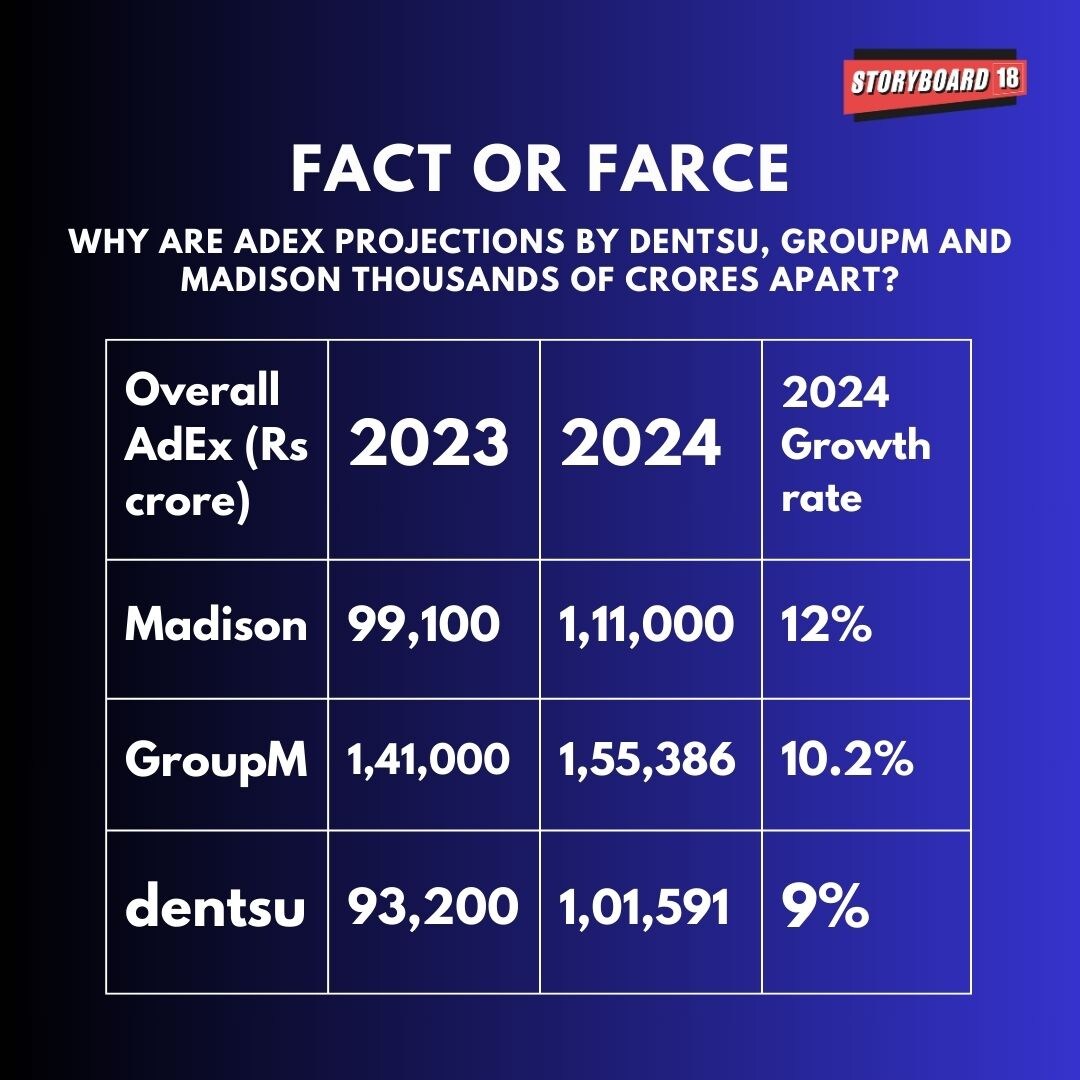

Fact or farce: Why are AdEx projections by Dentsu, GroupM and Madison thousands of crores apart?

Top advertisers said that the divergence in projections is due to differences in digital Adex numbers and agencies' own vantage and advantage

The difference in these projections is not a couple of thousands but thousands of crores. To be precise, the gap between Dentsu and GroupM AdEx projections is Rs 53,795 crore. Image: Shutterstock

The difference in these projections is not a couple of thousands but thousands of crores. To be precise, the gap between Dentsu and GroupM AdEx projections is Rs 53,795 crore. Image: Shutterstock

Advertisers are inundated with ad expenditure data. But the data lacks standardisation, leaving advertisers dazed, confused and, in some cases, increasingly indifferent to agencies' wildly varying AdEx projections. In the last two weeks, at least three top media agencies released their own advertising reports, each offering a unique and contradictory view of the Indian ad landscape.

Sample this. According to the latest dentsu advertising report, the AdEx is expected to touch Rs. 1,01,591 crore in 2024 with digital contributing Rs 50,857 crore. WPP-owned media investments powerhouse GroupM on the other hand said, in its ‘This Year Next Year’ report, the overall ad revenue is expected to reach Rs 1,55,386 crore in 2024 with digital contribution of Rs 88,502 crores. Homegrown media agency Madison said the year will end with AdEx touching Rs 1,11,110 crore with digital's contribution at Rs 46,565 crore.

The difference in these projections is not a couple of thousands but thousands of crores. To be precise, the gap between Dentsu and GroupM AdEx projections is Rs 53,795 crore.

What are we missing?

“To be honest, these reports are a bit of data and a bit of hope," said the marketing head of a popular Indian personal care brand, also a heavyweight advertiser.