Girish Mathrubootham on how to stay hungry amid a carnage

The poster boy of Indian SaaS is braving a brutal global tech meltdown and trying to keep Freshworks steady. What might come handy is turning deaf and building credibility

Girish Mathrubootham, Founder, Freshworks

Image: Balaji Gangadharan for Forbes India

Girish Mathrubootham, Founder, Freshworks

Image: Balaji Gangadharan for Forbes India

Bengaluru, December 21, 2022. The meeting starts at noon. It has been three days since the thrilling clash between Argentina and France. Though billed as one of the greatest finals in the history of Fifa, there were strong murmurs—and debate—around the role played by luck in deciding the winner of the most coveted sporting title in the world. Did Argentina get lucky in the penalty shootout, and did France run out of luck after a brilliant late surge were the two questions with which the interview started. The context, I made it clear to the interviewee, was luck, skill and fair game.

Girish Mathrubootham quickly dribbles into the debate. “If you are playing a game,” underscored the man who rolled out FC Madras in 2019 to promote grassroots football in the city, “then you must understand the rules of the game.” Whether penalty shootout is luck or skill is immaterial. What’s crucial to understand, stresses the founder and chief executive officer of Freshworks, is that the shootout is very much part of the rule, and the game was played fairly. “Somebody celebrated and somebody cried. But that’s part of the game,” reckons the founder. “Everybody followed the rules.”

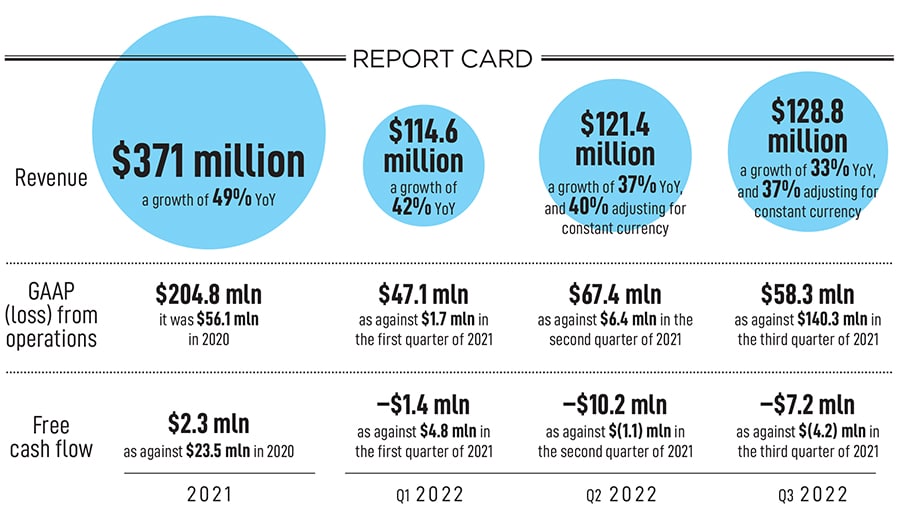

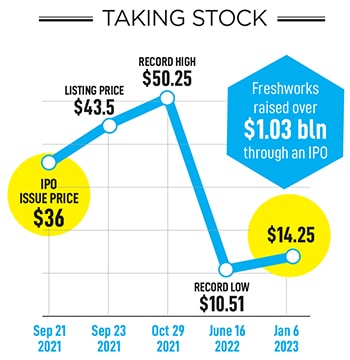

So, as a founder of a company, which got a blockbuster listing on Nasdaq on September 23, 2021, have the rules changed for Mathrubootham? Or is he still playing the game by sticking to the old rules? The entrepreneur, who started Freshdesk in a 700-sq-ft warehouse in Chennai in 2010, and seven years later, rebranded the software-as-a-service (SaaS) company Freshworks, underlines there has been a twin change as a founder of a listed company.

Both the context and the rules have changed. “IPO is not the end game. It’s the beginning of a new journey,” he says. While the IPO definitely marks an exit for a lot of VCs (venture capitalist), it also heralds a whole new bunch of investors. They are buying the stock and have a belief in the potential of the company to keep going for next 20 to 30 years. That is the belief with which they’re buying the stock. “And if that has to happen, one needs to learn the new rules of the game,” he says.

Agreed. So when Freshworks laid off 90 employees globally in December 2021, including 60 in India, was Mathrubootham playing by the new rules? Did the context of a global tech meltdown and how most of the stocks have got battered on the back of a cocktail of unavoidable reasons factors behind the first layoff by Freshworks in its history? Mathrubootham exposes the sensitive side of his personality. “I always operate from the heart. I was not happy with the move,” he confesses. “But I still believe that it was the right thing to do,” he underlines, adding that his life has changed as a founder of a public company.

Agreed. So when Freshworks laid off 90 employees globally in December 2021, including 60 in India, was Mathrubootham playing by the new rules? Did the context of a global tech meltdown and how most of the stocks have got battered on the back of a cocktail of unavoidable reasons factors behind the first layoff by Freshworks in its history? Mathrubootham exposes the sensitive side of his personality. “I always operate from the heart. I was not happy with the move,” he confesses. “But I still believe that it was the right thing to do,” he underlines, adding that his life has changed as a founder of a public company.