After FTX's collapse, there is a need to re-evaluate crypto exchanges

The bankruptcy of centralised exchange FTX has jolted the crypto world, but there is optimism within India's crypto exchanges, which are betting on the upcoming G20 presidency

Crypto prices had slumped by 15 to 17 percent during the days when Binance, an early investor in FTX, backed out of a deal to bail it out, citing concerns over FTX’s business practices. Oddly, since then, global prices of Bitcoin and Ethereum appear to be holding on, down just over 2.1 percent and 4.7 percent, respectively, since FTX announced its bankruptcy on November 11.

Imaging: Chaitanya Dinesh Surpur

Crypto prices had slumped by 15 to 17 percent during the days when Binance, an early investor in FTX, backed out of a deal to bail it out, citing concerns over FTX’s business practices. Oddly, since then, global prices of Bitcoin and Ethereum appear to be holding on, down just over 2.1 percent and 4.7 percent, respectively, since FTX announced its bankruptcy on November 11.

Imaging: Chaitanya Dinesh Surpur

The dramatic collapse of American entrepreneur and once high-flier Samuel Bankman-Fried’s (SBF) $32-billion crypto empire in November could soon become part of economic studies as one of the biggest financial debacles of centralised exchanges. There could maybe, even, be mini-television series and movies that follow.

The Bahamas-headquartered FTX was one of the world’s largest crypto exchanges, having raised $1.5 billion through private funding in 2021. Its 30-year-old founder, with his distinctive casual clothes and unkempt hair, had seen his fortune crash from $16 billion to near zero within days, Bloomberg notes.

The bankruptcy has sparked fears of a contagion: Bankman-Fried’s trading firm and FTX affiliate firm Alameda Research has gone bust; on November 28, cryptocurrency lender BlockFi filed for Chapter 11 bankruptcy citing exposure to FTX, while two other crypto lenders, Voyager Digital and Celcius Network, had also gone bankrupt earlier in the year. Today, Bitfront, a US crypto exchange said it suspended new sit-ups and will cease operations within a few months, Reuters reported. Bitfront's problems are not connected to FTX, though.

Crypto prices had slumped by 15 to 17 percent during the days when Binance, an early investor in FTX, backed out of a deal to bail it out, citing concerns over FTX’s business practices. Oddly, since then, global prices of Bitcoin and Ethereum appear to be holding on, down just over 2.1 percent and 4.7 percent, respectively, since FTX announced its bankruptcy on November 11.

A loss of confidence

The problems for Bankman-Fried came fast, after a CoinDesk news report in early November said that Alameda Research’s balance sheet comprised largely FTT, a cryptocurrency token that FTX Exchange had invented, and there were no “independent asset like a fiat currency or another crypto”. In the following days, there was a run on FTX, after customers withdrew millions of dollars from the exchange on news that Binance was going to liquidate all its FTT, after reflecting on Alameda’s financial health. Bankman-Fried tried to convince Binance to bail out the exchange but Binance declined to save FTX, after corporate due diligence and reports of “mishandled customer funds and alleged US agency investigations”, a Binance statement said. Alameda actively traded almost every cryptocurrency on every exchange and later became a market maker, which means it provided cryptocurrency to exchanges for their users to trade with. Alameda was a major cryptocurrency market maker and the largest recipient of all USDT printed by Tether. FTX was the preferred destination for institutional traders, day traders, and ordinary retailers.

Alameda actively traded almost every cryptocurrency on every exchange and later became a market maker, which means it provided cryptocurrency to exchanges for their users to trade with. Alameda was a major cryptocurrency market maker and the largest recipient of all USDT printed by Tether. FTX was the preferred destination for institutional traders, day traders, and ordinary retailers.

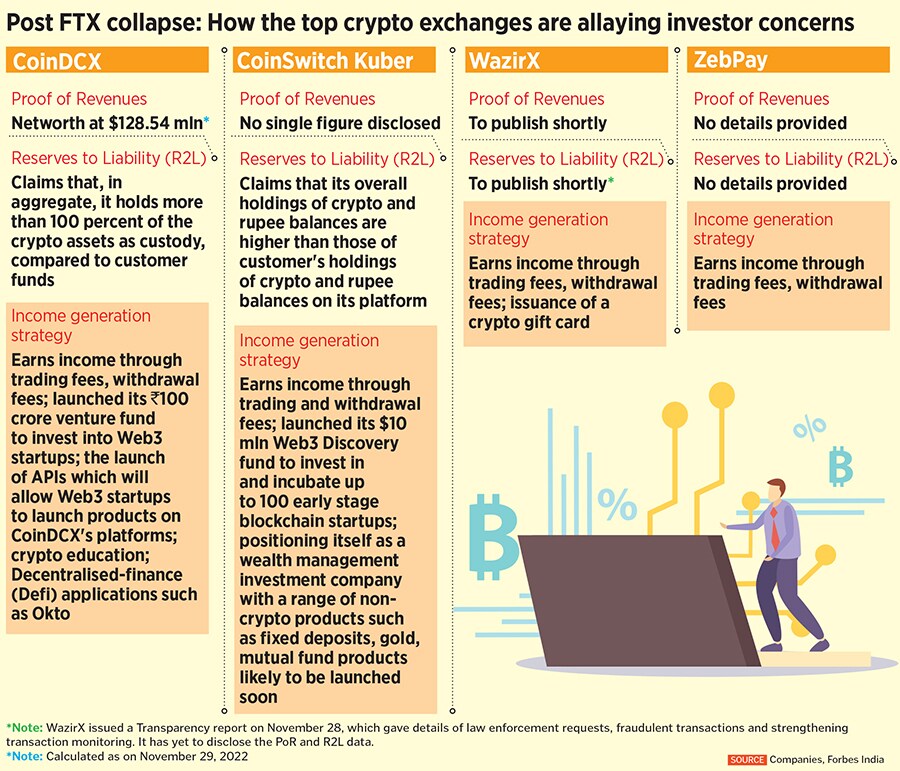

In November, phrases such as ‘Proof of Reserves’ (PoR) and ‘R2L’ (Reserve to liability) became common data points which crypto exchange heads started to disclose to investors. Some of the leading international exchanges, such as Binance, Huobi, Bybit and Bitget, issued their PoR earlier in November.

In November, phrases such as ‘Proof of Reserves’ (PoR) and ‘R2L’ (Reserve to liability) became common data points which crypto exchange heads started to disclose to investors. Some of the leading international exchanges, such as Binance, Huobi, Bybit and Bitget, issued their PoR earlier in November. Minister of Finance Nirmala Sitharaman has, in the past, called for international cooperation to regulate cryptos. Digital technology is being embraced by the Reserve Bank of India, as it is expected to continue to push for the adoption of the central bank digital currency (CBDC), whose pilots are currently underway.

Minister of Finance Nirmala Sitharaman has, in the past, called for international cooperation to regulate cryptos. Digital technology is being embraced by the Reserve Bank of India, as it is expected to continue to push for the adoption of the central bank digital currency (CBDC), whose pilots are currently underway.