Anita Kishore: Harnessing Newton's laws of motion

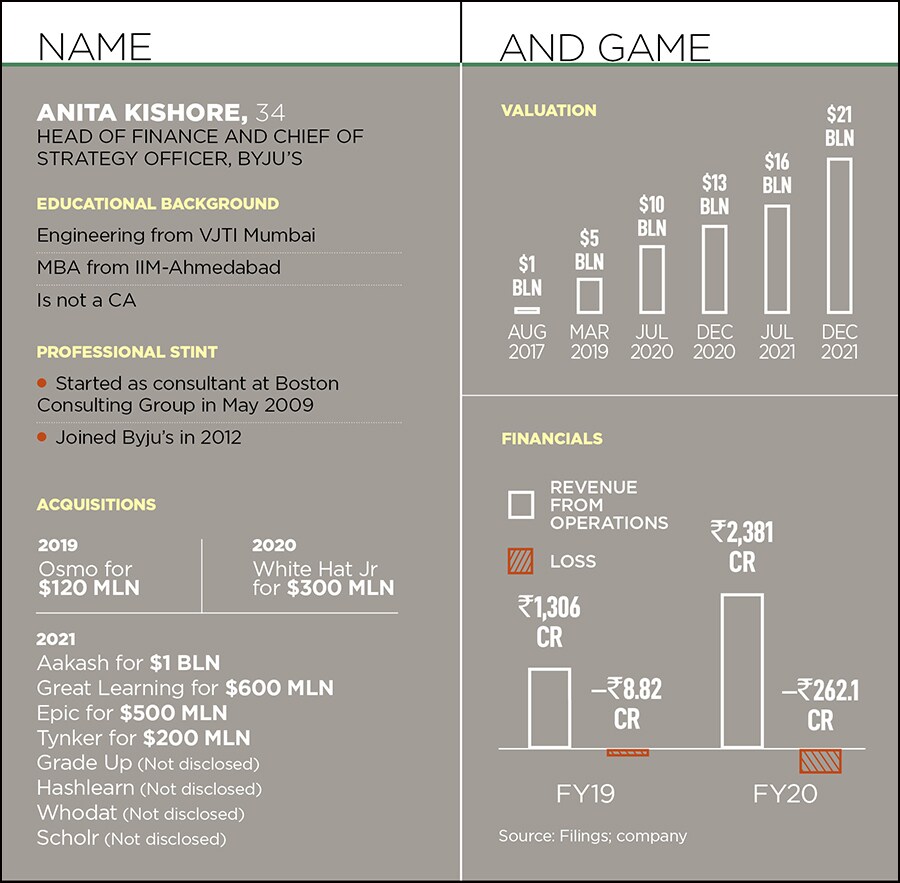

The 34-year-old head of finance and chief strategy officer at Byju's is an engineer-turned-teacher-turned-strategist. She's the stronghand behind many physics-defying moves that the edtech giant has made across the world

The biggest risk you are taking is not taking enough risks: Anita Kishore, head of finance and chief of strategy officer, BYJU's

Image: Nishant Ratnakar for Forbes India

In January 2019, Anita Kishore was taking her biggest, and boldest, bet. The timing seemed perfect. The engineer started her career as a consultant with the Boston Consulting Group in 2009. To continue with her passion for teaching, she took classes over the weekend for the next three years, and finally joined Byju’s in 2012. Over the next seven years, the maths and physics teacher diligently followed Newton’s Laws of Motion.

During the first few years, Byju’s, for sure, was an object in motion, growing at a constant speed. What this meant was making quick and decisive financial moves. “Any decision can’t be taken in isolation,” says the head of finance. “It has to be taken in the context of what the needs of the business are,” she adds, underlining the financial strategy in new-age, high-growth companies. By 2019, the edtech player had gathered enough pace and become the biggest in the segment. By snapping up four acquisitions since 2015, Kishore, who also dons the hat of chief strategy officer, had applied enough force to accelerate the growth across India.

Now, in January 2019, Kishore was getting anxious. Byju’s was about to make its first global acquisition, and the chances of the third law of motion—for every action (force) in nature, there is an equal and opposite reaction—playing out in full force was high and realistic. The reasons were simple. The biggest was the risk of the unknown. Byju’s was not present in the US market. Osmo, the edtech firm that Byju’s was about to buy, had a flat growth for the previous two years and had a revenue of $25 million in FY19. Second, Osmo’s offering—a blend of physical and digital learning for kids—was different from that of Byju’s. Third, the deal was going to cost a bomb: $120 million. The ingredients were perfect for any traditional CFO to play by the book and stay away from the deal.