Enterprising Comeback: Smartworks and its office play

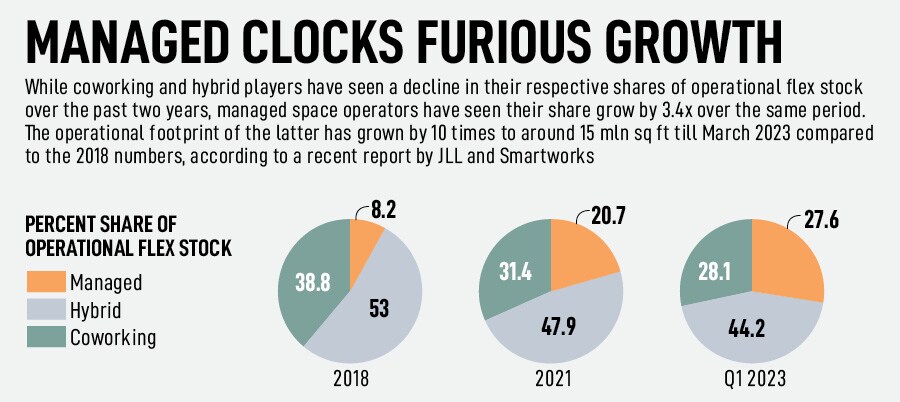

Timely pivot, sticky enterprises, waning pandemic and a more-than-strong resurgence in demand for office space have helped Smartworks post a heady growth. Can India's biggest managed office space provider keep up with its furious pace?

(L To R) Neetish Sarda, founder and Harsh Binani, co-founder of Smartworks. Image: Selvaprakash Lakshmanan

(L To R) Neetish Sarda, founder and Harsh Binani, co-founder of Smartworks. Image: Selvaprakash Lakshmanan

