Budget 2024: The long road to fiscal consolidation

The government is likely to walk the fiscal tightrope as it aims to achieve its commitment of lowering the fiscal deficit to 4.5 percent of GDP in FY26

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman commences Final stage of Union Budget 2024-25 with Halwa Ceremony, in New Delhi on January 24, 2024.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman commences Final stage of Union Budget 2024-25 with Halwa Ceremony, in New Delhi on January 24, 2024.

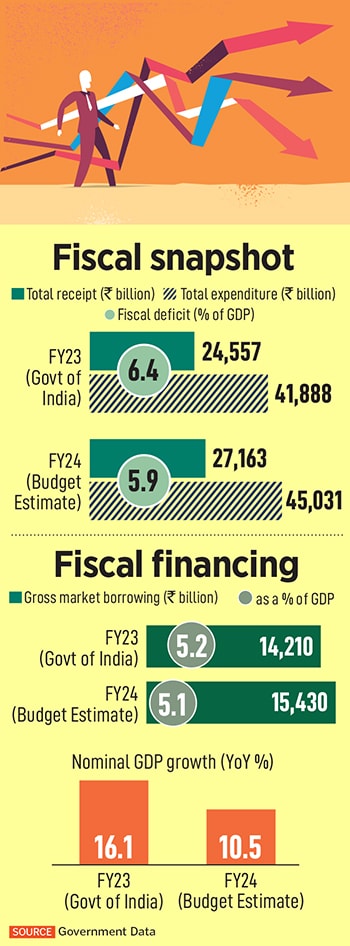

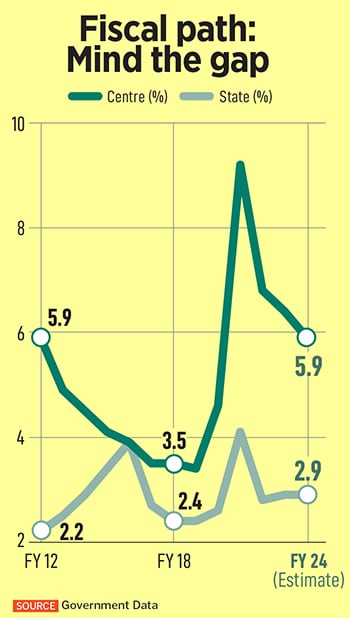

The upcoming general elections notwithstanding, the BJP-led government is likely to continue on the fiscal consolidation path when it announces the interim budget on February 1. Unprecedented challenges posed by the coronavirus pandemic four years ago pushed the government to shift its goalpost by raising the fiscal deficit target in FY22 to 6.8 percent from 3 percent (see table).

Now, the government aims to reduce the gap between revenue and expenditure to 5.3 percent and 4.5 percent in FY25 and FY26 respectively and seems to be well on course to meet its FY24 commitment to narrow the shortfall to 5.9 percent (see table).

“Concerns surrounding fiscal slippage in an election year are understandable. However, we expect the centre to meet their fiscal deficit target despite poll pressure,” says Bank of America’s economist Aastha Gudwani.

To be clear, Minister of Finance Nirmala Sitharaman has ruled out any big-bang announcements in her sixth budget. “I am not going to play a spoilsport, but it is a matter of truth that the February 1, 2024, budget will just be a vote on account because we will be in election mode. So, the budget that the government presents will just be to meet the expenditure of the government till a new government comes to play,” she said at the Global Economic Policy Forum in December.

A full budget for the current fiscal will be announced by the elected government in July.

But market participants, by-and-large, are confident that the government will refrain from populist schemes and deliver an investment-led budget to fast-track growth. Economists and brokerages expect capital expenditure to rise at a slower pace of 10 percent (to Rs 10.2 lakh crore) in contrast to the 20 percent-plus uptick seen in the previous two years.

But market participants, by-and-large, are confident that the government will refrain from populist schemes and deliver an investment-led budget to fast-track growth. Economists and brokerages expect capital expenditure to rise at a slower pace of 10 percent (to Rs 10.2 lakh crore) in contrast to the 20 percent-plus uptick seen in the previous two years.  Between April and November, the government has utilised 50.7 percent of the budgeted fiscal deficit target for the current fiscal year against the median of around 75 percent.

Between April and November, the government has utilised 50.7 percent of the budgeted fiscal deficit target for the current fiscal year against the median of around 75 percent.