Beyond Khao suey: How Burma Burma is stepping on the gas

For nearly 10 years, the bootstrapped, under-the-radar restaurant chain has navigated the unpredictable F&B industry and grown slow and steady. Now it's going on an expansion spree

Ankit Gupta (left) and Chirag Chhajer, co-founders of Burma Burma Image: Mexy Xavier

Ankit Gupta (left) and Chirag Chhajer, co-founders of Burma Burma Image: Mexy Xavier

A lot can happen over coffee, as a popular beverage chain will tell you. But a whole lot can also happen over khao suey, a Burmese noodle soup. Ask Chirag Chhajer and Ankit Gupta.

Chhajer and Gupta were friends from Utpal Shanghvi school in Mumbai, but both went their own ways post-school—Chhajer studied in Australia and then joined his father’s textiles business, while Gupta, who trained in hospitality, worked at the Taj Mahal Hotel for two years before moving into his family’s hospitality business. On work, Gupta would occasionally travel to China, where Chhajer’s family, too, had an office. “Once we happened to visit China together and the two of us got talking,” says Gupta. “We were friends, had similar business ethics, and both of us wanted to diversify into a new venture.”

Gupta’s mother’s family had lived in Burma [now Myanmar] for over two decades and had migrated to Mumbai only in the late 70s, so Burmese food was quite common at his home. In fact, it would be on the menu whenever relatives and friends visited, and Chhajer was no exception. “At that time,” says Chhajer, “the only khao suey I had eaten was at restaurants. And those were nothing like what I had at Ankit’s home.” When Gupta suggested the two launch a Burmese restaurant, he didn’t need much convincing.

In 2013, with about Rs 1.1 crore of their personal funds, the two started Hunger Pangs Pvt Ltd, the parent company, under which the first outlet of Burma Burma, a vegetarian, no-alcohol venture, was launched in 2014, in Mumbai’s Kala Ghoda area. The idea was to set up an all-day eatery to introduce Mumbai to food beyond khao suey, the only Burmese dish diners were familiar with and one that was often appended to the South Asian section of a menu. “On the first day itself, the response was so overwhelming that we had to shut down at 3.30 pm for a break. Ever since, we’ve run in two shifts,” says Gupta. “By the first weekend, we had reservations for the next two to three weeks.”

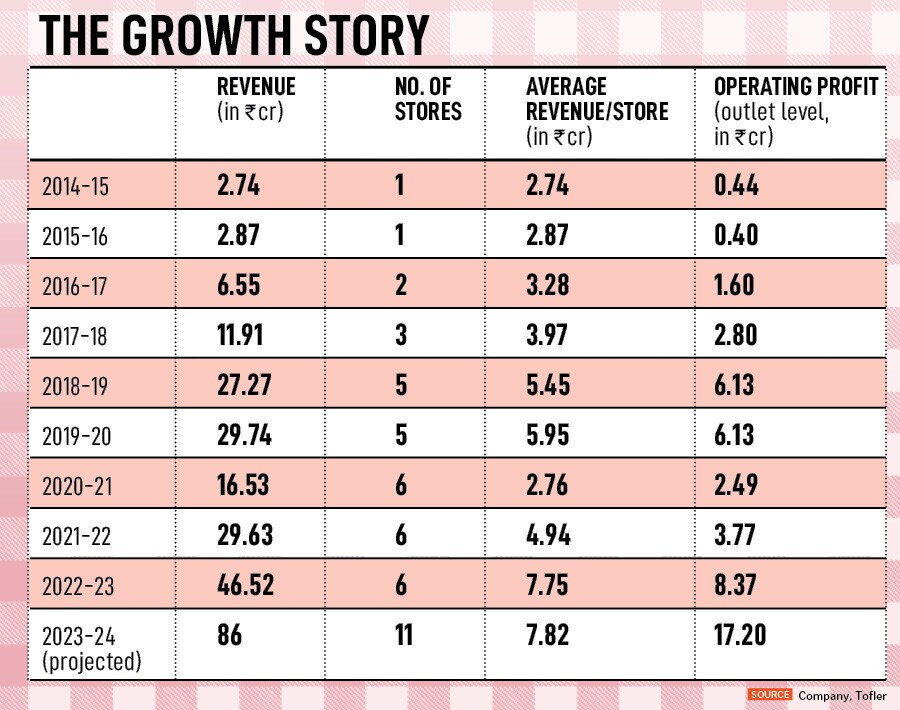

Along with it, its revenue has jumped from Rs2.74 crore in FY15 to Rs46.51 crore in FY23, and is estimated to reach Rs86 crore in FY24. It has also stayed profitable for most of this period, except for the last three years, when, first, Covid hit, and then the company, still bootstrapped, “channelled money towards scaling up and future openings”, says Chhajer. But, even through these fiscals, Burma Burma has remained profitable at the outlet level, with Rs8.37 crore in FY23, and a projected Rs17.2 crore in FY24.

Along with it, its revenue has jumped from Rs2.74 crore in FY15 to Rs46.51 crore in FY23, and is estimated to reach Rs86 crore in FY24. It has also stayed profitable for most of this period, except for the last three years, when, first, Covid hit, and then the company, still bootstrapped, “channelled money towards scaling up and future openings”, says Chhajer. But, even through these fiscals, Burma Burma has remained profitable at the outlet level, with Rs8.37 crore in FY23, and a projected Rs17.2 crore in FY24.  It’s a gear shift from its early years, when Burma Burma opened its second outlet, in Gurugram’s Cyber Hub, only two years after the first. That’s because both Chhajer and Gupta subscribe to the philosophy of organic growth, and want to finetune concepts over months and years before taking it to a wider audience. That includes travelling to Myanmar at least once a year, first to explore the cities and then dig into its regions to bring back the best of rural and tribal cuisines.

It’s a gear shift from its early years, when Burma Burma opened its second outlet, in Gurugram’s Cyber Hub, only two years after the first. That’s because both Chhajer and Gupta subscribe to the philosophy of organic growth, and want to finetune concepts over months and years before taking it to a wider audience. That includes travelling to Myanmar at least once a year, first to explore the cities and then dig into its regions to bring back the best of rural and tribal cuisines.