Meesho's Dhiresh Bansal and a banker's dozen

Bansal's rich investment banking background is helping the first-time CFO stay ahead of the game at Meesho

Fundraising and M&As are important skill sets that a CFO should have: Dhiresh Bansal, CFO, Meesho

Fundraising and M&As are important skill sets that a CFO should have: Dhiresh Bansal, CFO, Meesho

Image: Nishant Ratnakar for Forbes India

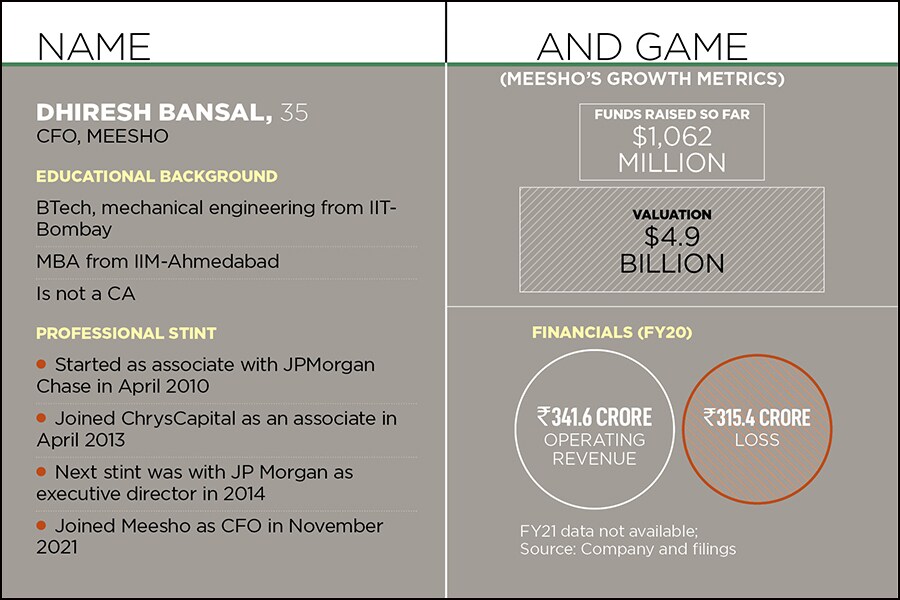

Last November in Bengaluru, the interviewer and the interviewee were taking a leap of faith. In fact, it was a first for both. Vidit Aatrey was sniffing for something extra in his next chief financial officer (CFO). The founder and chief executive officer of internet commerce platform Meesho, which had raised a staggering $570 million (around ₹4,227 crore) in its series F round in September, explained the requirement of his venture, which was then valued at $4.9 billion. As a company gets closer to milestones such as an IPO, he explained, a lot more competencies and capabilities become crucial in a CFO, which otherwise can be skipped during the early stage of growth.

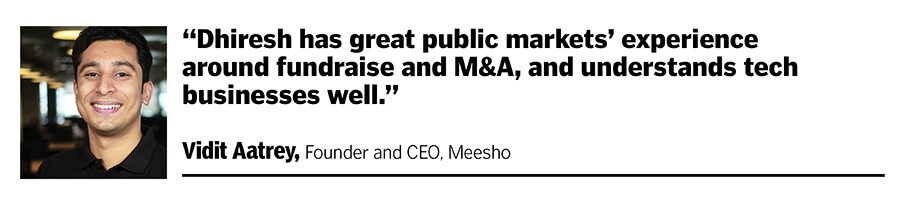

Aatrey outlined his checklist. The potential candidate must be somebody with an in-depth public market experience around fundraise. The contender must also be a master in merger and acquisitions (M&A). And last, the suitor must have a deep understanding of the tech businesses. All three qualities were indispensable. “Look at the US… all late-stage tech firms have CFOs from investment banking background,” he said.

Back in India, Dhiresh Bansal flaunted an impeccable background. The IIT-Bombay grad and IIM-Ahmedabad alum started his career with JPMorgan Chase in 2010. After three years, the investment banker had a year-long stint with ChrysCapital, and then went back to JP Morgan where he was executive director till last year. “As an investment banker, typically your client ends up being a CFO,” he laughs. Interestingly, last November, the 35-year-old was seeking the post of CFO, a first for him, and his first interview in over seven years.

Bansal, though, didn’t show any signs of nerves. After all, he had ticked all the boxes that Aatrey was scouting for. “What about things that you have not been doing consistently?” was one of the questions, trying to test the composure of a man who was not a chartered accountant (CA). “How would you handle situations you are not exposed to?” was the follow-up query. Bansal stayed unfazed. My role as a CFO, he replied, is not just to control the financials, but also to give leverage to the CEO. There are areas where investment bankers have slightly more experience than traditional CFOs.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)