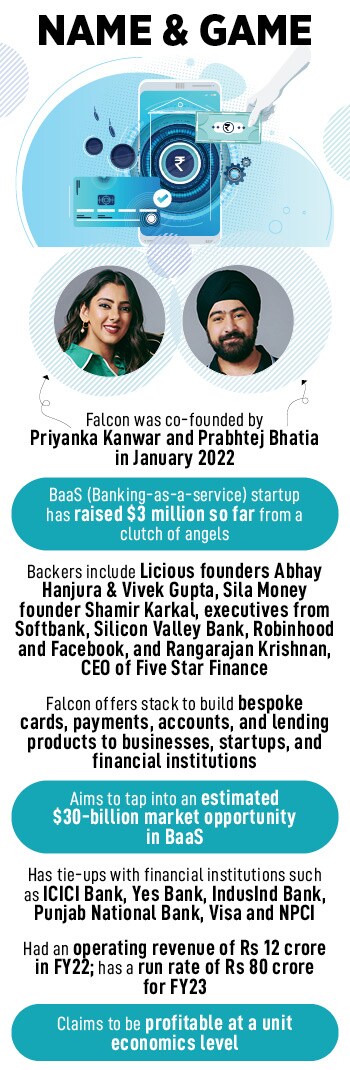

Priyanka Kanwar and Prabhtej Bhatia co Founder of Falcon

Priyanka Kanwar and Prabhtej Bhatia co Founder of Falcon

The ‘Kite’ was designed to soar from Day 1. An economics grad from Yale University, Priyanka Kanwar came back to India in 2015. The trigger was to make an impact in the fintech world. Apart from the entrepreneurial bug that she inherited—her family had been into the business of manufacturing and real estate for over five decades—Kanwar was inspired by the thesis that she worked on during the final year of her college. She studied impact of the direct benefits transfer (DBT) system, the service delivery and expansion of financial inclusion in rural India. “I wanted to create a mobile payments startup in India,” recalls Kanwar, who started Kite Cash along with her school friend Prabhtej Bhatia in 2016. “Kite Cash was like Venmo meets M-Pesa,” says the young entrepreneur who started her first venture when she was 22.

The rookie founder sharply identified the pain points. The first was clunky experience in peer-to-peer money transfer in the country. Like Venmo—an American mobile P2P payment app started in 2009, and bought by PayPal in 2013—Kite Cash was built for the easy transfer of money wherein the transacting parties were not required to know each other’s bank account details. The second problem was making the financial world more inclusive. Just like M-Pesa, a mobile banking service introduced in Kenya, Kite Cash enabled unbanked people to pay for and receive goods and services using a mobile phone. Kite Cash, Kanwar underlines, did two things. First, it let people easily exchange their cash for e-money. And second, it made them comfortable transacting on a mobile app without even owning a bank account. The proposition, she underlines, was crafted to work well for students, housewives, and anyone in Tier-II cities who didn't have bank accounts and wanted financial freedom.

The idea was great, but there was a small problem. For the kite to soar, the co-founders needed lift. “It took us 18 months to launch the product,” rues Kanwar, adding that Kite Cash became operational in 2017. The reason for an inordinate delay was simple. Banks were reluctant to back the rookie founders. “College ke bachche kya kar logey (what will college kids do)” was the dismissive reaction of most of the financial institutions. “Don’t waste our time. We just want to focus on our core business,” was how the young founders were snubbed by the bankers. Another problem was the lack of tech infrastructure. “Most of the banks didn’t have APIs. We had to build everything from scratch,” says Bhatia. Finally, RBL saw the promise and partnered with Kite Cash.

The idea was great, but there was a small problem. For the kite to soar, the co-founders needed lift. “It took us 18 months to launch the product,” rues Kanwar, adding that Kite Cash became operational in 2017. The reason for an inordinate delay was simple. Banks were reluctant to back the rookie founders. “College ke bachche kya kar logey (what will college kids do)” was the dismissive reaction of most of the financial institutions. “Don’t waste our time. We just want to focus on our core business,” was how the young founders were snubbed by the bankers. Another problem was the lack of tech infrastructure. “Most of the banks didn’t have APIs. We had to build everything from scratch,” says Bhatia. Finally, RBL saw the promise and partnered with Kite Cash.

Well, the Kite did soar on its debut. Kanwar decided to test the waters from one of the colleges in Delhi University. The reception was overwhelming. In fact, Kite Cash team found itself swamped on Day 1. “We had over 10,000 sign-ups,” she recalls. The B2C payments product had turned out to be a blockbuster. Day 1 turned out to be just the teaser. Over the next eight months, the bootstrapped venture managed to get a staggering 1.5 lakh users from across 2,000 cities. “The uptick was swift. We never imagined such a kind of reaction,” she recounts.

There was something else also which Kanwar failed to imagine: High cash burn. In a short span, Kite Cash had processed over $100 million in transactions. What the business lacked, though, was strong unit economics. Back in the pre-UPI days, and due to the easy option of loading money into the card, Kite Cash had to act as the merchant for the payment gateway. “We had to fund the loading on the wallet,” says Kanwar. Though the startup had tonnes of transactions, and the app was getting popular, the venture was losing money every month. “It was very difficult to monetise it,” says Kanwar. Coming from a traditional business background and trained in the so-called ‘old school’ of doing business, a bleeding business was the last thing that the co-founders could have built. “Cash burn was not in our DNA. We wanted to build sustainable business,” says Bhatia.