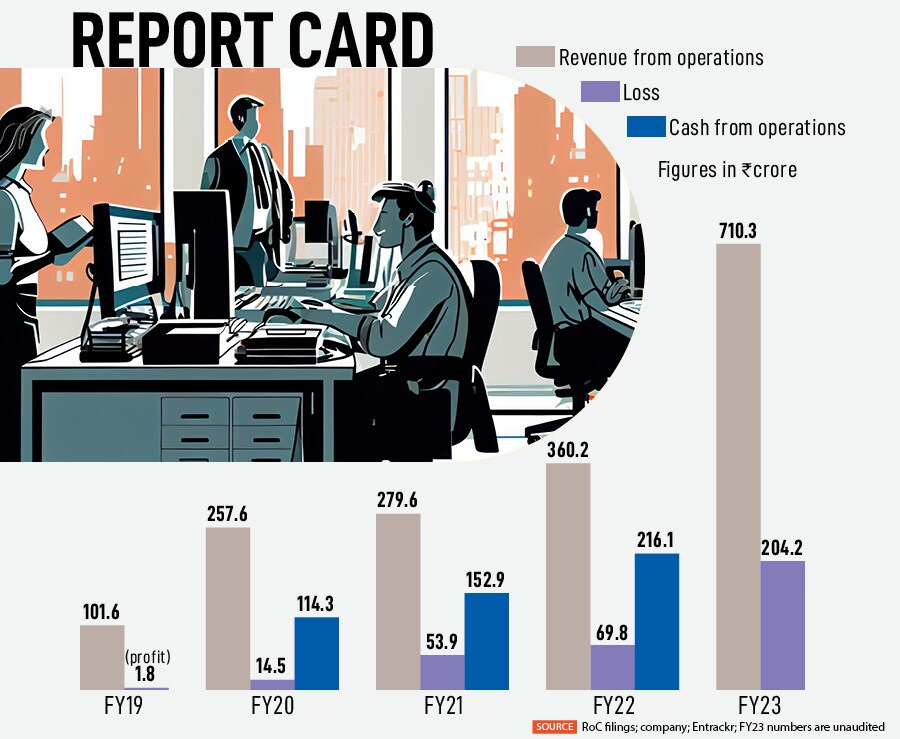

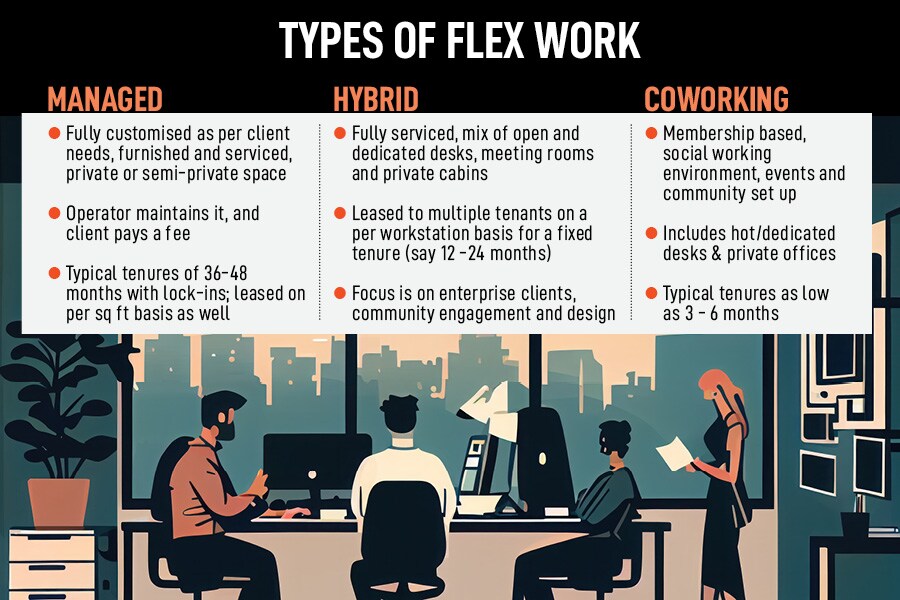

April 2021, Noida. Neetish Sarda was spaced out. One, though, can’t blame the entrepreneur for feeling disoriented. It has been over twelve months of a lockdown, the country was in the midst of a deadly second wave of the pandemic in April 2021, and, in an uncertain environment, the only thing that seemed certain was an end of the world. Like most of the startup founders battling the Covid headwind, Sarda too was hoping against hope, grappling mental demons, and praying for his world to stay intact. “What if Covid lasts for another 8 months or so,” wondered Sarda, who co-founded Smartworks in 2016. Started as a co-working startup in Delhi-NCR, Smartworks has had a sedate growth in the formative years, pivoted to a managed office space provider in 2019, and closed the next fiscal with a heady operating revenue of Rs 257.6 crore. Sarda had managed to find a space for his maiden venture.

Then came Covid. Work from home became a new normal, offices had almost turned into an obsolete concept, and after four years of managing millions of square feet of business space, Sarda’s thinking shrunk into inches. “Would this industry survive? And even if it does, will it be able to stand on its feet,” asked the founder who closed FY21 at a muted revenue of Rs 279.6 crore. What was exceptional, though, was the fact that Smartworks and Sarda had survived. “But for how long,” wondered the founder who raised $25 million from Singapore's Keppel Land Limited (Keppel Land) in Series A round of funding in 2019. “Will offices survive” was the larger question yet to be answered. Another searing question, which was certain to emerge post-pandemic, was: Who will pay a premium to get flexibility at workspaces?

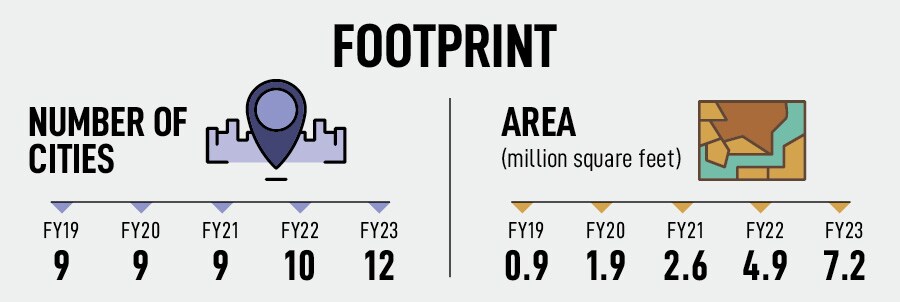

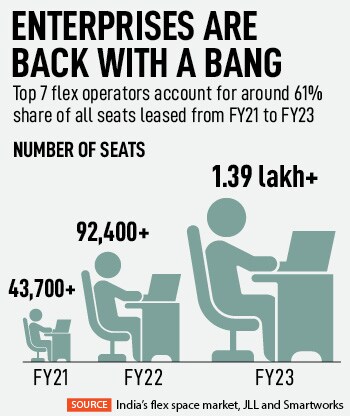

Fast forward to August 2023. The pandemic has waned, work-from-home has lost its charm, the hybrid model of work is gaining ground, and enterprises are back in action and have doubled down on their office space requirement. What this means for Smartworks—especially the last part as enterprises make up around 90 percent of the revenue of the startup--is just one thing: India’s biggest managed office space provider is back with a bang. The revenues have almost doubled from Rs 360.2 crore in FY22 to Rs 710.3 crore in FY23; the area of operation has leapfrogged from 4.9 million square feet to 7.2 during the same period, and footprint has expanded from 10 to 12 cities. “We knew that offices are not going to die,” says Sarda, adding that the pandemic was worse than recession. “We always gave ourselves a faint chance to survive,” he says.

What, though, Sarda didn’t know was the fact that a comeback would be much bigger than the setback. “It has been a hockey-stick recovery, and the demand has skyrocketed,” he says, adding that during the pandemic, Smartworks closed just two centres, and held on to its supply. “Nobody expected the demand to come back in such a manner,” he confesses.

What, though, Sarda didn’t know was the fact that a comeback would be much bigger than the setback. “It has been a hockey-stick recovery, and the demand has skyrocketed,” he says, adding that during the pandemic, Smartworks closed just two centres, and held on to its supply. “Nobody expected the demand to come back in such a manner,” he confesses.